Cardano (ADA) has surged past the upper boundary of its descending triangle, where it had been stuck for over 60 days. This breakout coincides with a notable rise in activity from large ADA holders.

With growing bullish sentiment around the altcoin, its price could potentially rally by another 33%. Here’s how it might unfold.

Cardano Breaks Out of Bearish Trend

Cardano’s 3% increase in the past 24 hours has pushed its price above the upper line of its descending triangle. This pattern appears when an asset’s price trades between two converging trendlines: one sloping downward, representing resistance, and one flat or slightly sloping horizontal line, representing support.

ADA entered this pattern on July 16. It repeatedly attempted but failed to break above the resistance line. However, a positive shift in market sentiment following Wednesday’s Federal Reserve rate cut has propelled the Cardano’s price above this key level.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

When an asset’s price breaks above the descending triangle, it is considered a bullish breakout. It indicates that buyers have regained market control and overwhelmed the sellers. It hints at the possibility that a new uptrend may begin.

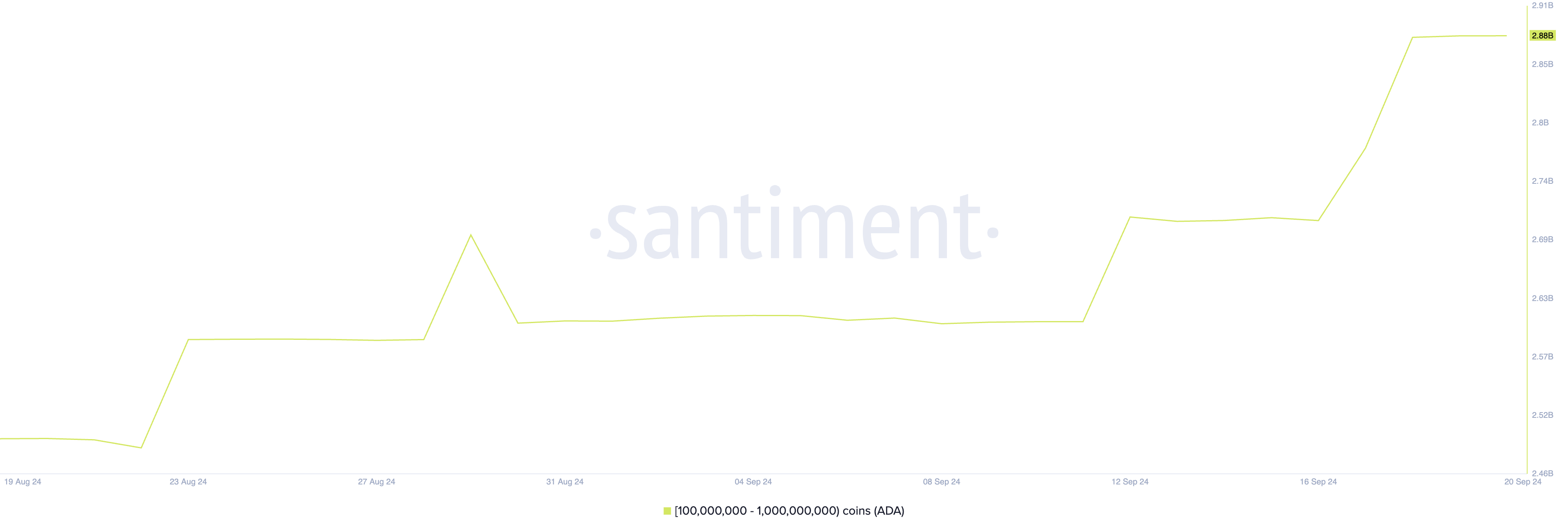

Apart from the improvement in general market sentiment, ADA’s breakout has been partly driven by the uptick in its whale activity. On-chain data reveals that addresses holding between 100 million and 1 billion ADA have gradually increased their accumulation since early September.

Since September 1, this cohort of ADA holders has bought 270 million ADA tokens worth above $97 million at current market prices. As of this writing, they currently hold 2.88 billion ADA, representing their highest count since April 2023.

ADA Price Prediction: Futures Traders Take More Positions

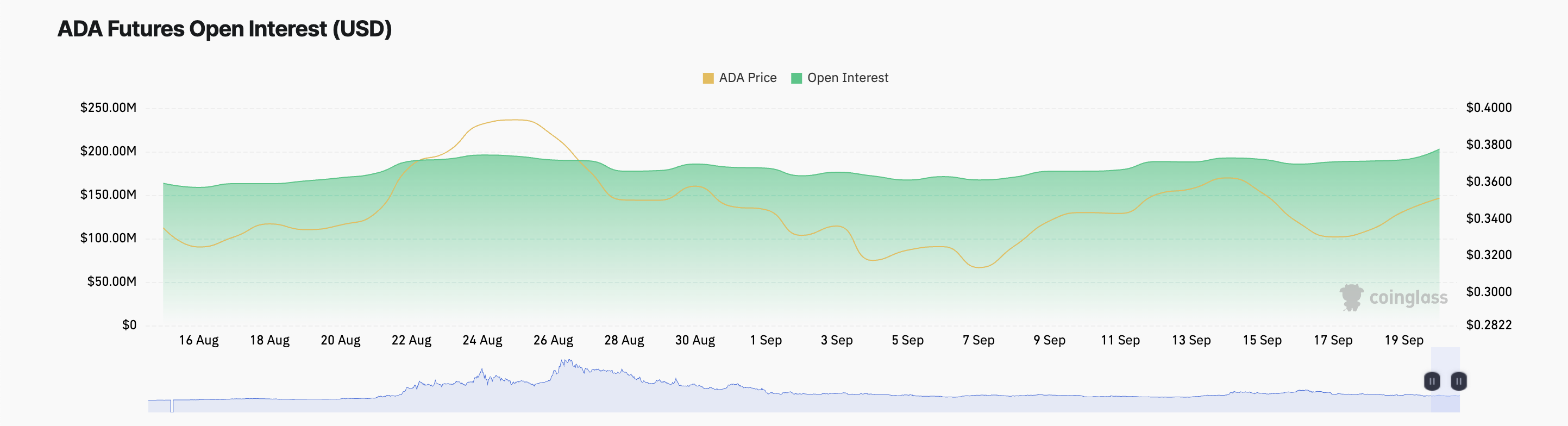

The price surge has also led to a growth in activity in ADA’s derivatives market. Over the past 24 hours, its open interest, which measures the total number of outstanding futures or options contracts, has increased by 4%.

An increase in open interest suggests growing activity in the market. More contracts mean more participants are entering the market, which can lead to increased trading volume.

Further, Cardano’s rising Chaikin Money Flow (CMF) confirms the increase in demand for the altcoin. The indicator, which tracks money flows into and out of an asset, is 0.08 at press time. A CMF value above zero signals market strength as it indicates capital inflow into the market.

If this trend continues, Cardano’s price will likely maintain its rally. A successful retest of the breakout line could occur if the bulls defend that level as support, allowing ADA to resume its uptrend and potentially set the coin on a path toward $0.47.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if the retest fails, Cardano’s price may fall within the descending triangle, potentially dropping to support at $0.31.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.