Ethereum (ETH) price recently surpassed $4,000 for the first time since March 2024, marking a 25% gain over the past 30 days. However, the 7D MVRV ratio, now at -1.35%, suggests short-term holders are experiencing unrealized losses, hinting at potential further downside before a recovery.

Historically, ETH tends to rebound after the MVRV dips to -4% or lower, aligning with growing whale accumulation, as addresses holding at least 1,000 ETH have steadily increased in December. While ETH faces key resistance at $3,987, breaking it could lead to $4,100 and beyond, but bearish signals from converging EMA lines could test its support at $3,500 or lower.

7D MVRV Shows ETH Could Go Down Before a Surge

The ETH 7D MVRV has dropped to -1.35%, down from 3.32% on December 16, signaling that, on average, short-term holders are now at an unrealized loss. Negative MVRV values typically suggest that the market is in a state of heightened pessimism, often reflecting oversold conditions.

This can create an environment where downside risk decreases, and the potential for recovery increases as undervaluation attracts renewed buying interest.

The MVRV 7D Ratio measures the average profit or loss of ETH tokens moved in the past week relative to their current market price. Historically, ETH’s 7D MVRV tends to decline to around -4% or below -5% before major price rebounds occur.

This pattern suggests that while there may still be some room for further downside, Ethereum could soon reach levels that historically trigger accumulation, potentially setting the stage for a price recovery.

Ethereum Whales Are Accumulating Again

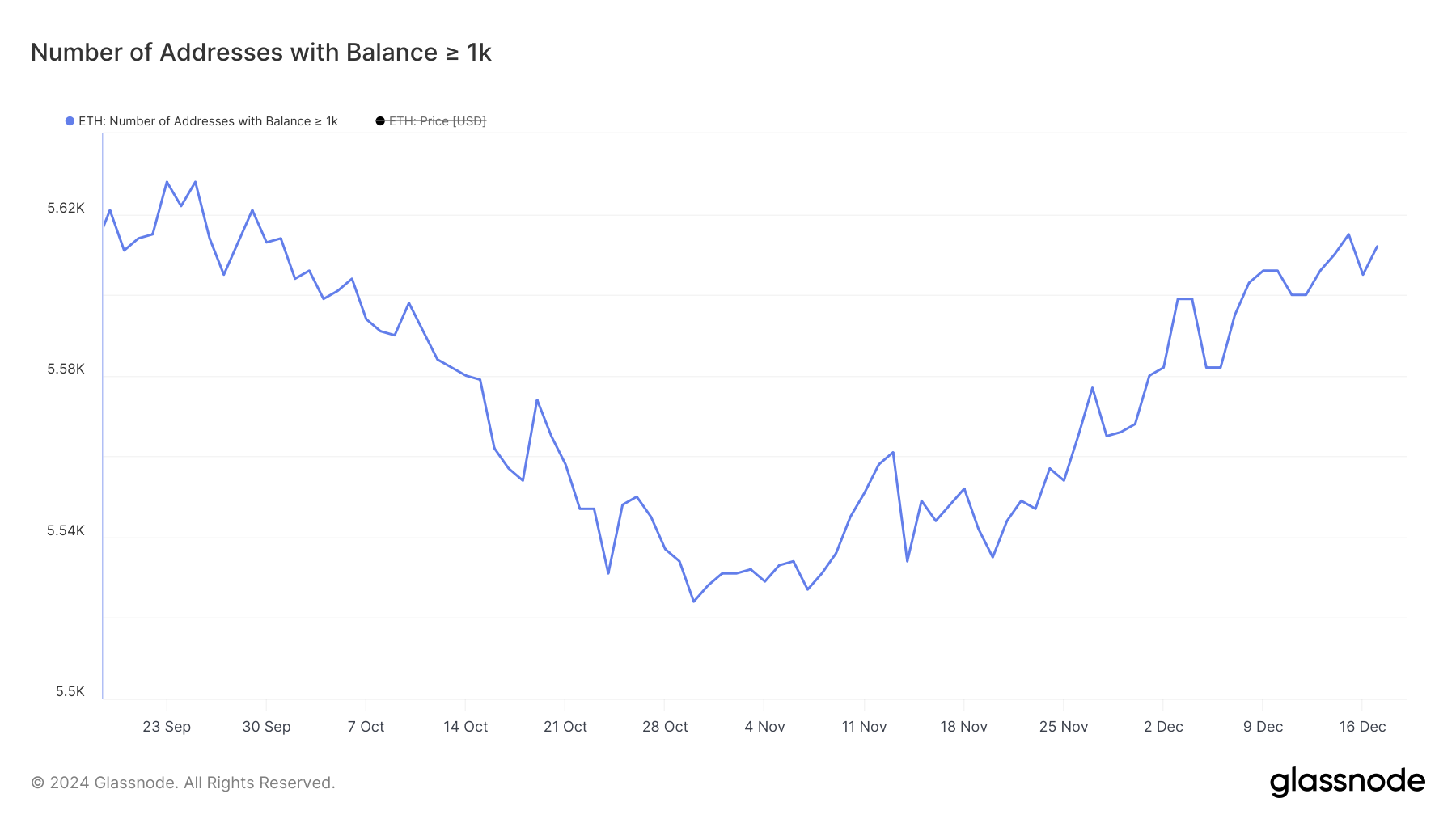

The number of addresses holding at least 1,000 ETH has been steadily increasing throughout December. On December 1, there were 5,580 such addresses, up from a three-month low of 5,524 on October 30.

This figure has now risen to 5,612, reflecting consistent accumulation by large holders, or “whales,” over the past month.

Tracking whale activity is crucial because these large holders can significantly influence market trends. An increase in the number of whales suggests growing confidence among major investors, often seen as a bullish signal.

This steady accumulation could indicate that whales anticipate a positive price movement for ETH in the near future, as their actions often precede or contribute to upward price momentum.

ETH Price Prediction: Can It Test $4,000 Again In December?

Ethereum price is currently trading between a resistance at $3,987 and a support at $3,763. If the resistance is broken, ETH price could climb to test $4,100 and, with further momentum, aim for new highs near $4,800 or $4,900.

These levels represent key targets for bullish continuation if buyers regain control.

However, the EMA lines are converging, signaling a potential weakness in the trend. Combined with the 7D MVRV, which indicates possible further corrections, ETH price could face downside pressure.

If the short-term EMA crosses below the long-term EMA, a bearish signal, ETH price may test the $3,500 support. A failure to hold this level could push prices lower, potentially reaching $3,256.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.