Ripple’s (XRP) price has shattered a nearly three-year-long barrier, climbing to $1 for the first time since November 2021. The milestone comes amid renewed optimism in the cryptocurrency market, fueled by bullish sentiment following rising interest and demand for the token.

With trading volumes spiking and investor confidence rebounding, the question now is whether XRP can sustain this momentum or if a correction is on the horizon.

The Ripple Token Breaks $1 Barrier After Almost Three Years

Earlier today, XRP’s price was $0.85. However, after a bullish engulfing candle appeared on the chart, the price spiked to $1.02, marking the first time the token had hit this level since the 2021 bull market.

This price increase coincides with the positive development around the altcoin since Donald Trump’s emergence as US president. But besides that, there have been several reasons why the Ripple native token has rallied to this point.

For instance, speculation around a potential XRP ETF has been gaining traction. Additionally, the altcoin experienced a significant uptick in institutional demand recently, coupled with its listing on Robinhood. These developments suggest rising interest in XRP within the U.S. market.

Furthermore, speculation that SEC Chair Gary Gensler, who has led the legal battles against Ripple, might resign has added to the momentum behind XRP’s surge.

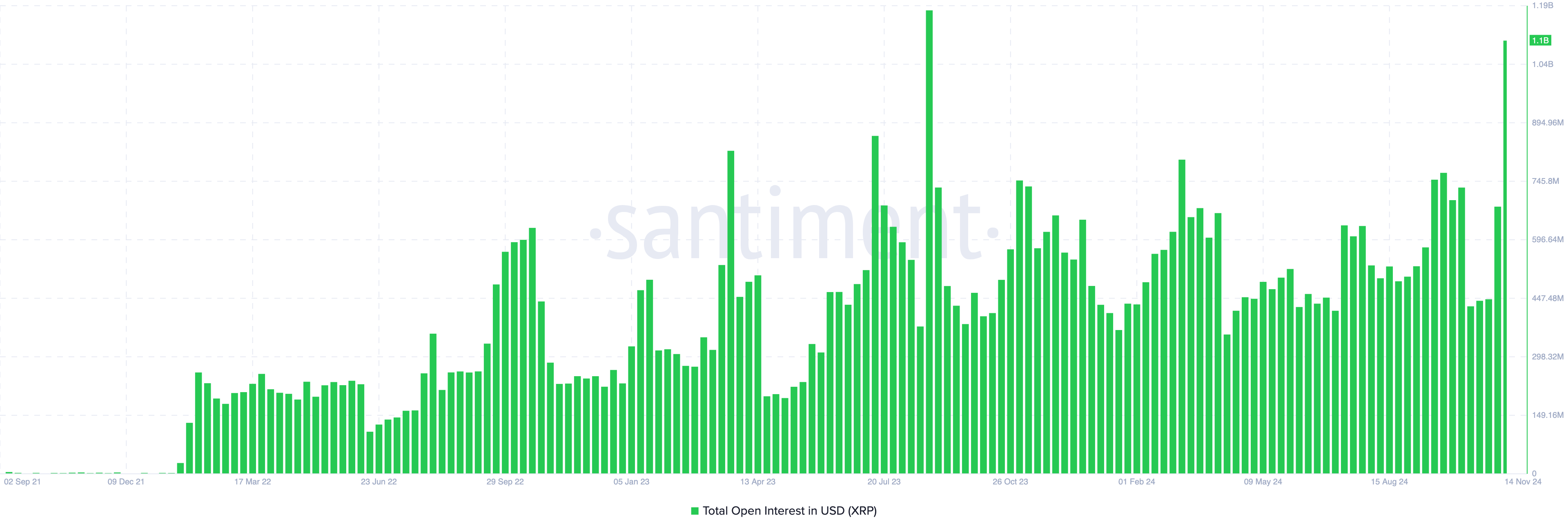

From an on-chain perspective, the increase in Open Interest (OI) appears to have been a significant driver of XRP’s momentum. Data from Santiment shows that XRP’s OI surpassed $1 billion for the first time since August 2023 — at that time it happened due to Ripple’s partial victory over the US SEC, highlighting heightened speculative activity around the token.

In terms of price movement, if OI continues to climb, XRP’s price could sustain its uptrend. This is because a high OI reflects increased liquidity in the derivatives market, which often fuels stronger price movements.

XRP Price Prediction: Overbought, But Rally May Go Ahead

XRP’s breakout began around November 5 when bulls vigorously defended the $0.50 support. Since then, XRP price has increased by over 100%.

While the Relative Strength Index (RSI) on the 3-day chart shows that the XRP $1 price has entered overbought territory, bulls continue to push for further gains.

The Bull Bear Power (BBP) confirms this, as it measures the strength of bullish versus bearish forces. An increasing BBP shows that bulls are in control, while a decreasing BBP signals bearish dominance.

Currently, the BBP forms a large green histogram, indicating that bulls are driving the price higher. If this momentum holds, XRP could climb to $1.40. However, if sentiment shifts to the bearish side, the price may drop to $0.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.