MicroStrategy has once again solidified its position as the world’s largest corporate holder of Bitcoin. The company announced its acquisition of 51,780 BTC, bringing its total Bitcoin holdings to a staggering 331,200 BTC.

With this strategic move, MicroStrategy not only strengthens its Bitcoin reserves but also highlights strong yield performance, reporting a quarter-to-date (QTD) yield of 20.4% and a year-to-date (YTD) yield of 41.8%.

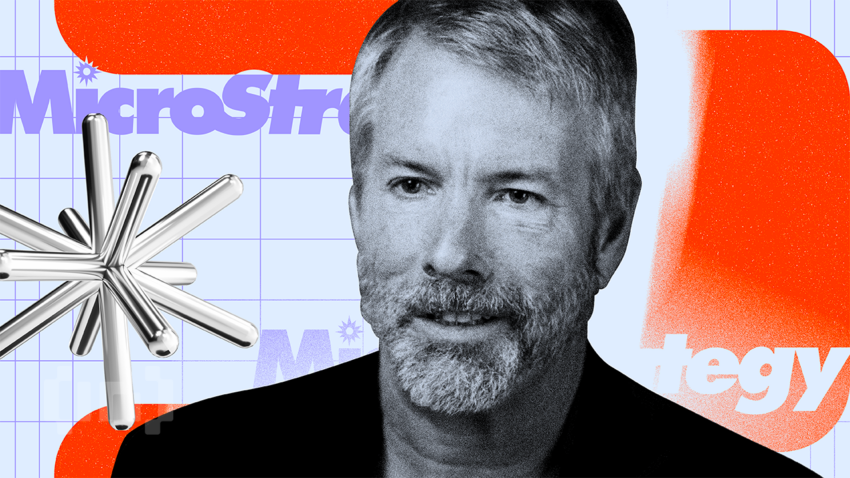

MicroStrategy Adds 51,780 BTC, Reports Impressive Yield Growth

This latest acquisition highlights MicroStrategy’s commitment to its Bitcoin-focused strategy. The company has been a vocal proponent of Bitcoin as a long-term store of value, often advocating its use as a hedge against inflation and a tool for financial independence.

This is the firm’s second BTC purchase in November 2024. Between October 31 and November 10, MicroStrategy acquired 27,200 Bitcoin at an average price of $74,463 per Bitcoin, including fees. Earlier this week, it was reported that their BTC stash surpassed the cash and liquid assets held by major global corporations, including IBM, Nike, and Johnson & Johnson.

The company’s yield performance speaks volumes about the effectiveness of its Bitcoin strategy. A 20.4% QTD yield highlights the rapid appreciation of its Bitcoin holdings over the current quarter. The even more impressive 41.8% YTD yield demonstrates MicroStrategy’s foresight in capitalizing on Bitcoin’s recovery and growth in 2024.

The decision to acquire Bitcoin at such a scale isn’t without challenges. Critics often question Bitcoin’s volatility and potential impact on MicroStrategy’s financial stability. Yet, the company’s continued yield growth demonstrates that its strategy is reaping significant rewards.

The acquisition also hints at broader market trends. Bitcoin’s recent price recovery has likely encouraged the company to double down on its holdings even more aggressively.

The cryptocurrency market has shown resilience, with increasing institutional interest and adoption driving growth. By accumulating more Bitcoin, MicroStrategy aligns itself with this momentum, betting on a continued upward trajectory.

“This morning: – MicroStrategy buys another 51,780 BTC for $4.6B – MARA announces $700 million convert to acquire more BTC – Semler Scientific raises $21mm ATM and acquires 215 BTC – Metaplanet issues ¥1.75B debt offering to buy more BTC The corporate Bitcoin race is heating up,” one X user commented.

With 331,200 BTC under its control, the firm now holds one of the most influential positions in the Bitcoin ecosystem. Its latest acquisition cements its role as a key player, with potential implications for Bitcoin’s price movements and overall market sentiment. As the company reaps the benefits of its bold strategy, it also sends a powerful signal to other institutions considering Bitcoin investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.