Litecoin (LTC) is seeing a surge in bullish momentum, with its price climbing 10% in the past 24 hours. The recent rally came as the US Securities and Exchange Commission (SEC) reviewed the application for the Canary Spot Litecoin exchange-traded fund (ETF).

While LTC validated a bullish double-bottom pattern, it has yet to breach a key resistance level at $133. Market participants remain divided—whales have started offloading holdings, while retail investors appear optimistic.

Litecoin Whales Move To Sell

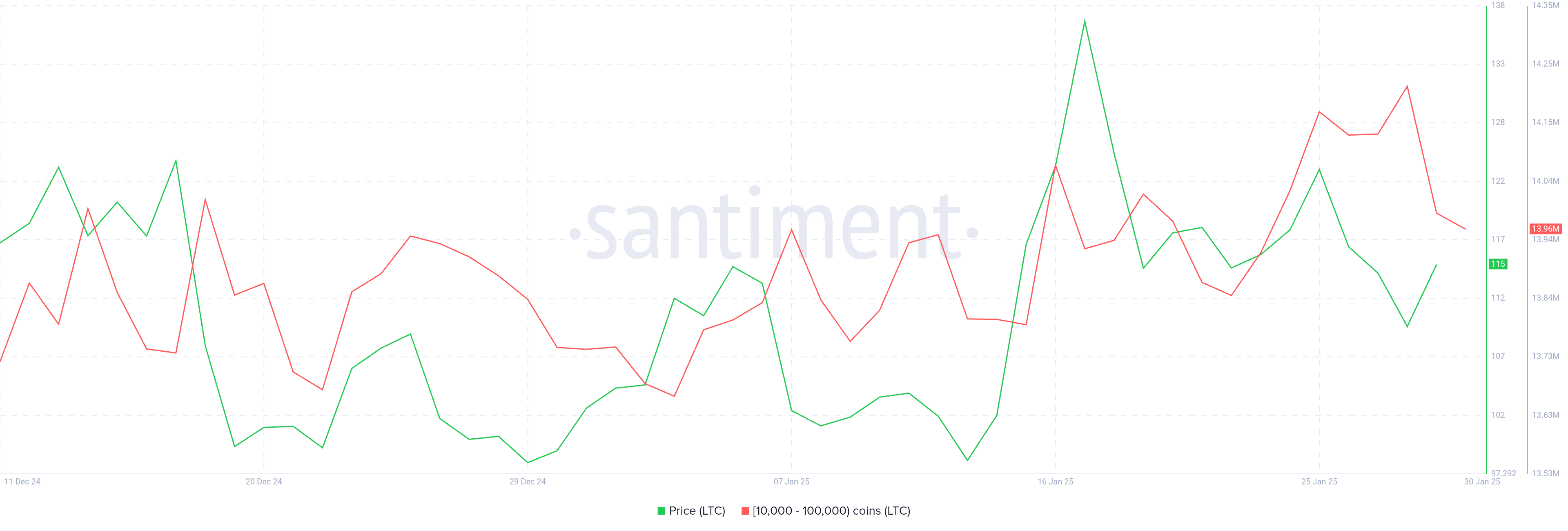

Whale activity suggests a cautious approach amid the recent price surge. On-chain data reveals that Litecoin addresses holding between 10,000 and 100,000 LTC and has sold over 230,000 tokens worth approximately $30 million within 24 hours. These large holders, or whales, are capitalizing on the ETF-driven hype to secure profits, signaling possible short-term price volatility.

Despite growing optimism surrounding a potential Litecoin ETF, uncertainty persists. Whales typically act as trendsetters in the market, and their recent selling spree suggests concerns about LTC sustaining its rally. If this selling pressure continues, retail investors may struggle to maintain momentum, potentially leading to a retracement

