The Federal Reserve kept its benchmark interest rate unchanged at 4.25%-4.50% on Wednesday. This marks a ‘hawkish pause’ as inflation remains elevated and economic activity grows at a steady pace.

The decision follows three consecutive rate cuts in late 2024 but signals that policymakers remain cautious about premature monetary easing.

Steady Interest Rates Likely to be Bullish for Crypto

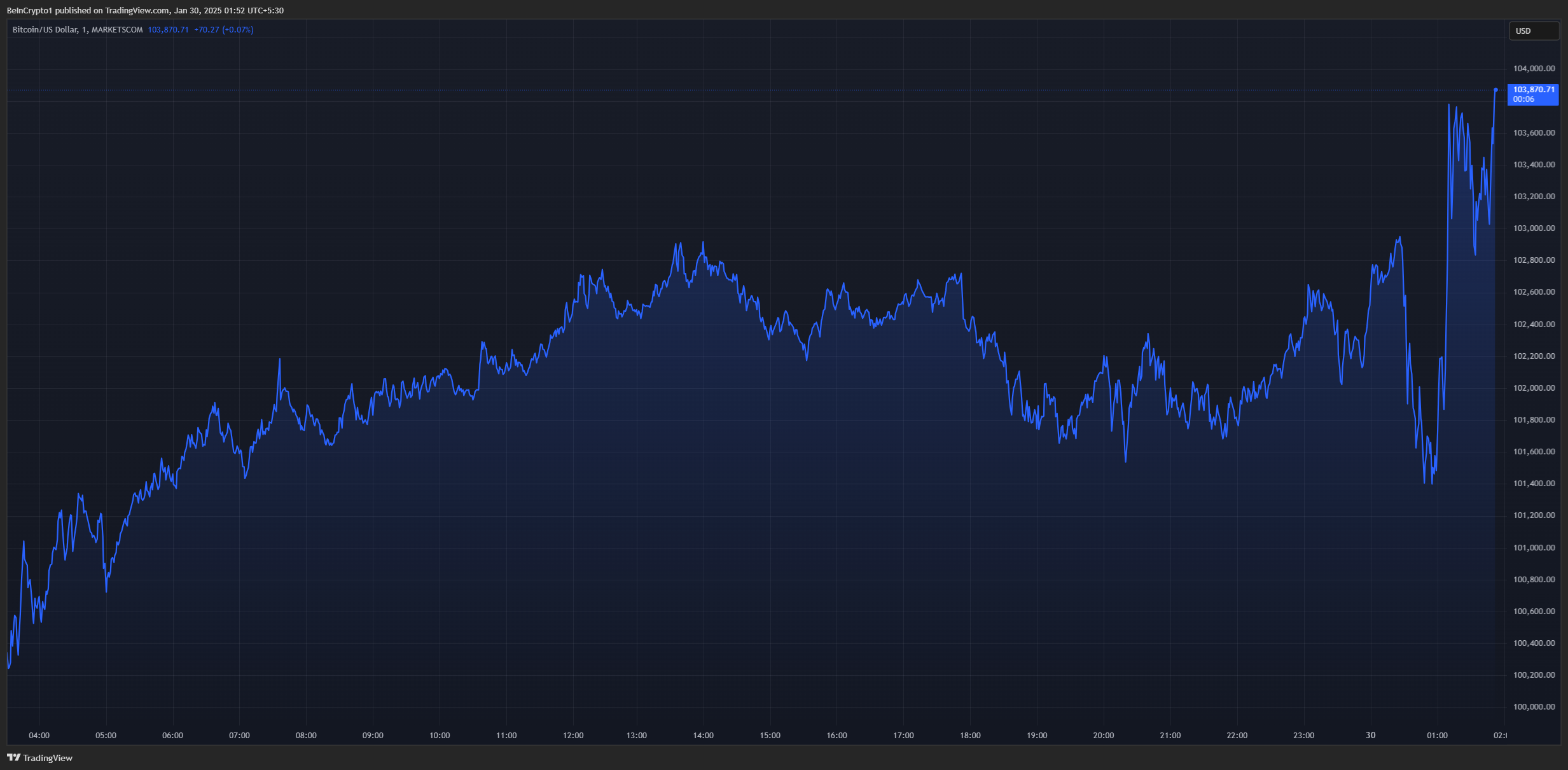

There haven’t been any major market movements following the announcement. Usually, steady rates are bearish for the crypto market. Fed’s stance suggests that capital will not flow into high-risk assets as quickly.

However, major cryptocurrencies saw a modest uptick. Bitcoin, Solana, and XRP each gained nearly 2% in the hour after the news.

So, there’s likely a market optimism over continued liquidity stability. A pause in rate hikes is generally viewed as bullish for risk assets, including cryptocurrencies.

Lower interest rates—or expectations of stable rates—make traditional fixed-income investments less attractive. This drives investors toward higher-yielding assets like equities and crypto.

“Trump’s out here begging for a cut, but the Fed’s like ‘nah.’ It’s bad news for crypto, cause when interest rates stay high, investors chill out and avoid risk. But if Powell flips the script and gets all dovish, we could see some action,” Mario Nawfal wrote on X (formerly Twitter).

Additionally, a ‘Hawkish Pause,’ suggests that economic conditions are stable enough to avoid aggressive tightening. This creates a favorable environment for crypto markets, which thrive on liquidity and investor confidence.

Fed’s Policy Stance and Market Expectations

Despite keeping rates steady, the Fed’s statement indicated that inflation remains elevated and removed previous references to progress toward its 2% goal. This suggests that further rate cuts may not be imminent.

However, steady employment levels and economic resilience reduce recession fears, supporting speculative assets like Bitcoin and other cryptocurrencies.

President Trump had urged the Fed to continue cutting rates, but central bank officials chose to maintain their current stance.

Overall, the crypto market will closely monitor any signals of future liquidity expansion. Until the Fed shifts toward rate cuts or implements measures that increase monetary stimulus, altcoins are expected to underperform Bitcoin.

Bitcoin, with its stronger institutional appeal and macro resilience, remains the safer bet in a hawkish monetary environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.