The latest US Consumer Price Index (CPI) report has delivered a surprise 2.4% outcome, revealing higher-than-anticipated inflation figures. Despite that, Bitcoin’s (BTC) price is holding on to the $60,000 threshold.

Before now, the broader market had expected that inflation would be around 2.3% and probably help BTC escape consolidation. But that did not happen.

CPI Outcome Disappoints Bitcoin Holders

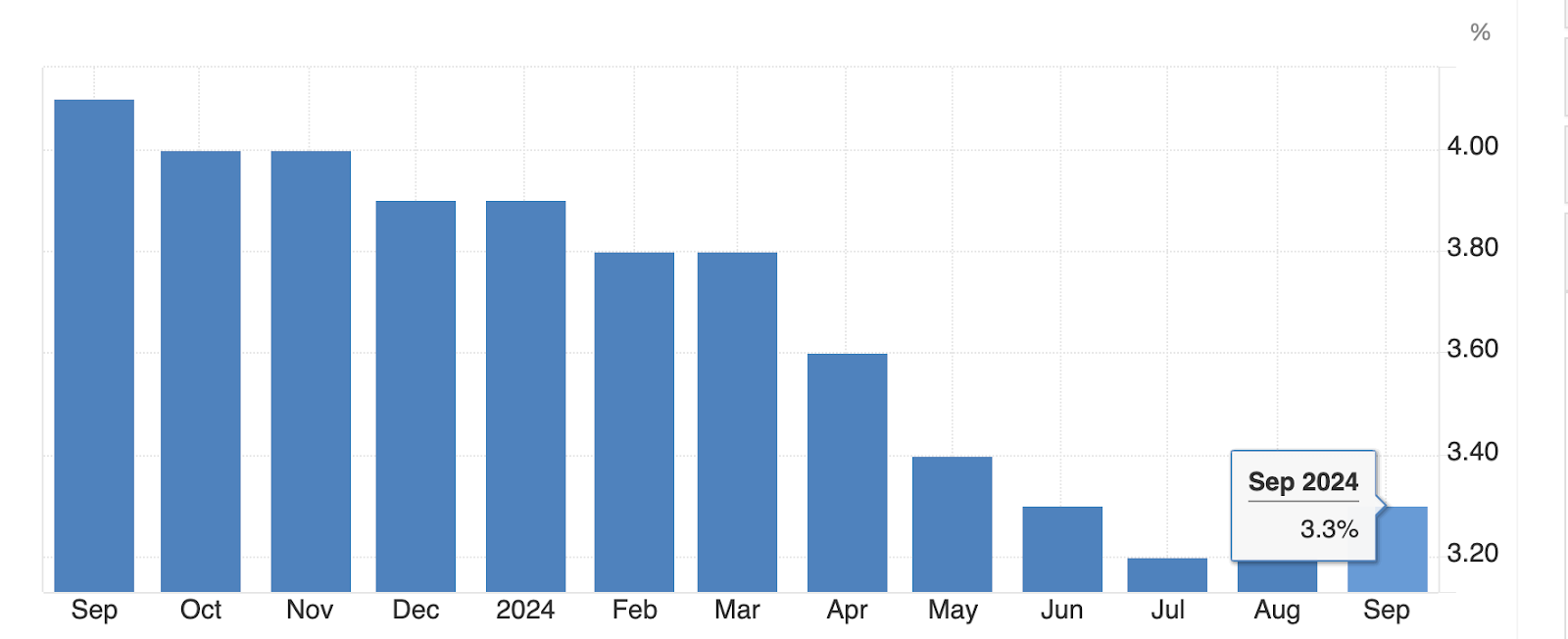

The CPI for September rose by 0.1% above expectations. While this is higher than the projected outcome, it is lower than the result for August, which was 2.5%. Meanwhile, the core inflation rate Year-Over-Year (YoY) rose to 3.3%, exceeding the expected estimate of 3.2%.

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in August and July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 2.4 percent before the seasonal adjustment,” the US Bureau of Labor Statistics stated.

For those unfamiliar, the CPI measures the average price changes that consumers pay for goods and services, acting as a key indicator of inflation and the dollar’s purchasing power.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

However, Bitcoin’s reaction to the development might not surprise those familiar with the market terrain. Last month, after August’s CPI report, Bitcoin’s price did the same, swinging between $56,000 and $57,000 after the announcement.

Furthermore, this development might be detrimental to the additional 50 basis points (bps) interest rate cut expected in November. In September, the US Federal Reserve announced a 50 bps, triggering a surge in Bitcoin and other crypto prices.

However, since the CPI is higher than expected, another rate cut might not happen until 2025. If that is the case, it might be challenging for BTC to hit a new high.

BTC Price Prediction: $60,000 at Risk

From a technical standpoint, Bitcoin remains stuck in a descending channel trading at $60,962. This has been the case for most of the last two quarters, suggesting that the coin’s momentum remains weak.

Based on the chart below, Bitcoin’s price is near the support at $60,217. If the coin drops below that, it could move to the middle part of the parallel channel. Considering the lack of sustained buying pressure, BTC is likely to drop below the middle trendline of the descending pattern.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

If that happens, the cryptocurrency’s value could decline to $57,398. On the other hand, a bounce off the support mentioned above could invalidate the forecast. In that situation, Bitcoin could rise above $60,271 and climb toward $65,858.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.