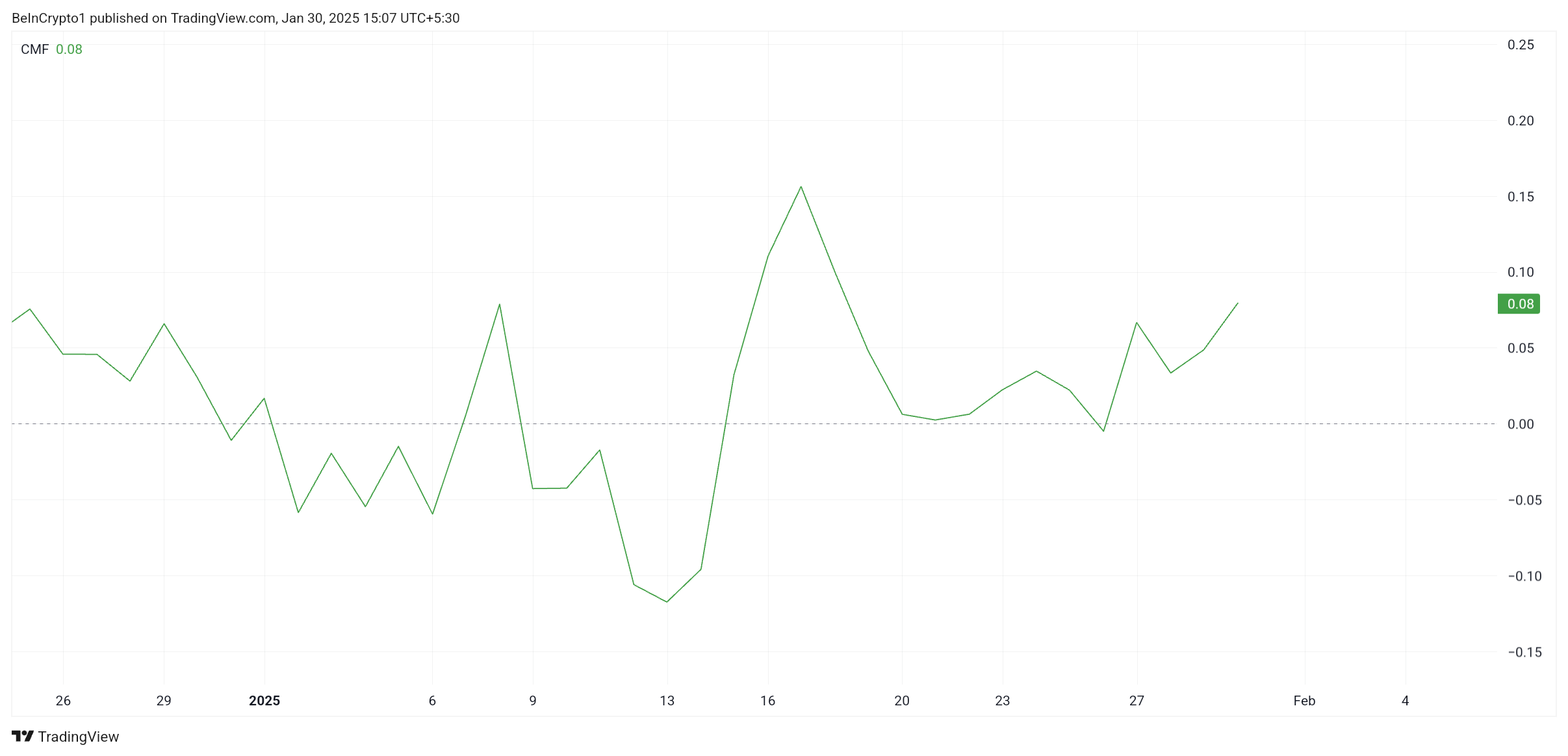

Litecoin’s macro momentum remains in a favorable position, supported by improving technical indicators. The Chaikin Money Flow (CMF), a key gauge of capital inflows and outflows, has climbed above the zero line. This indicates growing buying pressure, reinforcing the potential for sustained gains.

Historically, rising CMF values align with upward price movements, as increased inflows suggest confidence among investors. If this trend continues, LTC may have the necessary support to break through its resistance level, shifting its trajectory toward higher price targets.

