Cardano (ADA) has been in a downward trend since September 27, currently trading at $0.34, reflecting a 15% decline. The 11th-largest cryptocurrency by market capitalization is now hovering near a critical support level at $0.32.

The technical setup indicates the potential for further decline, especially with decreasing whale activity, which could push ADA below this key level.

Cardano Whales Take a Step Back

IntoTheBlock’s data shows a significant decline in Cardano’s whale activity over the past month. In the past 30 days, ADA whales or large investors have increasingly sold their coins, as evidenced by the 100% fall in ADA’s large holders’ netflow.

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. Their netflow refers to the difference between the amount of the coin these addresses are buying and the amount they are selling.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

When netflow declines, it means large investors are selling more coins than they are buying. This signals a loss of confidence in the coin’s future, often leading retail investors to sell their holdings, which further drives the price down.

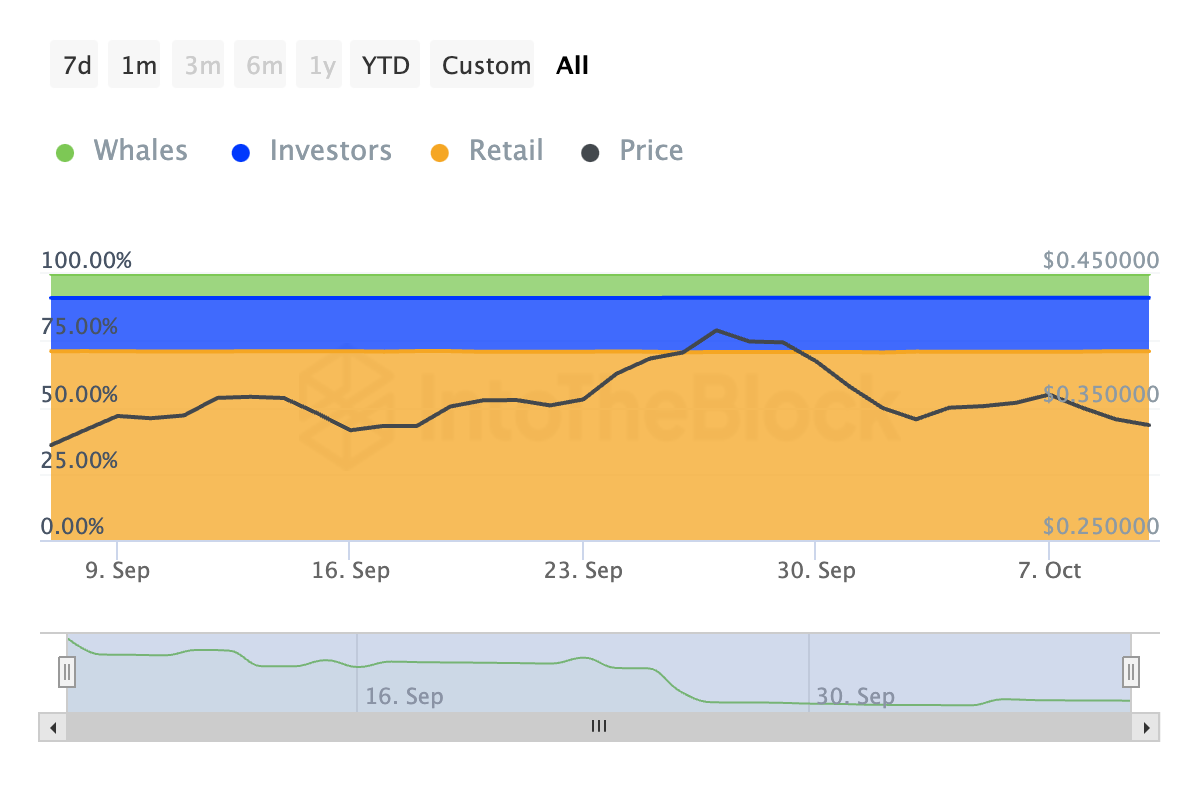

The drop in ADA’s whale concentration over the past month confirms their selling activity. On-chain data shows that their share of the coin’s circulating supply has declined by 0.38% over the past 30 days.

Interestingly, during the same period, retail traders have seen their share of ADA’s supply go up by 0.27%. However, this is not a net positive for ADA.

As whale activity declines and retail trader involvement increases, ADA may experience higher price volatility. Retail traders often have less market influence individually but can collectively create price fluctuations through smaller, more frequent trades.

ADA Price Prediction: Why Support Must Hold

A continued drop in whale trading activity could push Cardano’s (ADA) price to the critical $0.32 support level. If bulls cannot defend this support, and new demand for the altcoin does not materialize, the support will likely collapse, sending Cardano’s price toward its August 5 low of $0.27.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, this bearish outlook would be invalidated if ADA successfully holds at support and begins a rebound. A sustained recovery could put the altcoin on track to target $0.48, a high last seen in June.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.