BlackRock has expanded its digital asset offerings by launching the iShares Bitcoin ETF in Canada. The ETF is trading under ‘IBIT’, the same as the US.

This ETF began trading on January 13 on Cboe Canada, providing Canadian investors with a convenient way to gain exposure to Bitcoin without the complexities of direct ownership.

BlackRock Expands the Largest Bitcoin ETF Offering to Canada

The newly launched iShares Bitcoin ETF in Canada seeks to mirror the performance of Bitcoin’s price before accounting for the ETF’s expenses and liabilities. It achieves this by investing in the US-listed iShares Bitcoin Trust ETF.

This structure leverages a technology integration developed with Coinbase Prime, a leading institutional digital asset custodian.

“Cboe has a history of bringing many first-of-their-kind products to market, including spot crypto ETFs in the United States, and we’re thrilled to continue our leadership in innovation by listing BlackRock Canada’s IBIT ETF on Cboe Canada,” said Helen Hayes, Head of iShares Canada, BlackRock.

Also, the Bitcoin ETF carries a management fee of 0.32% and is available in both Canadian (IBIT) and US dollar (IBIT.U) denominated classes. At the time of writing, the fund’s net assets were approximately CAD 2 million, with 50,000 units outstanding.

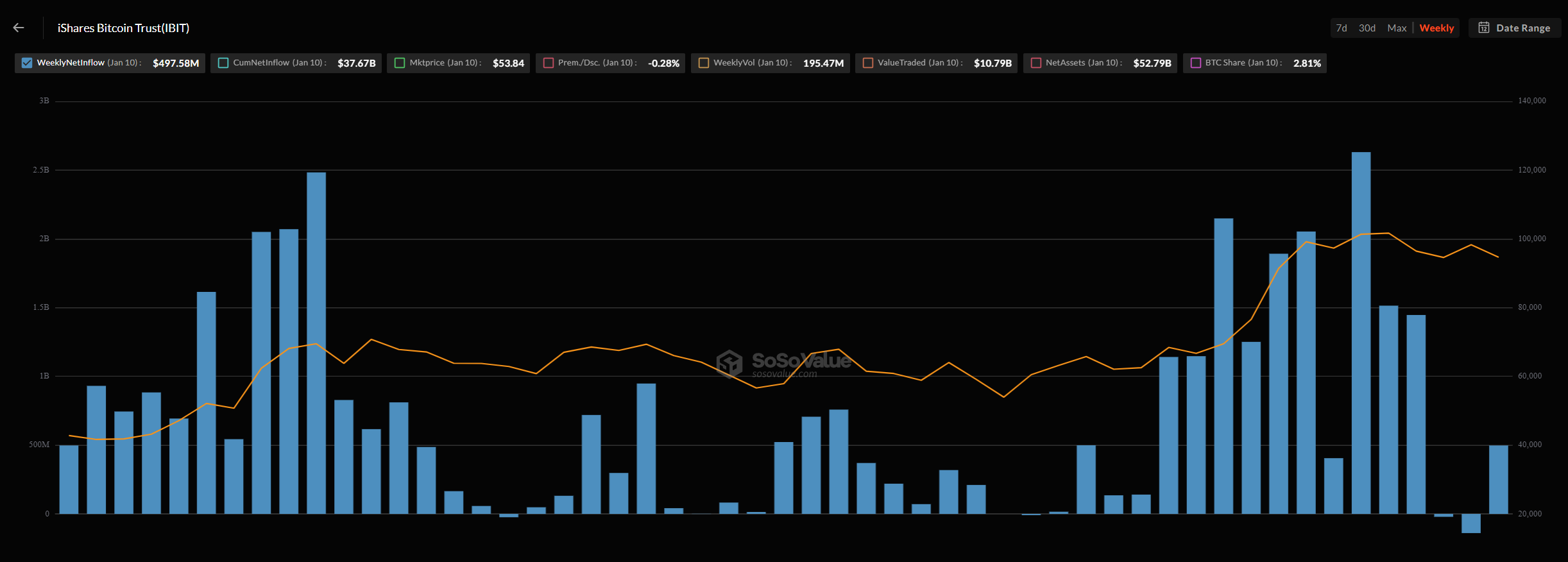

BlackRock’s IBIT is already the largest Bitcoin ETF in the US market. The fund currently holds over $52.7 billion in net assets, which is higher than all European ETFs combined. The ETF launched in the US exactly a year ago after the SEC’s approval, and today, it is expanding to Canada.

Since its debut, the US-listed ETF experienced net outflows in only three weeks. Its strong performance led Nasdaq ISE to propose an increase in position and exercise limits for BlackRock’s ETF options.

In addition to its Bitcoin ETF, BlackRock expanded its crypto initiatives in 2024 by launching BUILD, its first tokenized fund. The fund has been adopted by several stablecoin issuers, such as Frax and Ethena Labs, as a backing asset.

Overall, investor interest remains high. In November, BlackRock’s Bitcoin ETF options recorded over $425 million in trades on the first day, reflecting significant market demand for its Bitcoin-based products.

This expansion into Canada reflects BlackRock’s ongoing commitment to providing innovative products while responding to growing interest in Bitcoin investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.