The asset management firm Bitwise plans to launch a new ETF named the “Bitcoin Standard Corporations ETF.”

Additionally, Strive, an asset management company co-founded by Vivek Ramaswamy, has also filed for a new ETF named the Bitcoin Bond ETF.

The Growing Trend of Bitcoin Treasury Adoption Among Corporations

On December 27, the asset management company Bitwise filed a registration with the US Securities and Exchange Commission (SEC) to launch a new ETF named the “Bitcoin Standard Corporations ETF.” This fund will invest in companies that hold substantial amounts of Bitcoin as part of their corporate financial reserves.

According to the filing submitted to the SEC, Bitwise will manage and own the index, referred to as Bitwise Index Services. The new ETF will invest in the securities of companies included in this index.

Bitwise has also set specific criteria for the companies comprising the index. Besides requiring these companies to hold at least 1,000 Bitcoins, Bitwise also considers other financial conditions, including:

- A minimum market capitalization of $100 million.

- Average daily liquidity of at least $1 million.

- A publicly traded free float of under 10%.

This move by Bitwise comes amidst a growing trend of Bitcoin treasury operations among corporations.

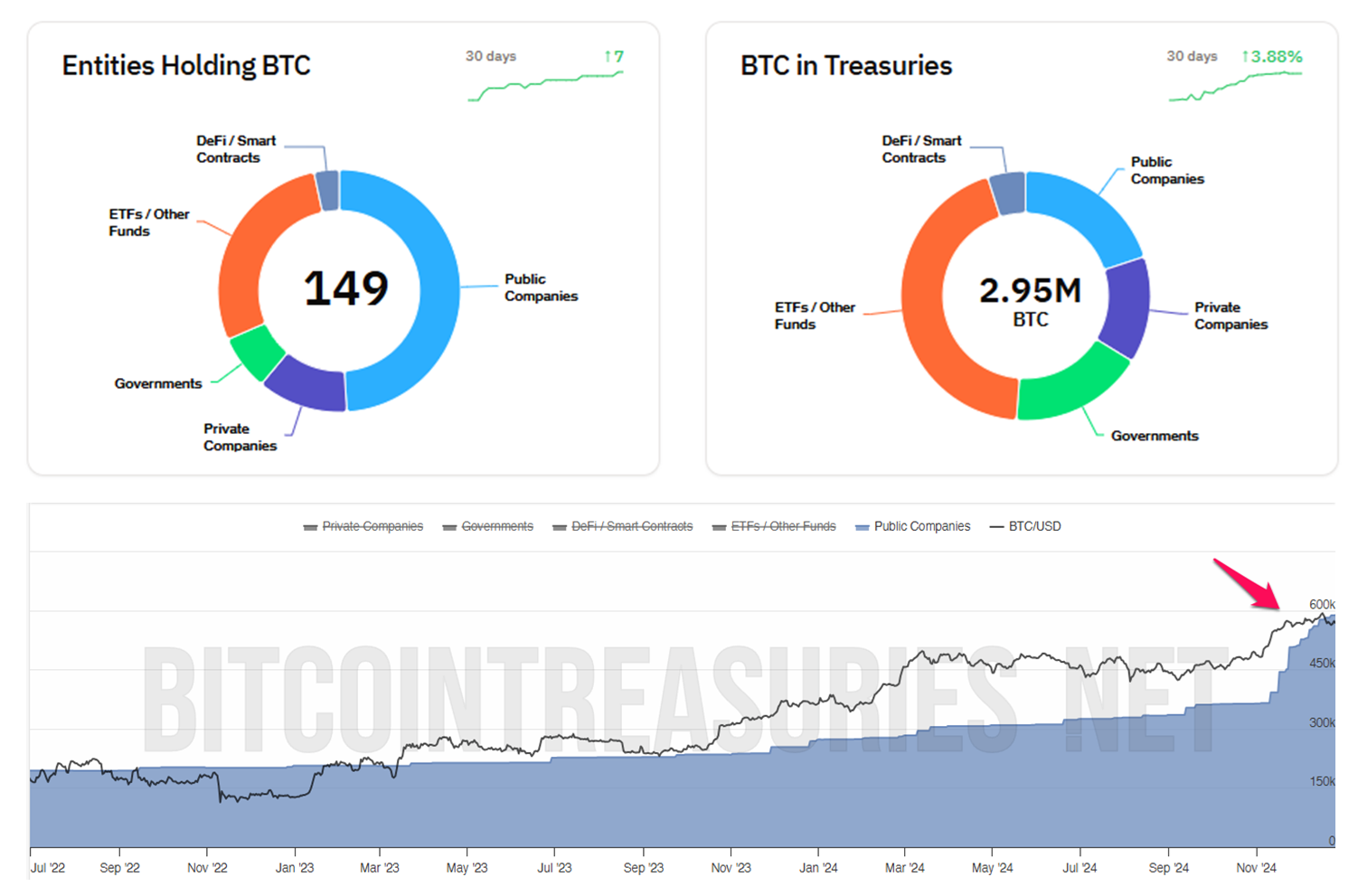

Based on data from BitcoinTreasuries, publicly listed companies account for 49% (73 out of 149) of all entities currently holding Bitcoin. Moreover, over the past two months alone, the amount of BTC held by publicly traded companies has surged by 60%. As of now, these companies collectively hold 587,687 BTC, representing 20% of the total Bitcoin held by all entities.

Recently, many companies unrelated to crypto have also joined the race to accumulate Bitcoin. For instance, firms such as Rumble, Anixa Biosciences, Interactive Strength, Hoth Therapeutics, Nano Labs, Solidion Technology, and Cosmos Health—operating in fields like biotechnology, pharmaceuticals, sports, cloud services, and video sharing—have also announced Bitcoin purchases. The stocks of these companies immediately rose in value following the announcement.

“The BTC treasury operations virus is spreading,” Nate Geraci, President of The ETF Store, commented.

Additionally, Strive, an asset management company co-founded by Vivek Ramaswamy, has filed for a Bitcoin Bond ETF. This ETF is expected to invest in convertible bonds issued by companies that Strive predicts will allocate most or all of the funds raised from these bonds to purchase Bitcoin, referred to as “Bitcoin Bonds.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.