Ethereum (ETH) price has dropped over 15% in the last seven days, putting it at risk of falling below the critical $3,000 level for the first time since November 2024. Key indicators like the DMI and EMA lines show a bearish setup, with increasing downward pressure and weakening bullish momentum.

While whale accumulation suggests long-term confidence in ETH, the short-term outlook remains uncertain as the price approaches significant support levels. If the current downtrend persists, ETH could face a deeper correction, but a reversal could pave the way for a recovery toward $3,300 or higher.

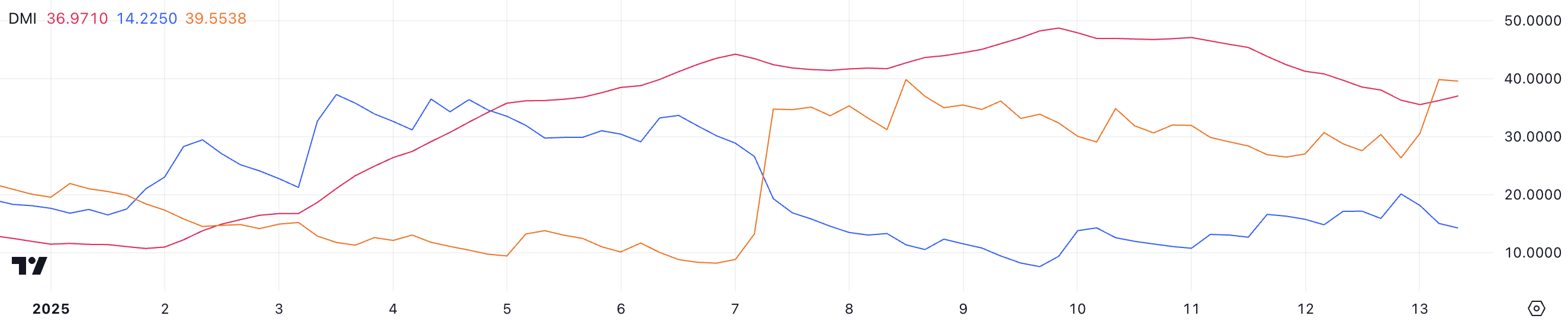

ETH DMI Shows a Bearish Setup

Ethereum Directional Movement Index (DMI) shows its ADX currently at 36.9, a drop from 48 just four days ago, indicating a weakening trend strength. Despite that, during this period, ETH price has fallen roughly 6%.

The ADX, which measures trend strength without specifying direction, typically signals a strong trend above 25, with values above 40 indicating a very strong trend.

The DMI further highlights the bearish scenario, with the negative directional index (D-) jumping from 26.3 to 39.5, signifying an increase in bearish pressure. Meanwhile, the positive directional index (D+) has dropped sharply from 20 to 14.2, reflecting weakening bullish momentum.

This widening gap between D- and D+ reinforces ETH’s short-term downtrend. If the ADX continues to fall, it could signal a potential reduction in trend strength, providing some relief for ETH price. However, until D+ shows signs of recovery or D- declines, the price may remain under bearish pressure in the near term.

