Cardano (ADA) price has experienced a significant rally recently, pushing its altcoin to a seven-month high.

However, maintaining these gains could prove challenging as market conditions hint at a potential shift in investor sentiment.

Cardano Investors Pose a Threat

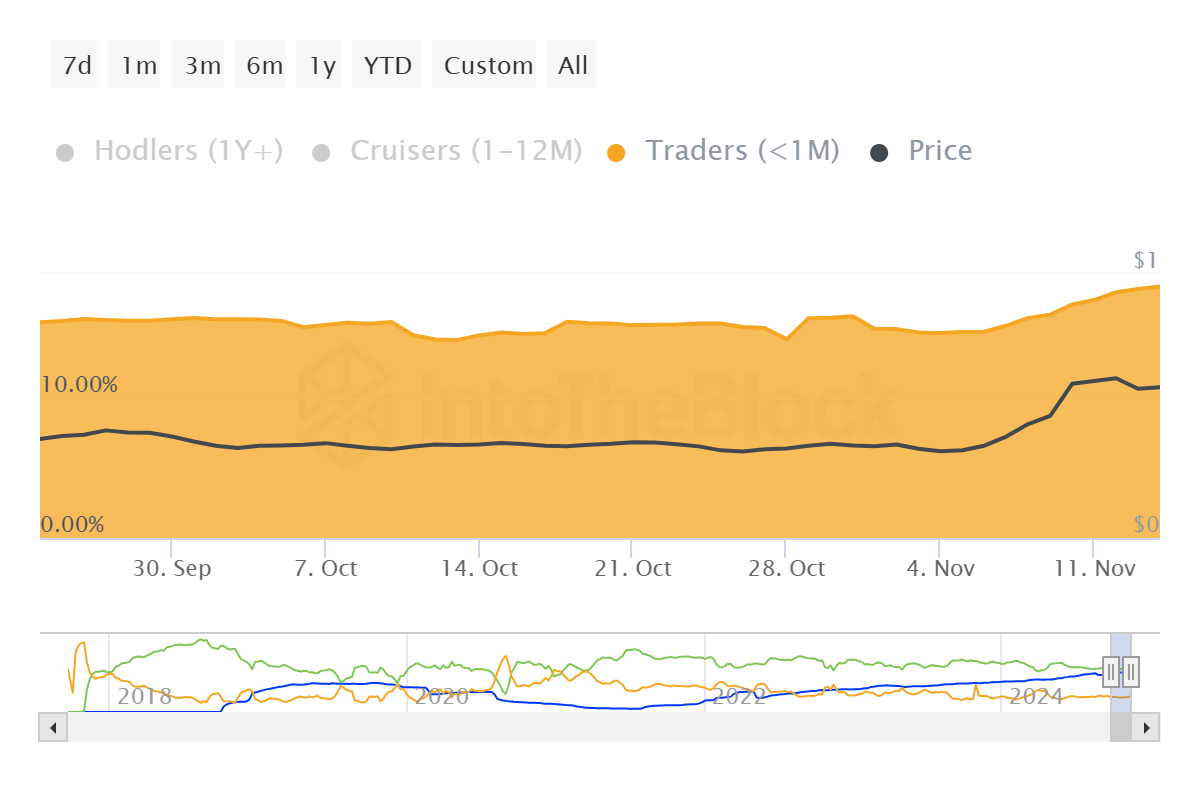

In the past two weeks, short-term investors have dominated Cardano’s market activity. These holders, typically keeping assets for less than a month, are more likely to sell during volatile periods. Their share of ADA holdings has risen from 14% to 18%, suggesting selling pressure may emerge soon. This increase in short-term activity could challenge ADA’s ability to sustain its current levels, especially if profit-taking gains momentum.

While short-term investor activity increases, the broader market remains optimistic, balancing potential selling risks. However, the growing short-term dominance highlights a fragile situation that requires monitoring, as it could signal a market top.

Cardano is currently experiencing a macro-level shift, with its EMAs forming a Golden Cross—a bullish indicator. The 50-day EMA crossing above the 200-day EMA marks the end of a six-month Death Cross. This Golden Cross is Cardano’s first in 12 months and signals a potential long-term uptrend for the cryptocurrency.

Historically, such Golden Crosses have been associated with significant price growth. However, ADA’s ability to capitalize on this momentum will depend on broader market conditions and whether the recent rally can withstand investor behavior changes.

ADA Price Prediction: Securing Support

Cardano’s price is facing mixed signals, trading at $0.58 at the time of writing. While broader market cues remain bullish, short-term investor activity raises concerns about potential selling pressure.

If the bullish momentum continues, ADA could climb to $0.62. Breaching this level may pave the way for Cardano to target $0.66, further solidifying its position in the market.

Conversely, failure to hold above $0.59 could cause ADA to drop to $0.54. Any further decline below this level would invalidate the bullish outlook and potentially send the altcoin down to $0.51, posing significant risks to its recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.