The leading altcoin, Ethereum (ETH), has experienced a 15% decline in the past seven days. However, on-chain data has revealed that this price dip merely mirrors the broader crypto market sell-off as the bullish bias toward the altcoin remains significant.

This analysis highlights two key on-chain metrics hinting at a potential rally toward the $4,000 price zone in the near term.

Ethereum Sees Bullish Momentum Despite Price Fall

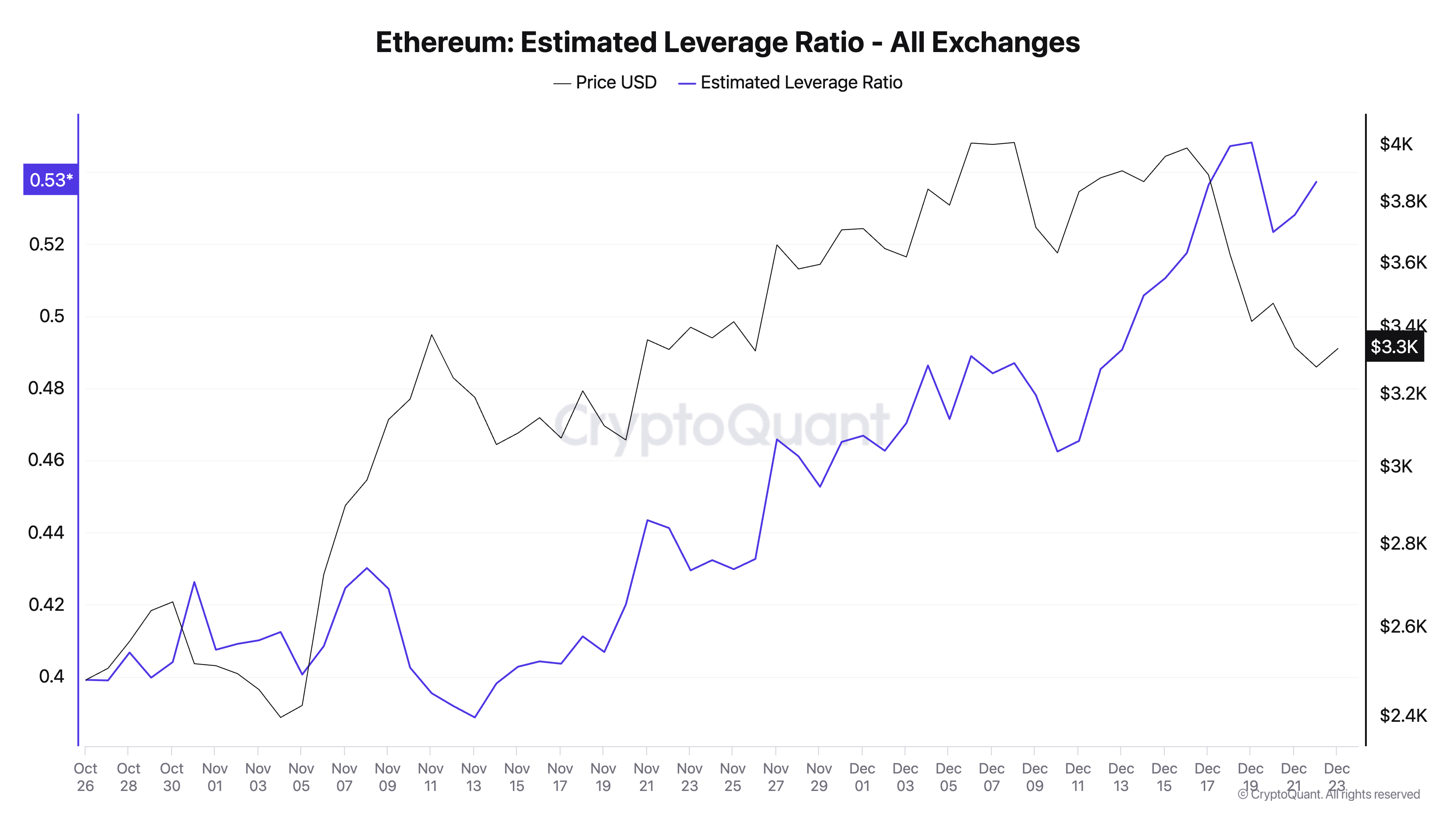

First, Ethereum’s rising Estimated Leverage Ratio (ELR) indicates a sustained appetite for risk, reflecting the likelihood of a price rebound. According to CryptoQuant, it stands at 0.53 at press time.

An asset’s ELR measures the average amount of leverage its traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

ETH’s climbing ELR indicates an increased risk appetite among traders. It suggests that many investors remain optimistic about the coin’s future price growth and are willing to leverage their positions to amplify potential gains.

