The Ethereum network has experienced a surge in activity over the past week, with a significant rise in daily active addresses and new accounts.

However, despite this increase in network activity, ETH price has faced selling pressure, as traders continue to offload the altcoin, raising concerns about its short-term outlook.

Ethereum Sees Rise in User Activity, But There Is A Catch

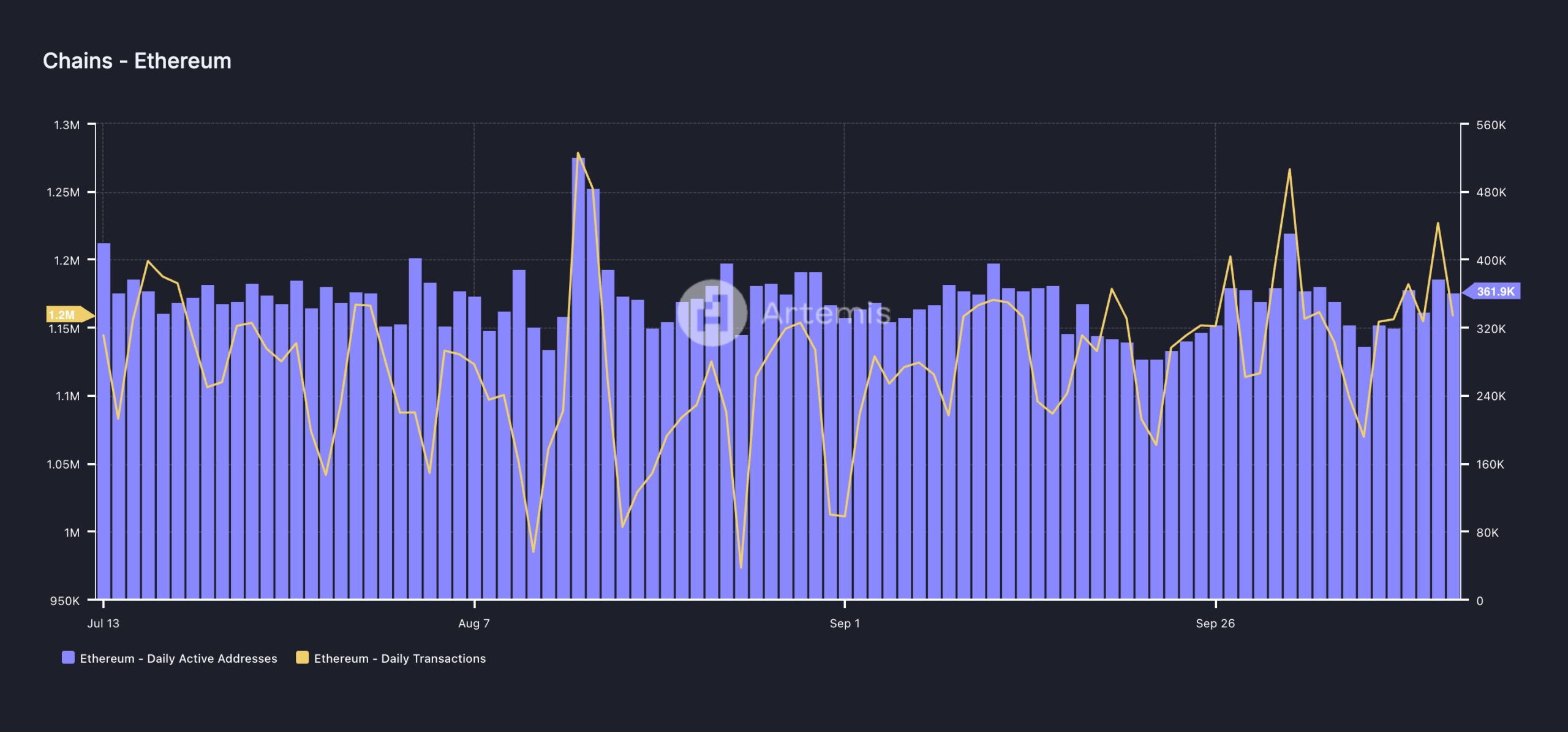

Over the past seven days, user activity has spiked on the Ethereum network. According to Artemis’ data, the daily count of unique addresses that have completed at least one transaction on the Layer-1 blockchain has increased by 21% this past week. During that time, the number of unique addresses on Ethereum totaled 362,000.

As expected, due to the growth in Ethereum users, there has been a corresponding surge in daily transactions completed on the network. During the review period, this reached 1,159,085, rising by 8%.

Read more: How to Invest in Ethereum ETFs?

Generally, an increase in Ethereum’s daily active addresses and transaction count is seen as a positive indicator for its price. However, price reactions may lag if the broader market sentiment is neutral or bearish. This has been the case for ETH, whose price reaction has remained muted to the surge in network activity because its holders have continued to sell.

