Privacy-focused cryptocurrency Monero has emerged as the market’s top gainer on Thursday, rising by 5% in the past 24 hours. The price rally comes as the broader crypto market grapples with a downturn.

As the bullish bias toward the altcoin strengthens, Monero appears poised to maintain its uptrend in the short term.

Monero Climbs, Bullish Momentum Shows Strength

XMR has consistently traded above an ascending trendline, which has provided significant support since December 9. The token’s price has dipped below this trendline only once during this period, quickly rebounding and resuming its uptrend. This behavior indicates that bulls have been actively defending the support level formed at $220.74.

An ascending trendline is formed by connecting the lowest points of a price chart, creating a line that slopes upward. It indicates that the asset is in an uptrend, with each successive low being higher than the previous one. This signals a growing demand for the asset.

The trendline acts as support, and when prices stay above the line, it suggests the potential for continued upward movement.

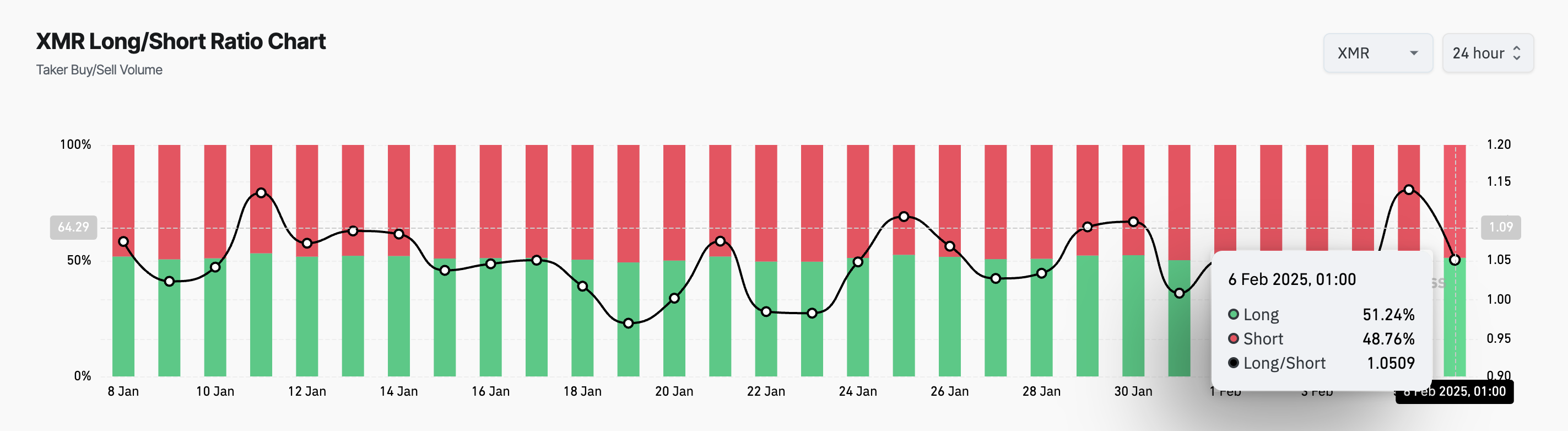

Further, XMR’s steady uptrend amid broader market consolidation has prompted its futures traders to demand more long positions than short ones. This is reflected by its long/short ratio, which stands at 1.05 at press time, per Coinglass.

This ratio compares the number of long positions (bets that the price will rise) to short positions (bets that the price will fall) in a market. When the ratio is above 1, it indicates that there are more long positions than short ones, suggesting a bullish sentiment among traders.

XMR Price Prediction: Bullish Momentum Could Propel Price to $289

On the daily chart, XMR’s Relative Strength Index (RSI) is in an upward trend at 58.53, confirming the demand for the altcoin.

This momentum indicator measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. On the other hand, values under 30 indicate that the asset is oversold and may witness a rebound.

At 58.59 and in an uptrend, XMR’s RSI indicates that the asset is in a bullish zone, with price momentum showing more buying than selling pressure. If buying activity persists, XMR’s price could climb toward $289.11, a high it last reached in April 2022.

Conversely, a negative shift in market trends could cause XMR to lose its recent gains. In that scenario, its price may attempt to break below the support offered by its ascending trendline at $220.74.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.