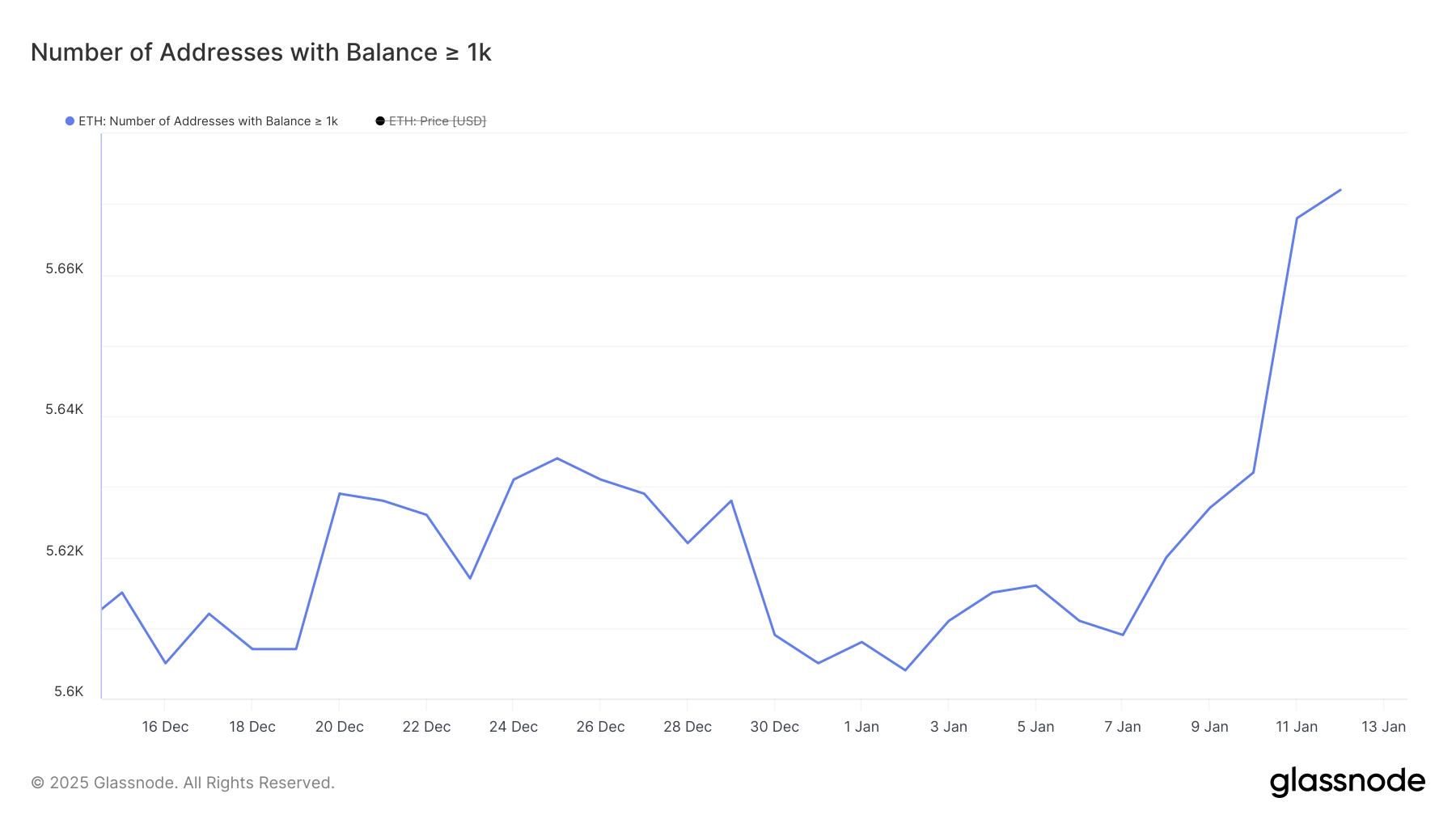

Ethereum Whales Hit the Biggest Level In 11 Months

Ethereum whales seem to be taking advantage of the recent correction to accumulate more ETH.

Between January 7 and January 12, the number of addresses holding at least 1,000 ETH increased from 5,609 to 5,672, marking a notable rise in large holders during this period of price weakness.

Tracking whale activity is crucial as it often provides insights into market sentiment and potential price trends. Whales can influence price movements due to the sheer volume of their holdings, and their accumulation phases can indicate confidence in the asset’s future performance.

The current number of ETH whales, now at its highest since February 2024, suggests growing interest from large players, which could signal potential upward momentum if this accumulation trend continues.

ETH Price Prediction: A Potential 23% Correction

Ethereum EMA lines currently show a bearish setup, with all short-term lines positioned below long-term ones. This alignment, combined with ETH’s sharp decline of over 15% in the last seven days, shows a strong downtrend, leaving the price in a precarious position.

If the bearish momentum continues, Ethereum price could test the critical support level at $3,014. Losing this level might push ETH below the $3,000 mark for the first time since November 2024, with subsequent supports at $2,723 and $2,359, the latter representing a potential 23% correction.

Conversely, a reversal of this downtrend could enable ETH price to retest $3,300, with further breakouts possibly targeting $3,545 or even $3,745, offering a pathway to recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.