Bitcoin ETFs (exchange-traded funds) surpassed $1 billion in total net inflows over the past three trading days. BlackRock leads these positive flows, providing institutional investors with continued access to BTC through this financial instrument.

Amid positive market sentiment, BTC is trading above $67,000, with the potential to reclaim its all-time high of $73,777.

Bitcoin ETF Inflows Breach $1 Billion Mark In 3 Days

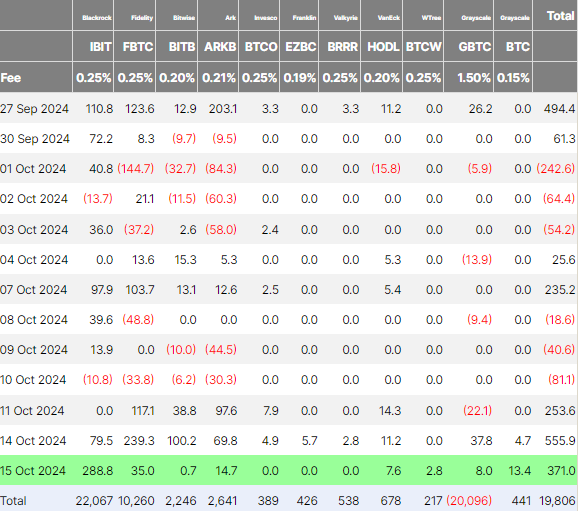

Total net inflows for spot Bitcoin ETFs in the US soared to an impressive $1.18 billion over the last three trading days. Meanwhile, the cumulative total net inflow metric surged to record a new high of $19.73 billion. Monday, October 14, saw the largest daily total net inflows, coming in at $555.86 million.

The renewed interest was seen across the past week, where crypto investment inflows reached $407 million. This reversed early October’s $147 million negative flow amidst rising US election focus.

Meanwhile, BlackRock remains at the forefront of this wave of institutional interest for Bitcoin investments. Alongside Fidelity, the two asset managers jointly attracted nearly $760 million over the last three days, data on Farside shows. On Tuesday, October 15, BlackRock led the inflows, recording up to $288.8 million in positive flows.

Read more: What Is a Bitcoin ETF?

The soaring inflows align with Bitcoin’s nearly 13% price surge since Friday. Standard Chartered analysts predict that this momentum could drive Bitcoin to reclaim its all-time high as the US election approaches. CoinShares researchers echoed this view, attributing the rising interest to US politics rather than monetary policy.

BlackRock’s dominance in the Bitcoin space is unsurprising, given the firm’s pivot to cryptocurrency. Alongside MicroStrategy’s Michael Saylor, BlackRock remains one of Bitcoin’s strongest advocates. During the Q3 earnings call, CEO Larry Fink revealed that IBIT reached a $23 billion market in just nine months, fueled by billions in investments.

Read more: Who Owns the Most Bitcoin in 2024?

Despite the enthusiasm around Bitcoin, Ethereum-related products do not show the same sentiment for BlackRock. Challenges range from few entries to net outflows for some offerings, suggesting a focus of interest on Bitcoin. Robert Mitchnick, head of digital assets at BlackRock, ascribed this to a more complex investment narrative surrounding Ethereum.

“We believe in the potential of Ethereum, but we know it takes time for investors to grasp the full extent of this asset,” Mitchnick said during his speech at the Messari Mainnet conference in New York.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.