The Bitcoin (BTC) market is experiencing uncertainty as the resurgence of dormant coins coincides with lackluster demand for the coin in the spot market. On-chain data has revealed that many long-held BTC have re-entered circulation.

While this is usually a net positive for the coin’s value, it has been met with low demand, potentially adding further downward pressure on Bitcoin’s price.

Old Bitcoin Returns to the Market

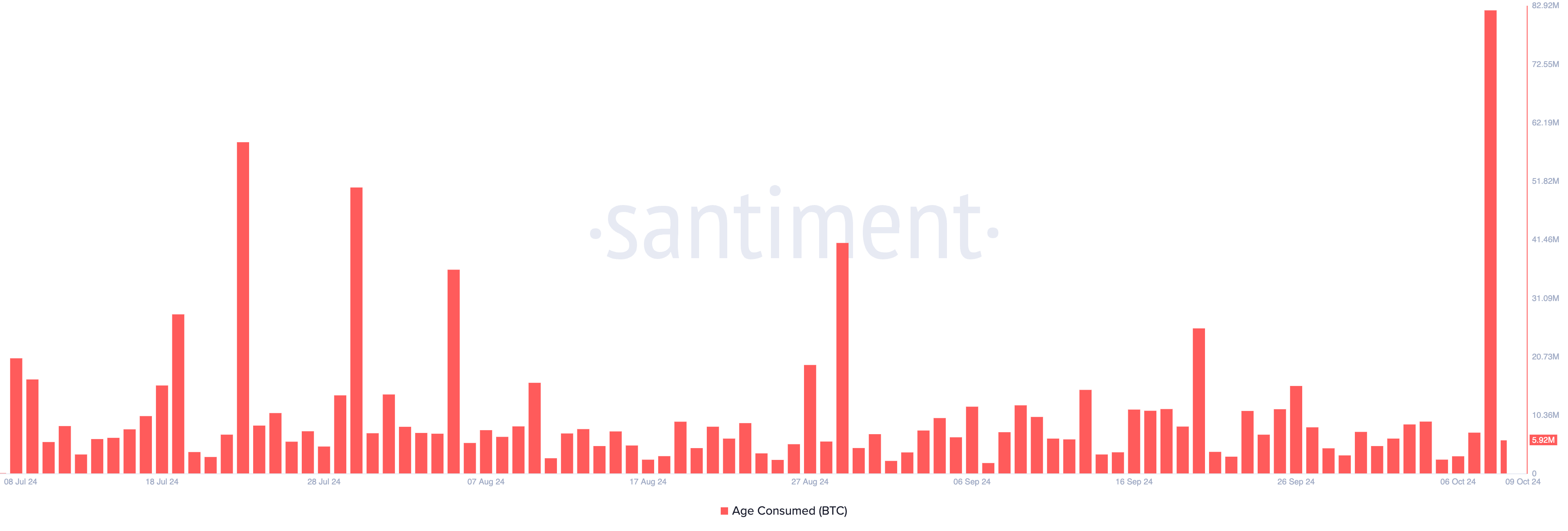

In a post on X, Lookonchain noted that on Wednesday, a major Bitcoin whale withdrew 250 BTC from leading exchange Binance after six months of dormancy. This whale activity coincided with a sharp rise in Bitcoin’s Age Consumed metric, which tracks the movement of long-held coins. That day, the metric surged by 1026%, reaching 82.1 million — its highest level in over 90 days.

This spike is significant because long-term holders rarely move their coins. When they do, it often signals a shift in market trends. Historically, when dormant BTC re-enters circulation, it’s viewed as a positive indicator for future price movements, suggesting renewed activity from strategic long-term holders.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

However, for the positive scenario to play out, the movement of dormant coins must coincide with strong market demand. If these previously inactive coins re-enter circulation during a period of weak demand, it can increase selling pressure and drive down Bitcoin’s price — much like what we’re seeing in the current market.

