Hedera (HBAR) has surged an impressive 220.70% over the last 30 days, ranking among the best-performing coins in the top 20 with a market cap of $10.89 billion. However, technical indicators now point to a potential slowdown in the rally’s momentum.

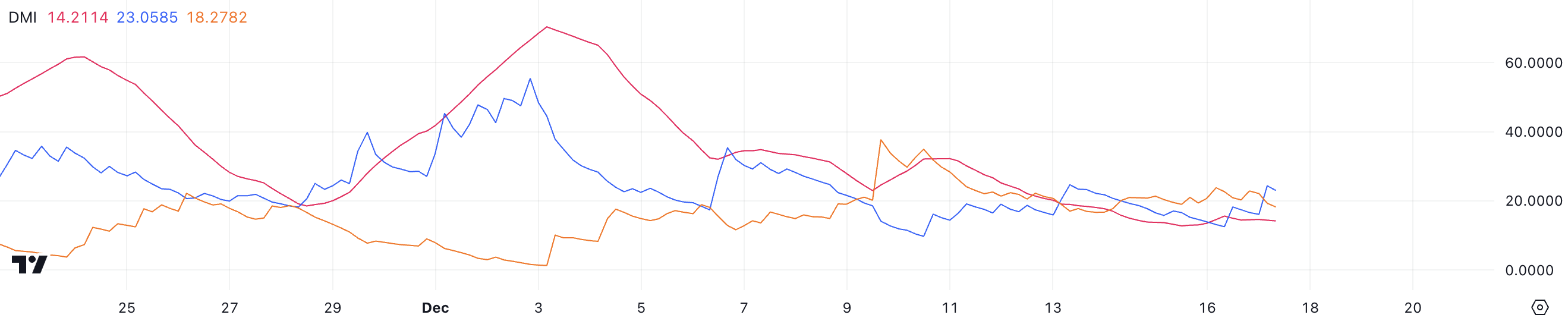

While the Directional Movement Index (DMI) still reflects a slight bullish bias, with D+ rising above D-, the low ADX indicates weak trend momentum, leaving HBAR vulnerable to range-bound trading or potential downside in the short term.

Hedera DMI Hints at Trend Weakness

HBAR ADX has dropped from its peak of 65 on December 3, when HBAR reached a 6-year high, to a current level of 14.2. ADX is a technical indicator measuring trend strength, with readings above 25 indicating a strong trend and below 20 suggesting a weak or absent trend.

The current 14.2 reading indicates the previous strong uptrend has dissipated.

The Directional Indicators show D+ at 23 and D- at 18.2, with D+ rising from 18 two days ago. Since D+ is higher than D- and increasing, this suggests a slight bullish bias.

However, the low ADX indicates weak trend momentum, suggesting HBAR may experience range-bound trading in the short term rather than continuing its previous strong uptrend. This technical setup typically precedes a period of consolidation.

Ichimoku Cloud Shows a Bearish Setting

Hedera price is sitting below both the cloud and the key Ichimoku lines, with multiple resistance layers above. The cloud itself shows significant thickness and remains above price, indicating strong overhead resistance.

The blue line (Tenkan-sen, or conversion line) recently crossed below the red line (Kijun-sen, or baseline), forming a bearish cross signal that confirms downward momentum.

Both lines are now resistance rather than support, having failed to hold the price. The cloud’s thickness represents accumulated selling pressure that must be absorbed before any meaningful reversal.

This bearish Ichimoku setup (price below the cloud, the bearish cross of blue under the red line, failed support turned resistance) shows bears controlling the short-term trend.

For any bullish reversal, the price would need to first reclaim both the blue and red lines, then push through the cloud’s lower boundary, and finally clear its upper edge — a major challenge given current momentum. The prior support zones that have been lost are now likely to act as resistance to any recovery attempts.

HBAR Price Prediction: Will It Drop Below $0.2?

The current state of Hedera EMA lines indicates caution, as the shortest-term line has begun to trend downward and is now very close to the longer-term lines. If this trajectory continues and results in a death cross, it could signal a bearish shift for the asset. Such a formation would likely put pressure on HBAR to maintain the $0.275 support level.

If that support fails, HBAR price could move toward the next critical zone at $0.23. If bearish momentum persists, a further decline to $0.17 may come into play, as sellers could dominate the market.

On the other hand, HBAR price still has the opportunity to reverse its current trend and regain upward momentum. A recovery could lead the asset to challenge the $0.33 resistance level, a crucial barrier for bullish confirmation.

Should HBAR manage to break above this level with sufficient strength, it may open the path to test $0.40, a point that could attract increased buying interest and further solidify a positive trend. This upward move would require strong volume and renewed optimism to overcome the recent bearish signals.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.