LTC Price Prediction: Securing Supports

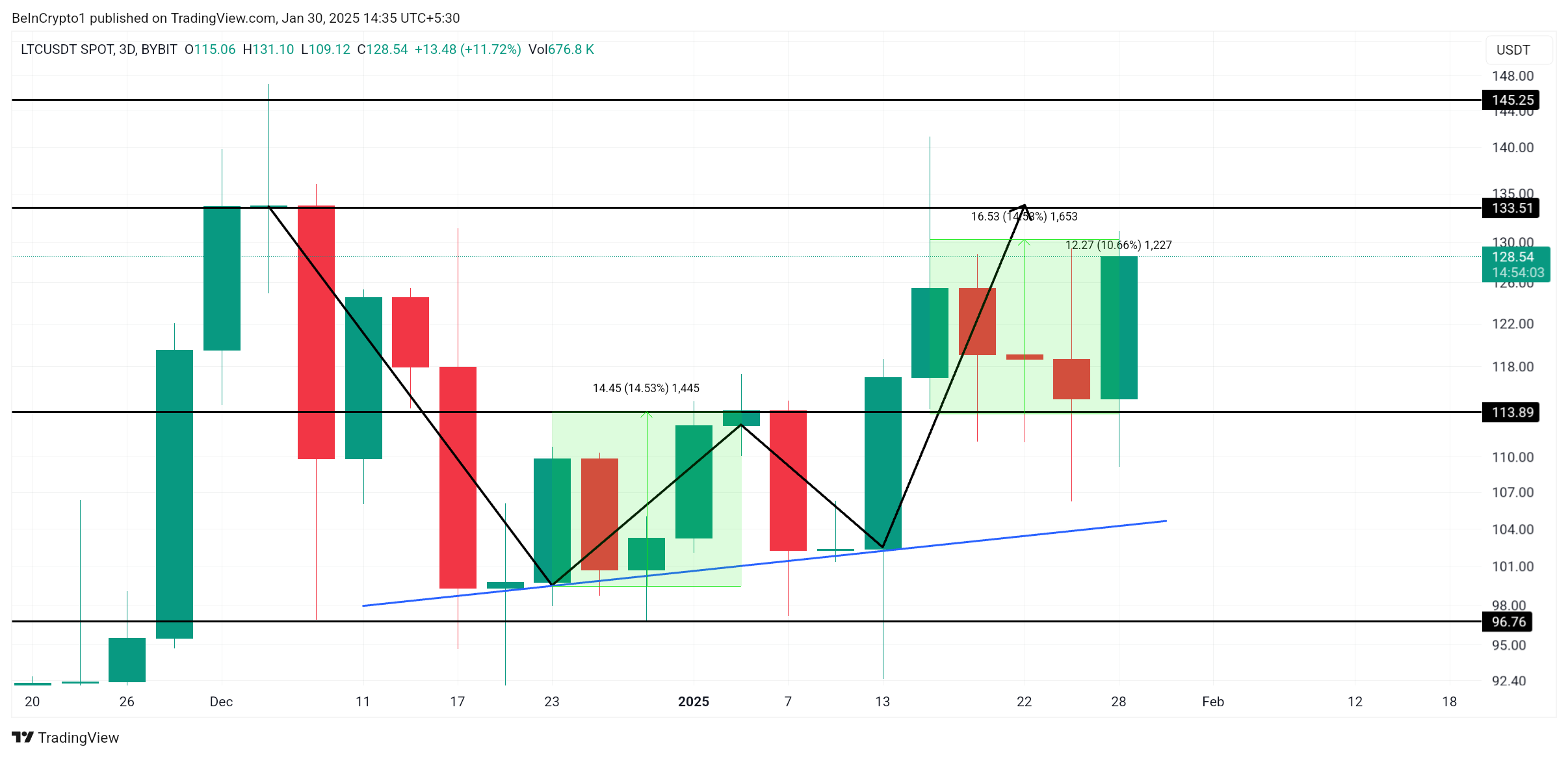

Litecoin’s recent surge follows the SEC’s decision to review the Canary Spot LTC ETF application. The announcement spurred a 10% increase in LTC’s value, bringing it closer to a crucial resistance level of $133. However, breaking this barrier remains a challenge as selling pressure from whales introduces volatility into the market.

Despite validating a bullish double-bottom pattern, Litecoin failed to breach the two-month-old resistance and is currently trading at $128. The altcoin remains above the critical support level of $113, but as long as whale selling persists, LTC may continue consolidating below $133 in the short term.

A decisive move above $133 could trigger a broader breakout, pushing LTC toward $145. Overcoming this level would invalidate the current bearish-neutral sentiment, opening the door for a stronger recovery. If bullish momentum accelerates, Litecoin could establish a higher range, reinforcing its position as one of the leading altcoins in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.