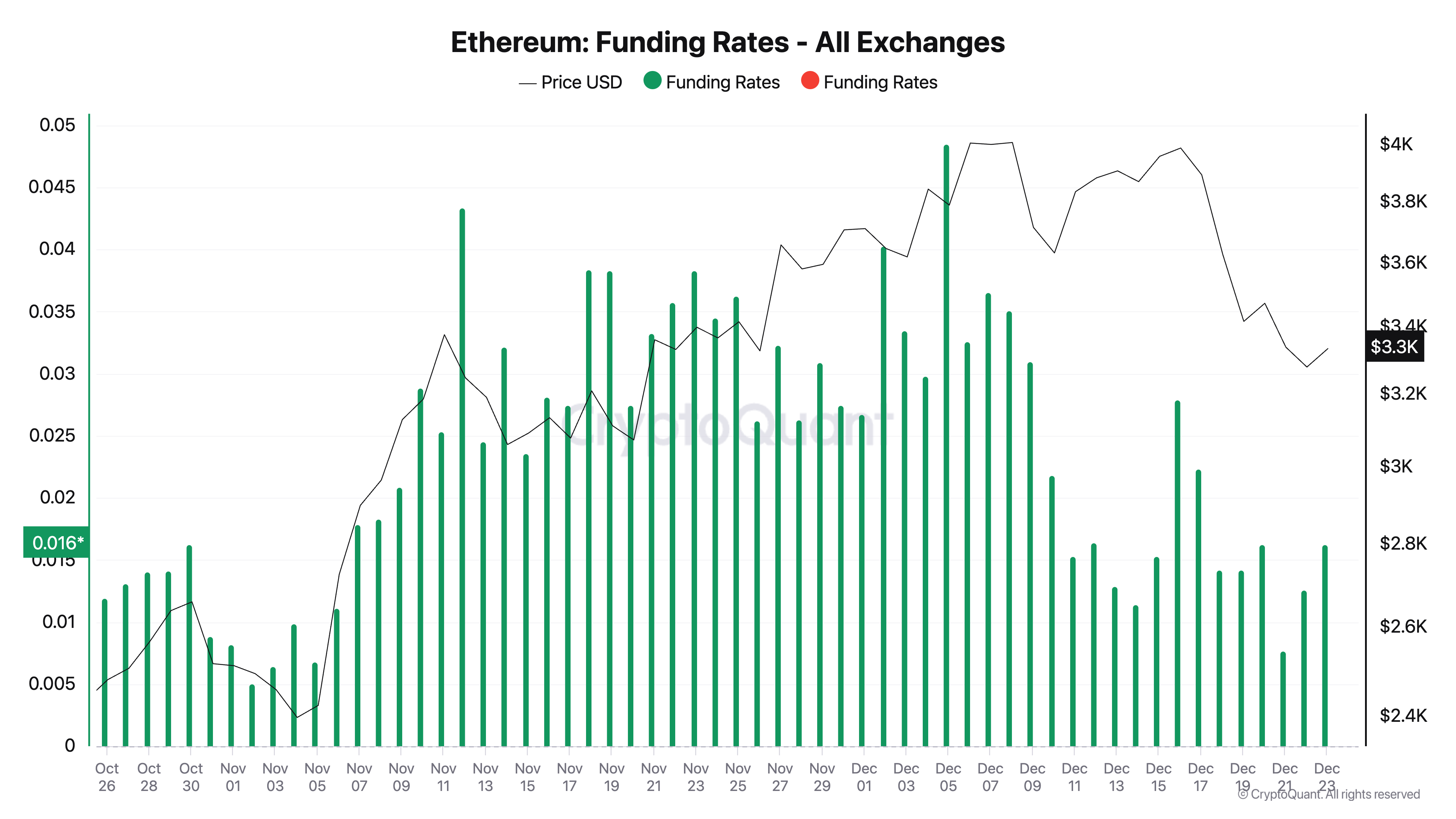

Further, ETH’s positive funding rate is another sign that its price may soon witness a rebound. According to CryptoQuant, this currently stands at 0.016. Despite the recent price decline, the funding rate across cryptocurrency exchanges has stayed positive, reflecting a bullish sentiment toward ETH.

An asset’s funding rate is a periodic fee exchanged between long and short traders in its futures market. It ensures the perpetual futures price aligns with the spot price. When it is positive, long traders are paying shorts, indicating bullish sentiment and expectations of price increases.

ETH Price Prediction: Will $4,000 Be the Next Stop?

ETH is currently trading at $3,344. If the bullish bias persists and buying activity picks up, ETH’s price could rally above the $3,439 resistance. A breakthrough at this level might drive the coin toward $3,733, paving the way for it to surpass the $4,000 psychological barrier.

However, if the downward trend persists, ETH’s value could drop to $3,232, invalidating this bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.