Grayscale has successfully converted its Bitcoin Trust and Ethereum Trust into spot ETFs. Now, the company has applied to the SEC to convert its Digital Large Cap Fund (GDLC) into a new ETF.

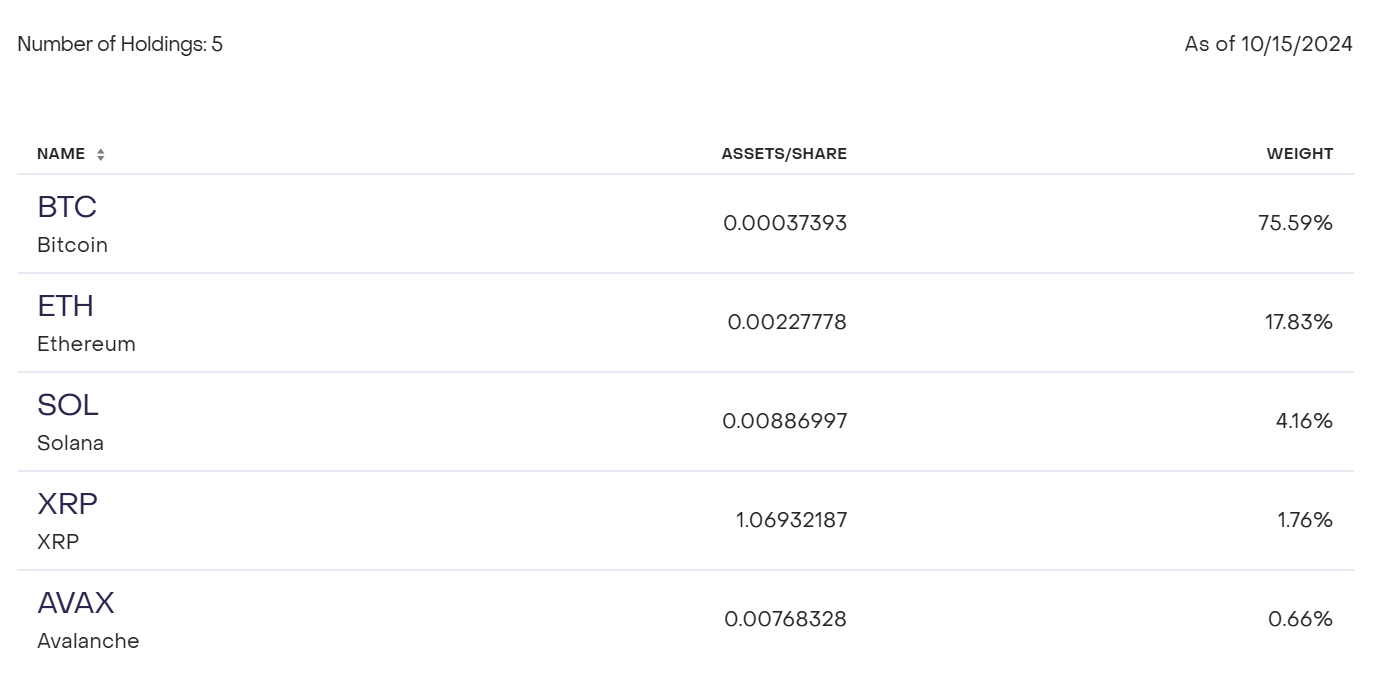

The Grayscale Digital Large Cap Fund (GDLC) is a multi-asset fund that allows investors to gain exposure to leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Avalanche (AVAX) without directly managing these assets.

Grayscale Seeks to Launch First Multi-Asset Crypto ETF

On October 15, Grayscale filed a 19b-4 application with the US Securities and Exchange Commission (SEC) to request the conversion of the multi-token Grayscale Digital Large Cap Fund (GDLC) into a new ETF.

Currently, GDLC manages more than $524 million in assets. According to the official website, Bitcoin and Ethereum account for 94% of the fund, with 76% allocated to BTC and 18% to ETH. The remaining assets – SOL, XRP, and AVAX – represent smaller portions at 4.16%, 1.76%, and 0.66%, respectively.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Although SOL and XRP hold minor shares in GDLC, both are facing legal challenges with the SEC. The SEC views SOL as a security, and the ongoing legal battle between the SEC and XRP is yet to be resolved.

“The fundamental issue I see is that GDLC cannot be converted into an ETF as easily as GBTC. The fund contains five cryptocurrencies and, only two of them have received approval by the SEC to be traded as ETFs.” Geneva Investor said.

GDLC Trading at Over 30% Discount

The price chart comparing GDLC shares to their net asset value (NAV) per share shows that GDLC is trading at a significant discount of more than 30%. Before Grayscale Bitcoin Trust (GBTC) became a Bitcoin ETF, it also traded at a discount of over 40%, which caused Grayscale challenges.

The successful conversion of GBTC into an ETF narrowed its discount. However, investors who had been holding GBTC during the downturn tended to sell afterward, leading to persistent selling pressure on BTC after the ETF conversion.

Thus, if GDLC overcomes its legal hurdles and successfully converts into an ETF, the discount on GDLC could narrow. Additionally, Grayscale might trigger new selling pressure on BTC and ETH, which together represent 90% of GDLC’s holdings.

Read more: Best Investment Apps in 2024

Recently, Grayscale has been actively launching new products. These include the MakerDAO Trust, XRP Trust, Bittensor Trust, Sui Trust, and most recently, the Aave Trust.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.