Coinbase, the largest US-based crypto exchange, indicated the addition of Ether.fi (ETHFI) and Bittensor (TAO) to its listing roadmap.

ETHFI is a decentralized protocol token offering liquid staking and restaking solutions for Ethereum. Meanwhile, Bittensor’s TAO has multiple purposes within the ecosystem, acting as a utility token and a reward mechanism.

Traders React to Coinbase Listing Announcement

Coinbase only supports two types of assets: native assets on their network and tokens that adhere to a supported token standard. Based on this standard, the exchange has added ETHFI and TAO to its listing roadmap.

The exchange posted the update on X (Twitter), suggesting that ETHFI and TAO meet its listing threshold. The US-based exchange also shared the contract addresses for the two tokens.

“Assets added to the roadmap today: Ether.fi (ETHFI), and Bittensor (TAO),” the post read.

Coinbase’s decision to add ETHFI and TAO to its listing roadmap follows what the exchange describes as a “thorough processes and standards evaluation for legal, compliance and technical security.” The criteria do not consider a project’s market cap or popularity.

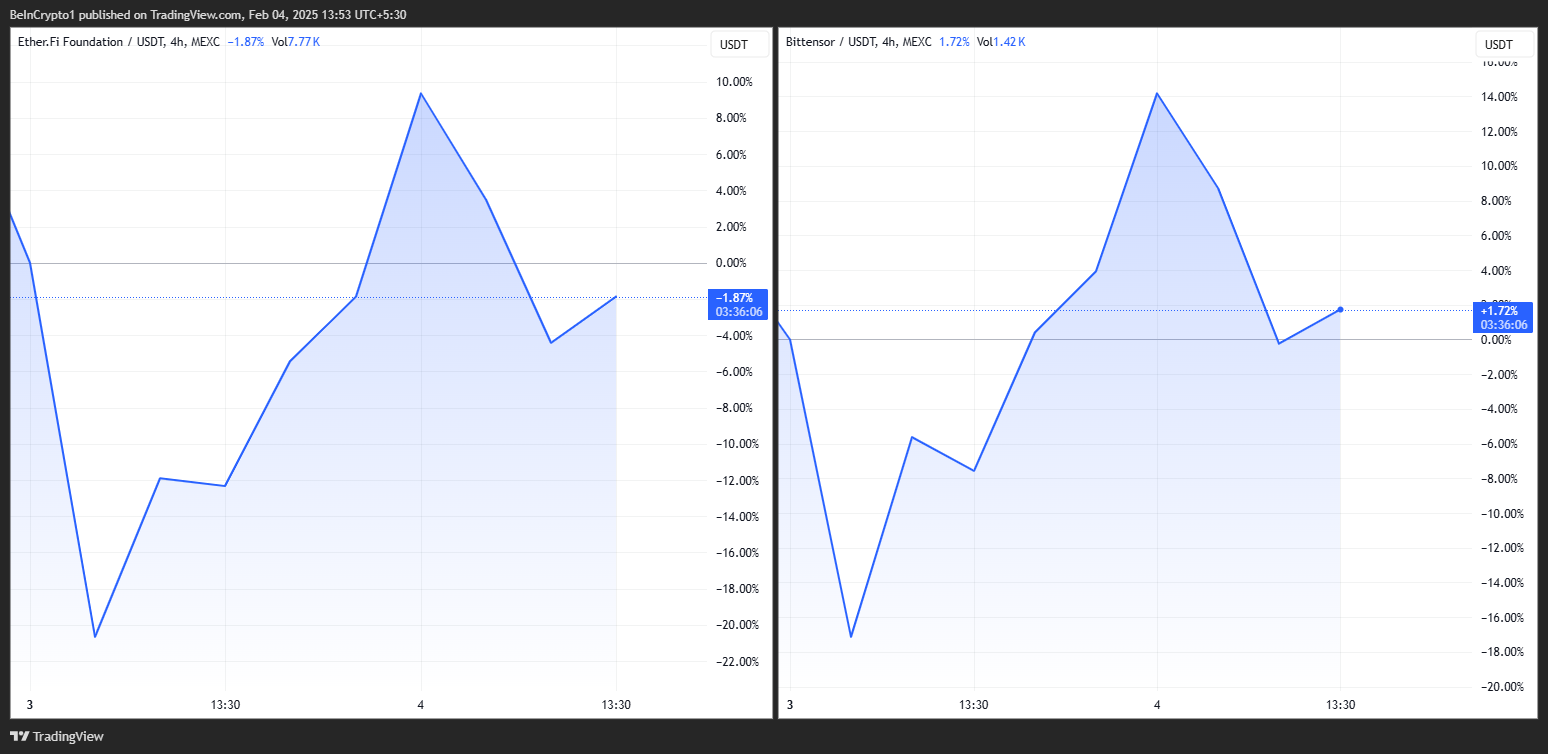

After the Coinbase listing announcement, ETHFI and TAO token prices reacted, soaring by over 30% each before profit booking kicked in.

The surge was expected, coming off as a typical reaction of tokens following listing announcements on popular crypto exchanges. For instance, the Base token TOSHI recently skyrocketed by 70% when Coinbase added it to its listing roadmap. The same reaction happens following Binance exchange’s listing announcements.

Such reactions come amid the “buy-the-rumor, sell-the-event” situation and the expectation of increased liquidity. It is worth noting that Binance is the largest crypto exchange in terms of trading volume metrics. Meanwhile, Coinbase is the largest US-based crypto exchange. Given their high trading volumes and liquidity, it becomes easier for traders to buy and sell the tokens on these platforms.

Higher liquidity often leads to price appreciation, reducing price volatility and making it easier for traders to enter and exit positions. Other factors at play include increased accessibility, increasing demand, credibility, and trust.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.