Cardano’s (ADA) price recently experienced a significant drop, failing for the second time in a month to close above the $0.40 level. The altcoin’s price fell by 11% within 48 hours, bringing it down to around $0.35.

Despite this sharp decline, ADA still has a chance to recover. The possibility of the cryptocurrency regaining lost ground is presenting an opportunity for traders and long-term investors alike.

Cardano Has Profits to Look Forward To

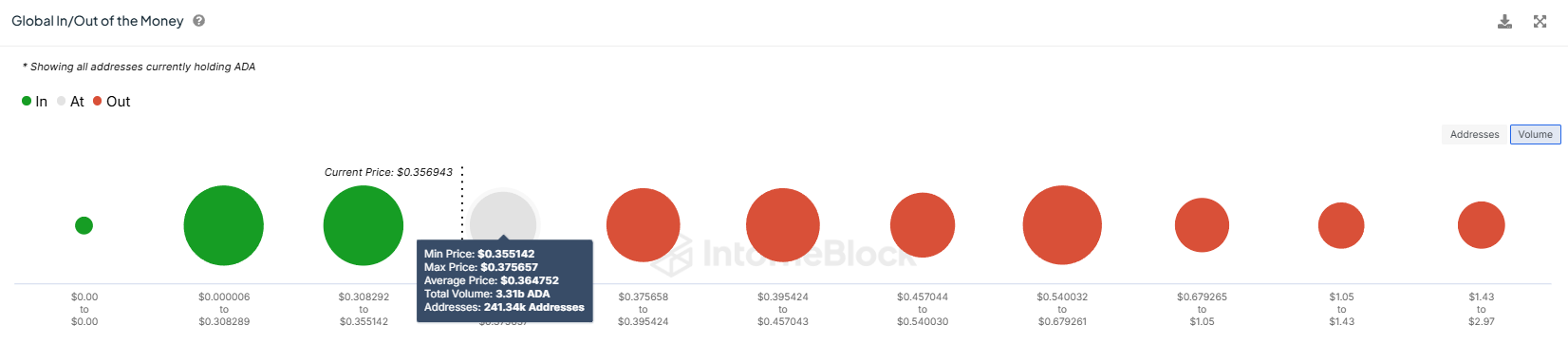

The recent downturn in Cardano’s price has led to a loss in profitability for approximately 3.31 billion ADA tokens. According to the Global In/Out of the Money (GIOM) metric, this supply, worth over $1.1 billion, was acquired when Cardano was trading between $0.35 and $0.37. This supply currently sits underwater, but if ADA manages to recover above the $0.37 mark, it could return to profitability.

As Cardano approaches this crucial price level, investor sentiment will be key in determining whether the cryptocurrency can bounce back. A recovery above $0.37 would improve profitability for those holding ADA as well as reinforce confidence among investors, potentially leading to further price gains.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

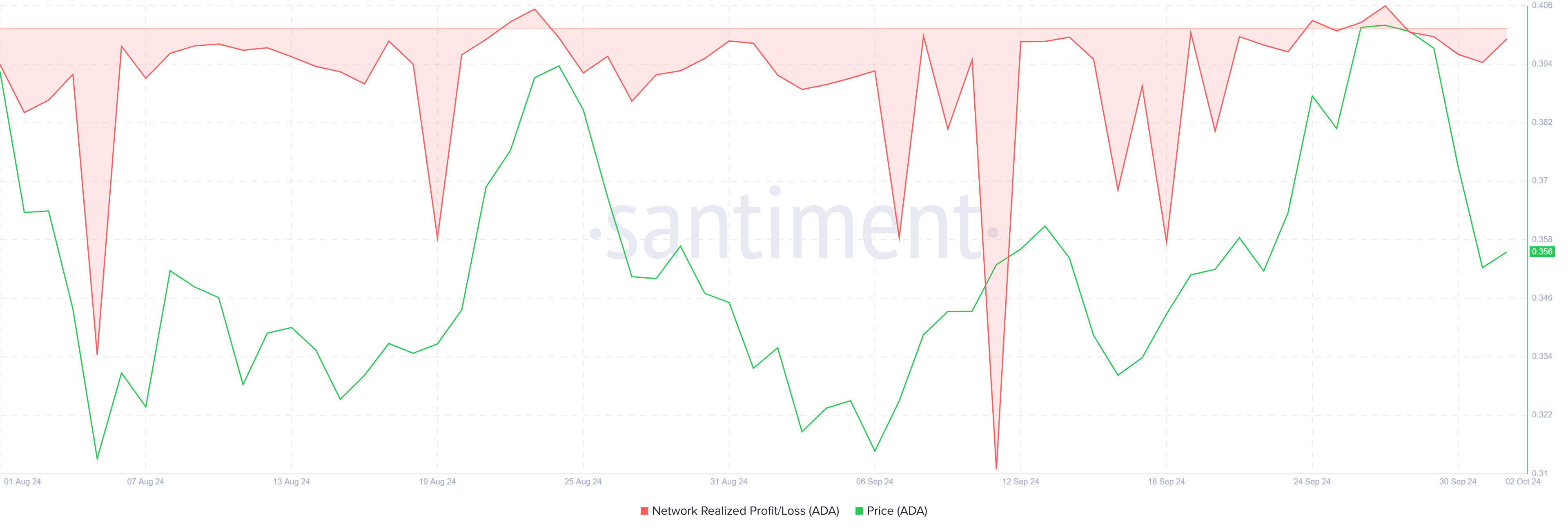

Despite the recent 11% decline, Cardano’s realized profit/loss indicator suggests that investors are remaining composed. The lack of significant spikes in the indicator signals a low level of panic selling.

This stability is crucial, as it indicates that ADA holders are opting to “HODL” their positions rather than selling at a loss. Such behavior from investors is encouraging, as it suggests that confidence in Cardano’s long-term potential remains intact.

ADA Price Prediction: Finding Momentum

At the time of writing, Cardano is trading at $0.35, hovering just above the key support level of $0.34. Should ADA successfully defend this support, it stands a strong chance of bouncing back toward the $0.37 resistance level. A recovery here could open the door for further upward momentum, allowing Cardano to reverse its recent losses.

If ADA manages to flip $0.37 into support, the 3.31 billion ADA tokens bought between $0.35 and $0.37 will turn profitable. This scenario could drive renewed bullishness among investors, reducing selling pressure and supporting a sustained rally in price.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if Cardano fails to break through the $0.37 resistance, it may struggle to gain upward momentum, keeping the price consolidated below this critical barrier. A drop below the $0.34 support would invalidate the bullish outlook, potentially leading to more significant losses and further discouraging short-term traders.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.