The Dubai Financial Services Authority (DFSA) granted Ripple an in-principle approval to expand its services from the Dubai International Financial Centre (DIFC), effectively unlocking the firm’s end-to-end payment services in the UAE.

Ripple will roll out its enterprise-grade digital asset infrastructure to a broader customer base in the United Arab Emirates.

Ripple Receives In-Principle Approval from the DFSA

The Chief Executive Officer (CEO) of Ripple, Brad Garlinghouse, lauded the UAE in a post on X (formerly Twitter). He highlighted the region’s crypto-friendliness as a magnate for digital assets-related firms.

“Regulatory clarity is what businesses want, and what consumers need. The UAE understands that,” Garlinghouse commented.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This decision will significantly enhance Ripple’s operations in the Middle East, following the establishment of its regional headquarters in Dubai in 2020. With this expansion, Ripple is poised to advance its mission of delivering faster, more cost-effective, and efficient cross-border payment solutions to businesses.

Additionally, it strengthens Ripple’s global presence as a regulated entity, introducing seamless cross-border payment services to Dubai. By combining regulatory compliance with continued investments in key infrastructure, Ripple becomes the first DFSA-licensed blockchain-enabled payment services provider.

The Middle East offers a favorable regulatory environment for cryptocurrency ventures, providing a promising base for Ripple’s growth. Other major players, like Animoca Brands, are also looking toward the region, with Animoca considering going public there by early 2025.

UAE as Global Hub for Innovation

The United Arab Emirates’ regulatory clarity positions it strategically as a global financial services and trade hub. Crypto-related firms eye the region as it offers access to fast-growing markets across the Middle East, Africa, and South Asia. This likely explains Ripple’s inclination to continue investing in the region.

Its comprehensive regulatory framework, as established by the DFSA, among other regulators in the country, creates an environment where innovative crypto firms can thrive.

“With its forward-thinking regulatory approach and clear guidance for innovative businesses seeking to invest and scale, the UAE is positioning itself as a global leader in this new era of financial technology,” Garlinghouse noted in the press release.

Meanwhile, even as Ripple eyes global expansion, it remains at odds with the US Securities and Exchange Commission (SEC). As BeInCrypto reported, the securities regulator could appeal Ripple’s partial victory, challenging the XRP token’s non-security status. There remains a lot of uncertainty in the matter, as the victory stood unchallenged barely a month ago.

Read more: Everything You Need To Know About Ripple vs. SEC.

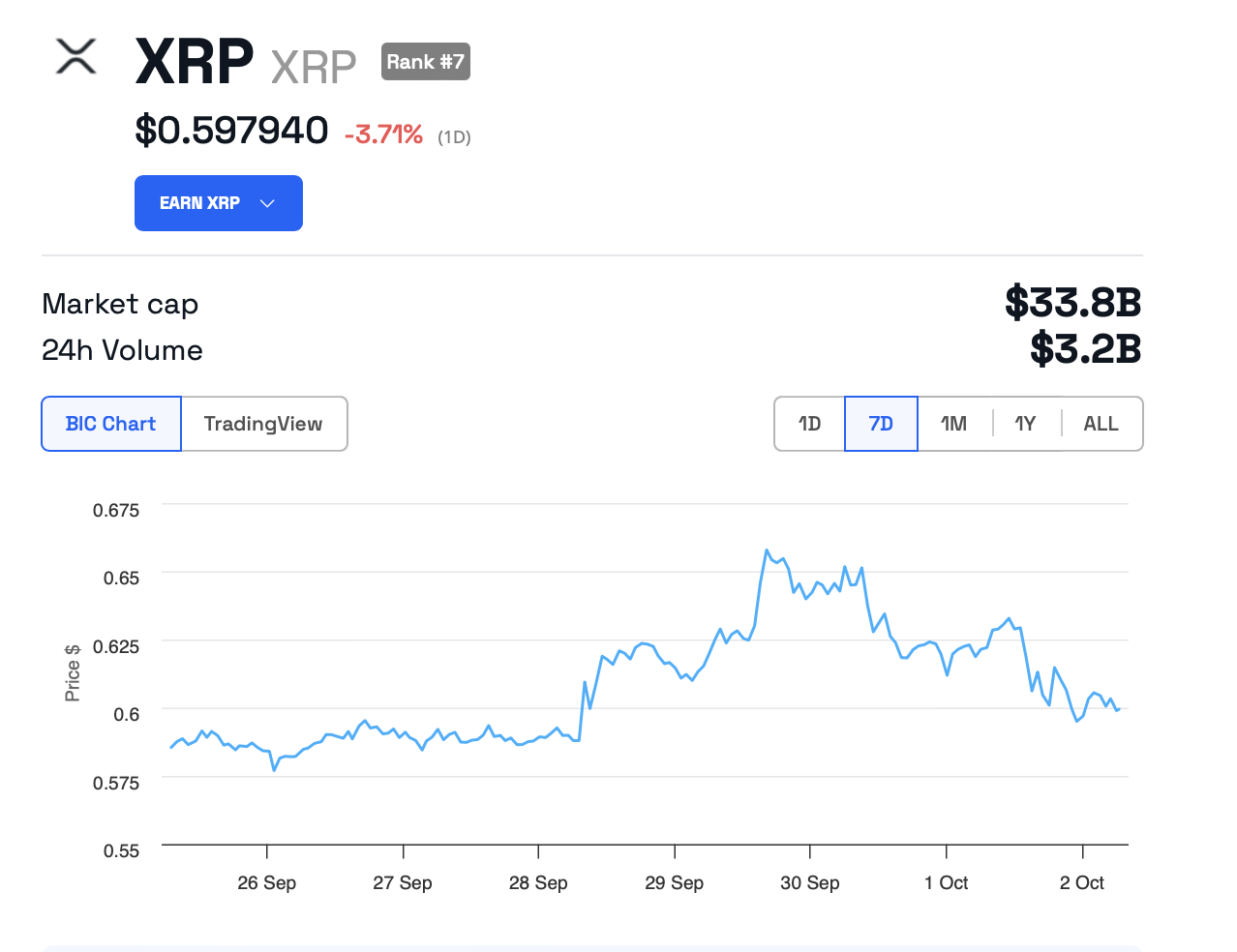

Amid the ongoing legal battle, the XRP token continues to struggle below the crucial $1.00 psychological level. According to BeInCrypto data, XRP is currently trading at $0.59, marking a nearly 4% decline in the past 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.