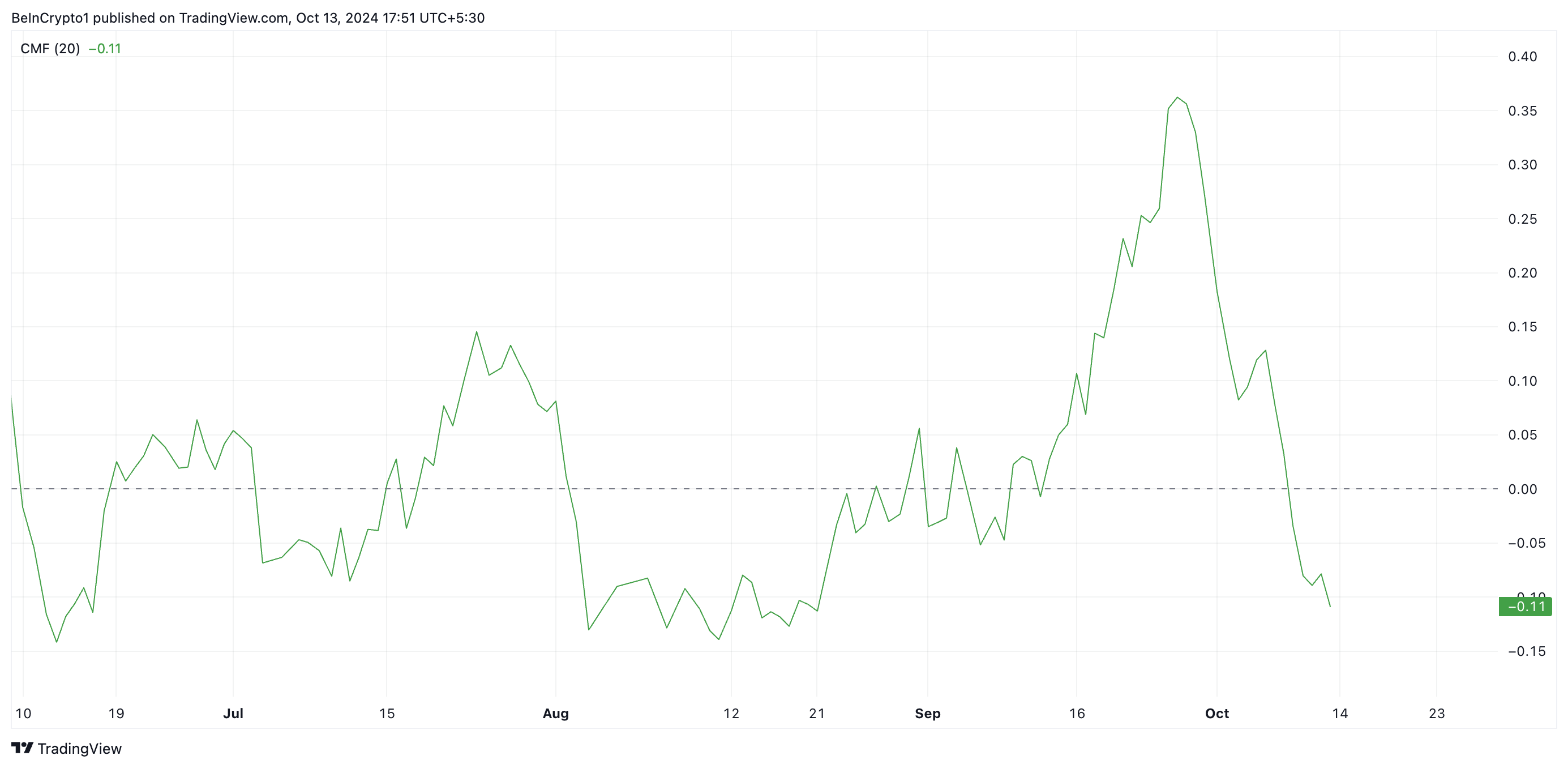

ETH’s negative Chaikin Money Flow is a clear indicator of this. This indicator, which measures money flow into and out of an asset’s market, is below the zero line at -0.11.

A negative CMF indicates that the asset has experienced more selling than buying. It signals more traders are selling rather than accumulating the asset.

ETH Price Prediction: What Traders Need to Look Out For

ETH currently trades at $2,465. Ethereum’s price may plummet to its immediate support level of $2353 if selling activity strengthens. However, if the bulls fail to defend this price level, ETH’s value will drop further to $2,111.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, this bearish projection will be invalidated if Ethereum sees a spike in new demand. This will drive its price to $3102, a level it last reached in August.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.