Tether’s USDT stablecoin has received approval from the Financial Services Regulatory Authority (FSRA) as an Accepted Virtual Asset (AVA) within the Abu Dhabi Global Market (ADGM).

This decision allows licensed entities under FSRA to provide pre-approved services related to USDT.

A Major Regulatory Boost for Tether’s USDT

USDT’s approval in ADGM reflects compliance with the region’s regulatory standards, paving the way for its inclusion in licensed financial services. This move aligns with the UAE’s efforts to modernize its financial sector and promote diversification.

Tether recently injected over $5 billion into the market in November. The firm minted over $1 billion USDT on November 6, which coincided with Bitcoin’s rally.

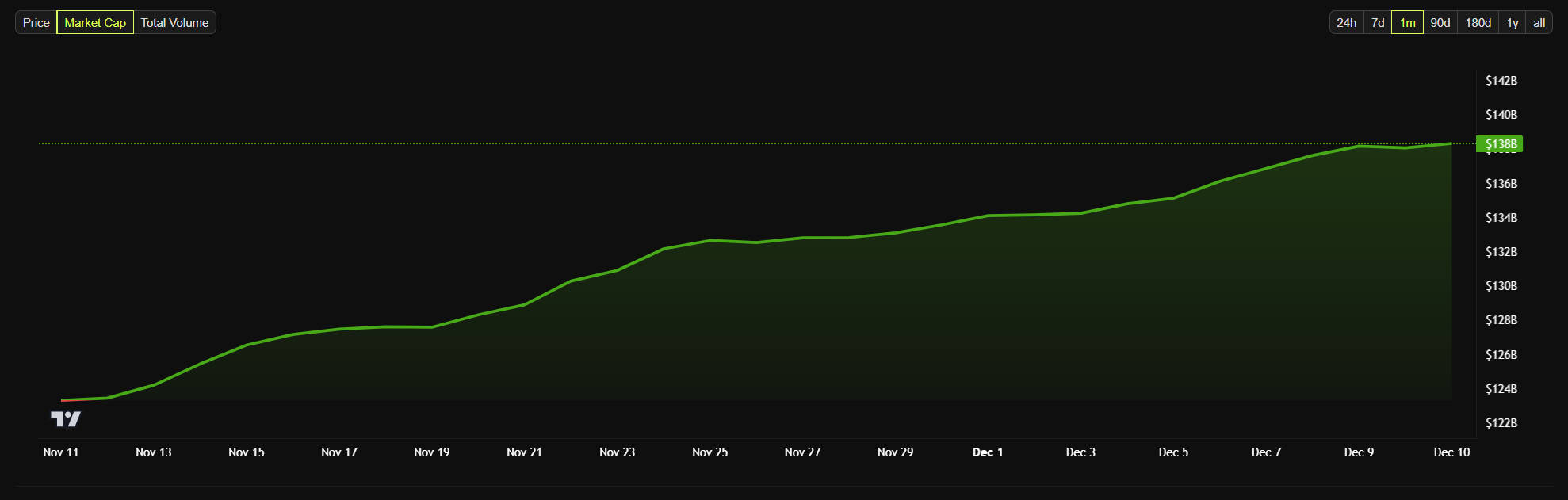

Last week, Tether issued an additional 2 billion USDT, bringing its total issuance to 19 billion since November. Following ADGM’s approval on December 10, USDT’s market capitalization surged to $138 billion.

“The UAE’s forward-thinking approach to virtual asset regulation sets a global benchmark, and we are proud that USDT can play a pivotal role in driving economic progress and digital transformation in the region,” said the company’s CEO, Paolo Ardoino.

Tether reported record profits of $2.5 billion in Q3 2024, pushing its total earnings for the year to $7.7 billion. The company’s quarterly report highlighted total assets of $134.4 billion, reflecting its financial dominance in the crypto sector.

The stablecoin issuer is also looking to expand beyond the crypto sector. Tether recently completed its first crude oil transaction in the Middle East, executing a $45 million deal using USDT for 670,000 barrels of oil.

The company is also exploring lending opportunities for international commodities traders. Tether is particularly looking into developing markets, leveraging its substantial profits and industry connections.

Despite its achievements, Tether remains under scrutiny from US regulators. Earlier reports from WSJ claimed that the Attorney’s Office in Manhattan is investigating the company over potential misuse of its platform for illicit activities.

However, Tether’s CEO, Paolo Ardoino, denied these claims. Ardiono stated that the company has not identified any indications of a federal investigation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.