The U.S. Securities and Exchange Commission (SEC) admitted that the underlying assets in its case against Ripple and Terraform Labs do not necessarily constitute securities.

However, it intends to appeal the judge’s ruling in its case against crypto payment company Ripple because it could affect its other litigations.

In its motion for interlocutory appeal, the regulator noted its concerns all this while was not whether the XRP token in itself was a security.

Motion for Interlocutory Appeal

The filing asserts:

“The SEC did not argue here or in Terraform that the asset underlying those investment contracts were necessarily a security (and the SEC does not seek appellate review of any holding relating to the fact that the underlying assets here are nothing but computer code with no inherent value).”

Although it is not questioning the status of cryptocurrencies, SEC still wants the court to certify an order for interlocutory appeal and argued that it fulfilled all the requirements for an interlocutory appeal.

According to the regulator, the court ruling in the Ripple case involves controlling questions of law. It noted that the decision could affect several other SEC litigations, including the ones against Coinbase and Binance.

Additionally, it argued that there is substantial ground for difference in opinions and points particularly to the decision in the Terraform Labs case. Thus, the SEC believes other fair-minded courts could decide differently on the ruling of Programmatic Sales and other distributions.

In its third argument on why an order of interlocutory appeal should be granted, SEC noted that it would advance the case’s resolution. Failure to appeal now would only postpone a potential appeal until after the final judgment.

Meanwhile, SEC is also asking for a stay of remedies and any pretrial proceedings pending the determination of the appeal. Ripple has until September 1 to respond to the motion.

XRP Price Performance

The XRP community has focused more on SEC admission than the possibility of a potential appeal. Crypto lawyer John Deaton said the asset holders were responsible for the regulator’s concession because their amicus brief asked the judge to include that in the ruling.

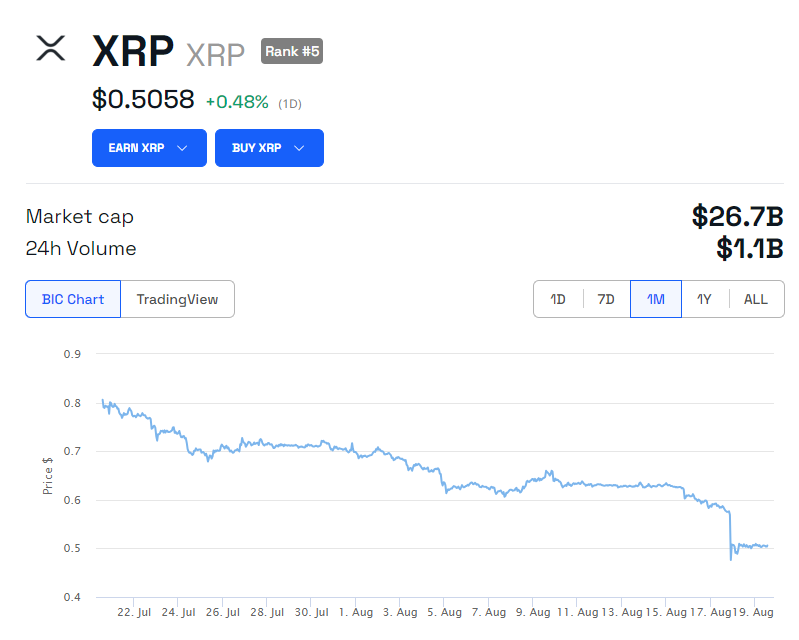

However, the financial watchdog’s admission has not impacted XRP’s price performance. The asset is up 0.48% in 24 hours and was trading at $0.50 as of press time, according to BeInCrypto data. Over the past week, the abrupt market movement wiped off all its gains post-SEC victory.

Interested in AI Trading? 9 Best AI Crypto Trading Bots to Maximize Your Profits

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.