Cardano (ADA) price has dropped over 25% in the last seven days, bringing its market cap down to $26 billion. Trading volume has also fallen 35% in the past 24 hours, now sitting at $766 million, signaling decreased market activity.

Meanwhile, whale addresses have stabilized after a brief surge, suggesting a period of balance as large holders await clearer market signals.

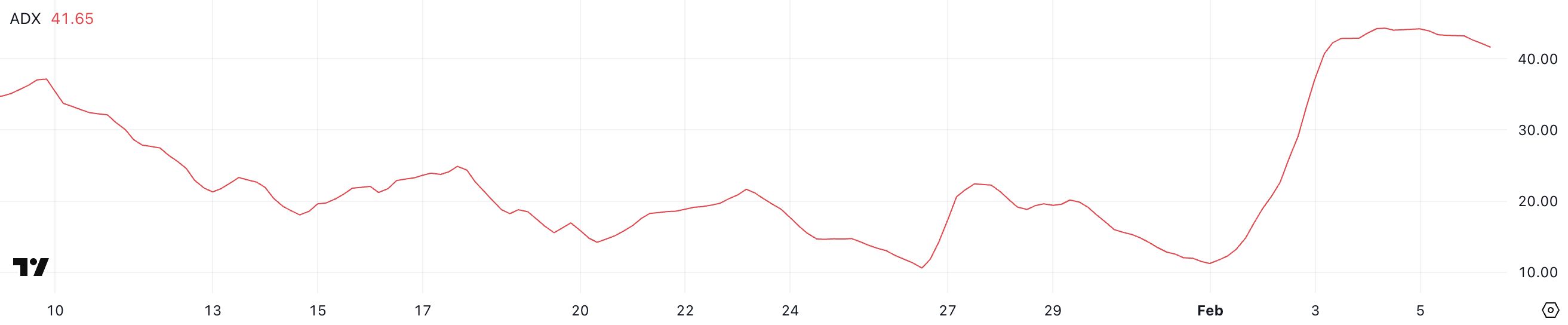

Cardano ADX Shows the Current Downtrend Is Still Strong

Within five days, Cardano’s Average Directional Index (ADX) climbed from 11.2 to 41.6, indicating a strong trend that coincided with a 20% price correction.

ADX measures trend strength, not direction, with readings above 25 indicating a strong trend and below suggesting weakness. Given ADA’s high ADX, the recent downtrend has been powerful, reinforcing bearish momentum.

Despite still being in a downtrend, ADA’s ADX has remained stable around 41 and 42 for two days and slightly declined between yesterday and today.

This suggests the trend may be losing intensity, though it hasn’t reversed and is still very strong. If ADX continues to drop while ADA price steadies, sellers could be weakening, possibly leading to consolidation.

However, with no clear reversal, downside risks remain.

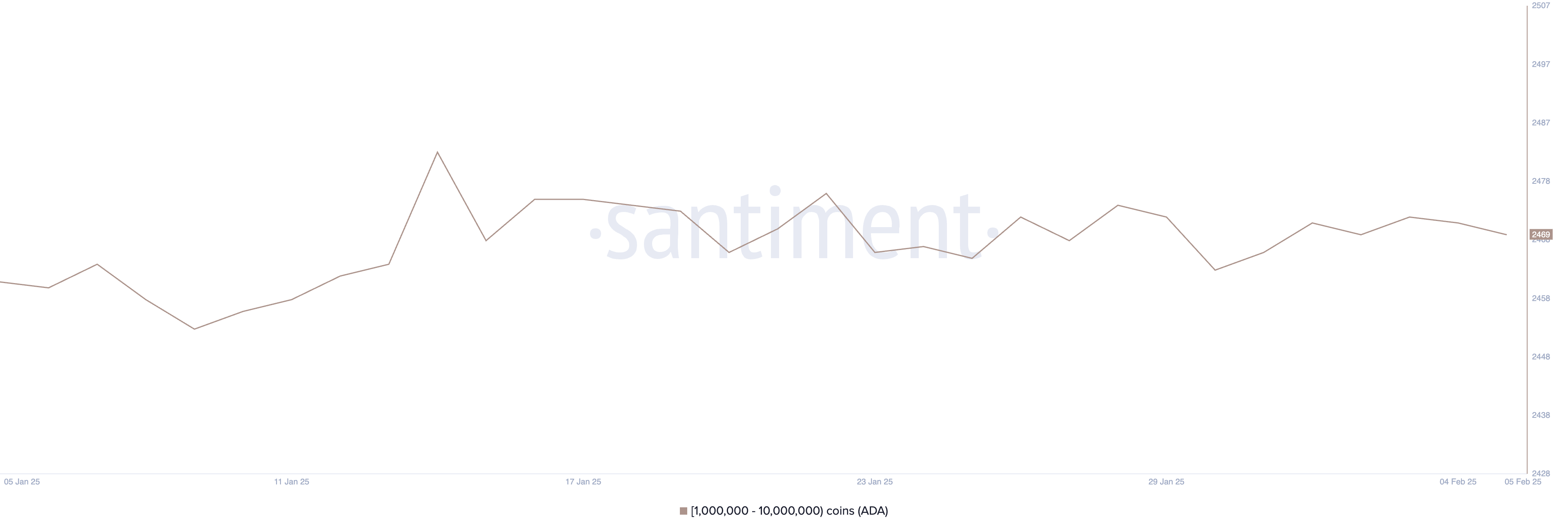

Cardano Whales Has Been Stable For Three Weeks

The number of Cardano whale addresses, holding between 1,000,000 and 10,000,000 ADA, jumped from 2,453 to 2,483 between January 9 and January 14. However, after that spike, the number declined slightly and has remained stable over the past few weeks.

Tracking these whales is important because their accumulation or distribution can signal shifts in the market. A rising number of whale addresses often suggests confidence and potential price support, while a decline may indicate selling pressure.

Currently, ADA whale addresses are at 2,469, hovering around this level with minor fluctuations for the past three weeks. This suggests a period of balance. Large holders are neither aggressively accumulating nor selling, possibly focusing their investments on other coins for possible gains in February.

If stability continues, it could mean ADA price is in a consolidation phase, with whales waiting for clearer market direction before making major moves.

ADA Price Prediction: A 55% Upside or Downside?

Cardano price is currently trading between support at $0.65 and resistance at $0.82, with its EMA lines showing a bearish setup—short-term EMAs are positioned below long-term ones.

This suggests that downward momentum remains dominant, reinforcing the idea that ADA is still in a downtrend.

If an uptrend emerges, ADA could test the $0.82 resistance, and a breakout above it could open the door for a move toward $1.03 or even $1.16, a potential 55% upside.

However, if the downtrend continues and ADA price loses the $0.65 support, it could drop further to $0.51 or even $0.32, marking a 55% decline and reaching its lowest levels since December 10, 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.