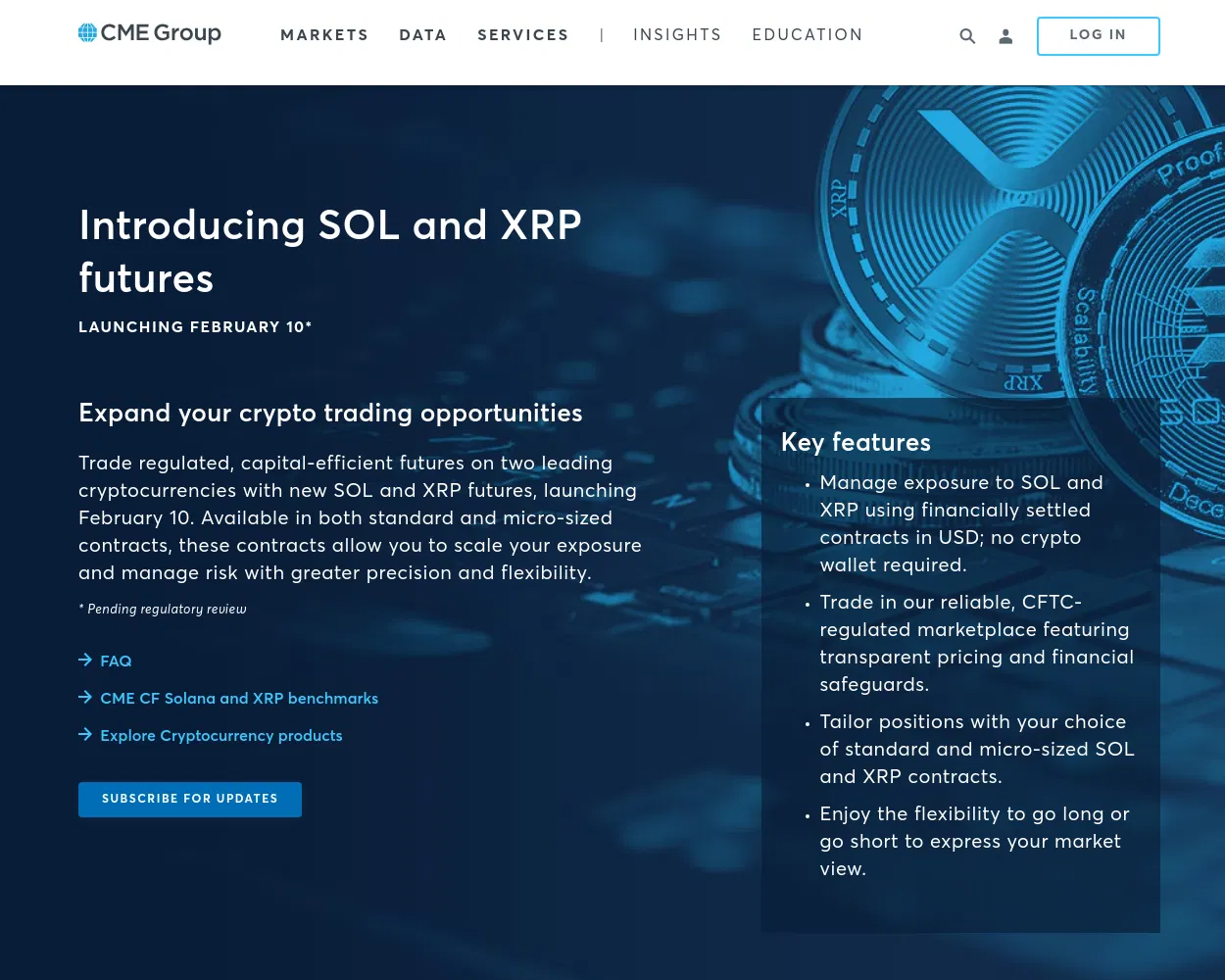

The Chicago Mercantile Exchange (CME) is reportedly preparing to introduce futures contracts for Solana and XRP. There’s a potential launch date of February 10, contingent on regulatory approval.

The CME website briefly displayed details of the new offerings before removing the page.

Solana and XRP Futures Trading for Retail Investors

The advert for futures contracts was posted on a beta version of the CEM’s website. While some users claim it to be fake, analysts emphasized that it’s likely.

“Looks like CME is expecting to launch SOL & XRP futures on February 10. But this isn’t available on the actual website yet. Honestly makes sense and largely to be expected if true IMO,” wrote ETF analyst James Seyffart.

According to the leaked advert, the Solana and XRP futures contracts will be available in both standard and micro sizes.

The standard SOL contract will have a lot size of 500 SOL, while the micro-contract will include 25 SOL.

Similarly, XRP standard futures contracts will feature lot sizes of 50,000 XRP, with micro-contracts set at 2,500 XRP. All contracts will settle in US dollars.

Surge in Crypto ETF Amid Regulatory Changes

The re-election of President Donald Trump and Gary Gensler’s resignation from the SEC have spurred a wave of new applications for crypto-related financial products. Firms are anticipating a more favorable regulatory environment.

Yesterday, the SEC, under acting chair Mark Uyeda, established a crypto task force. This initiative will reportedly aim to bring regulatory clarity to the industry.

“In the short time he has before Atkins takes over, Mark Uyeda is expected to de-escalate the strict approach toward regulation by enforcement that Gensler oversaw. The SEC’s current composition shows three commissioners, including Hester Peirce, Caroline Crenshaw, and Uyeda. Both Uyeda and Peirce are pro-crypto, meaning any positive regulation that may impact the industry can easily pass moving forward,” Agne Linge, head of growth at WeFi, told BeInCrypto.

As of now, four asset managers have applied for an XRP ETF, which includes WisdomTree Bitwise, 21Shares, and Canary Capital.

More applications for altcoin ETFs are expected in the near future, with Litecoin identified as a potential frontrunner.

Meanwhile, Nasdaq has already filed Form 19b-4 to list Canary Capital’s proposed Litecoin ETF. This aligns with Canary’s recent S-1 amendment and feedback from the SEC.

Analysts predict that Litecoin could become the first altcoin after Ethereum to have an ETF approved, positioning Canary Capital as an early leader in this space.

While XRP ETFs are generating significant interest, approval timelines could extend due to ongoing legal proceedings between Ripple and the SEC.

Industry insiders expect the lawsuit to conclude under new SEC leadership, with Paul Atkins likely to take over as permanent chair. If resolved, the decision could accelerate approval processes for XRP ETFs.

Overall, the potential launch of SOL and XRP futures contracts and the surge in ETF applications reflect growing institutional interest in crypto assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.