Today, Federal Reserve Chairman Jerome Powell told a Senate Banking Committee that he’s in no rush to cut interest rates. President Trump has agitated for more intense cuts due to high inflation, but Powell remains unmoved.

He also expressed his support for comprehensive new stablecoin regulations and an end to anti-crypto debanking campaigns. Although some in the industry wish for higher rate cuts, his statements were bullish overall.

Steady Interest Rates Might Be Bullish for Crypto

Jerome Powell, Chairman of the Federal Reserve and one of the US’ most powerful finance regulators, testified before a Senate Banking Committee today. Powell has recently taken a favorable approach to the crypto market, and his comments touched on a few key areas.

Most pressingly, Powell is not interested in cutting US interest rates.

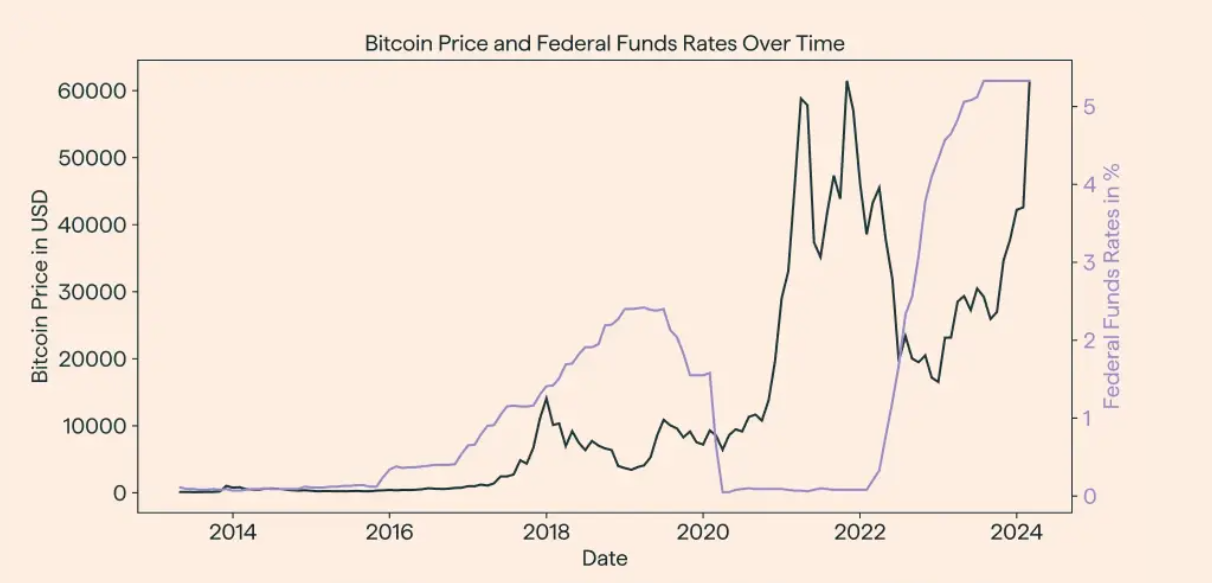

The Federal Reserve cut US interest rates by 50 bps last September, and this had a bullish influence over the crypto market. However, aggressive cuts can have a negative impact, and he slowed the pace of future cuts in October.

Today, despite President Trump’s inflation-related requests for substantial cuts, Powell said that the Fed “does not need to be in a hurry.”

As Powell is well aware, rate cuts can be a double-edged sword. On one hand, small cuts limit borrowing, which may slow capital inflows into the crypto market.

On the other hand, intense cuts reflect market chaos and may encourage investors to take a conservative approach, especially with risk-on assets like Bitcoin. This middle course will maintain a status quo.

However, institutional investors may delay moving funds into crypto until future policy adjustments provide clearer signals. This might result in a cautious market response.

The institutional market already signaled this cautious mindset today, as Bitcoin ETFs saw the first weekly net outflow in 2025.

Fed Chair Advocates for Stablecoin Regulation

Powell also touched on a few key areas outside interest rates, such as stablecoin regulations and anti-crypto debanking efforts. There have been several efforts to codify stablecoin policy in the US, but none have quite materialized.

This concern is especially relevant because the EU recently adopted its own framework. Powell, for his part, fully supports this.

“The Federal Reserve definitely supports efforts to create a regulatory framework around stablecoins. They may have a big future with consumers and businesses, and it’s important that stablecoins develop in a manner that protects consumers and savers, that there be a regulatory framework,” Powell claimed.

Additionally, while Powell supports clearer guidelines for stablecoins, he concurs with the crypto industry’s hostility to a US CBDC.

Powell’s comments on a few topics seemed to generally align with industry opinion. In addition to slow rate cuts and stablecoin regulation, he also wants to combat Operation Choke Point 2.0 and other debanking initiatives.

“My colleagues and I are struck by the growing number of cases of what appears to be debanking. We’re determined to take a fresh look at that,” Powell said.

Congress is currently intensifying its investigations of Operation Choke Point 2.0, and the FDIC released a tranche of 175 documents on the subject.

This overwhelming evidence has apparently convinced Powell, and he will use his influence at the Fed to fight further debanking efforts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.