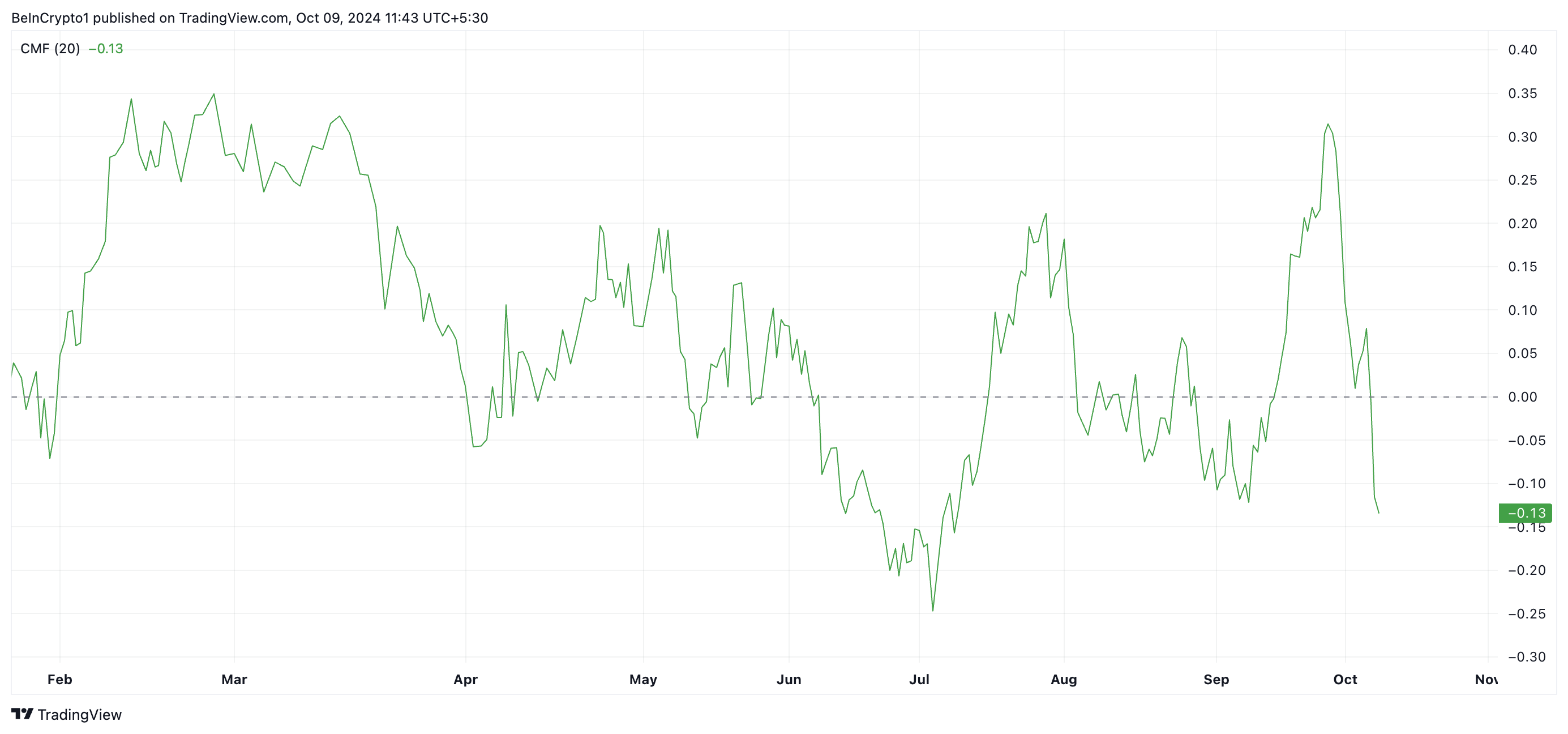

Bitcoin’s declining Chaikin Money Flow (CMF) highlights this weak demand. The CMF, which tracks the flow of capital into and out of the market, currently sits at -0.13, below the zero line. This suggests a liquidity exit, with more traders selling off their Bitcoin holdings, adding to the bearish pressure.

BTC Price Prediction: The Market Needs New Demand

The current surge in BTC’s supply without the demand to absorb it may cause its price to draw down in the meantime. BTC’s Fibonacci Retracement tool readings indicate that if selling pressure gains momentum, the coin’s price could slip under $60,000 to test support at $58,464.

Should the bulls fail to defend this level, Bitcoin’s price may drop to $54,847.

Read more: Bitcoin Halving History: Everything You Need To Know

However, if the coin witnesses a surge in new demand, the previously dormant coins re-entering circulation could be absorbed by buyers, potentially driving the price higher and invalidating the bearish outlook mentioned above. In this scenario, Bitcoin’s price could reach $68,474.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.