Following a prolonged period of correction and consolidation, Shiba Inu (SHIB) may be set for a bullish breakout. This development comes after the Federal Reserve interest rate cut, which has driven crypto prices up.

As the meme coin positions for an explosive move, this analysis explores the factors behind the revised prediction and what traders should watch out for.

Shiba Inu Offers an Opportunity, Boosts Traders’ Confidence

Two weeks ago, SHIB was trading at $0.000012, amid concerns of a potential capitulation. However, the price has since climbed to $0.000014, spurred by the Federal Open Market Committee’s (FOMC) decision to implement a 50 basis point interest rate cut.

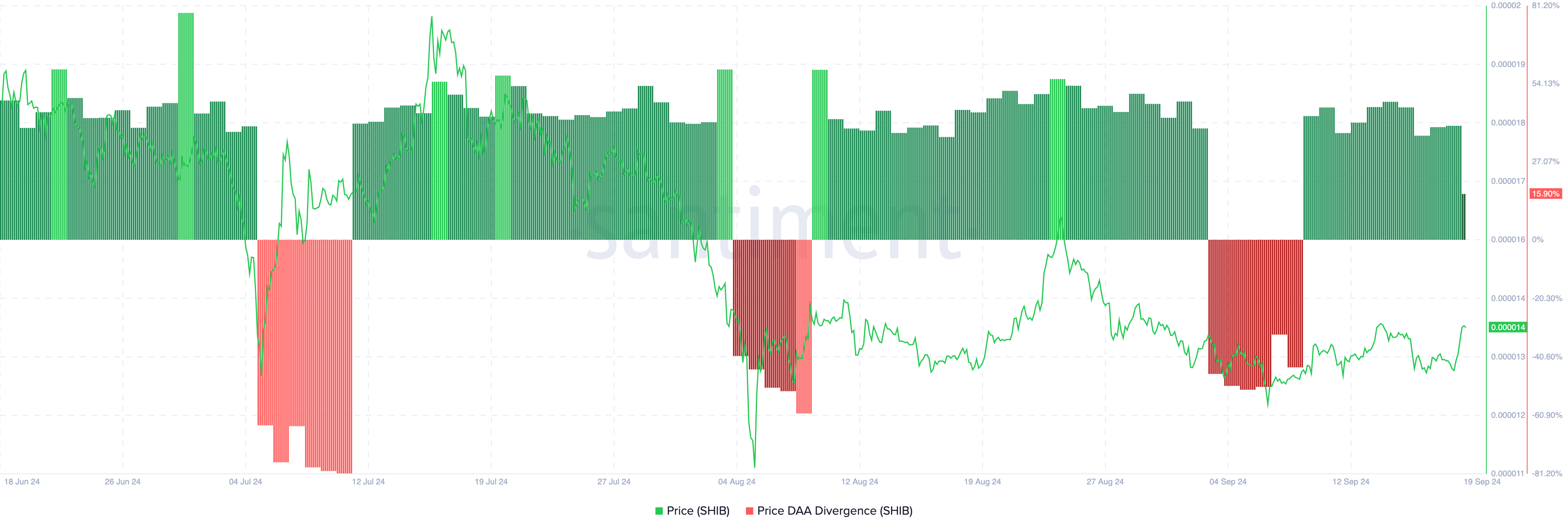

At the time when SHIB traded at $0.000012, its price-Daily Active Addresses (DAA) divergence showed a negative reading. This on-chain metric is vital for identifying potential entry and exit points in the market. A negative price-DAA divergence signals low user engagement on the blockchain, suggesting that a price rise may not be sustainable due to insufficient network activity to maintain the trend.

However, as seen below, Shiba Inu’s price-DAA divergence has turned positive at 15.90%. This indicates that the recent uptrend is backed by rising network activity. Hence, SHIB still offers an opportunity to buy as the price could swing higher than its current level.

Read more: Top 9 Safest Crypto Exchanges in 2024

Speaking of SHIB’s future potential, data from Coinglass reveals a surge in derivatives volume. Previously, both the spot and derivatives markets showed low activity, reflecting limited interest in the token.

As volume increased, there was a notable shift in the Funding Rate, which serves as an indicator of trader sentiment. A negative Funding Rate typically signals that most traders hold short positions. However, at press time, the rate has shifted to positive, suggesting that traders are now anticipating further price increases and are backing this outlook with long positions.

SHIB Price Prediction: Bullish Breakout in Sight

To provide a clearer picture of SHIB’s price prediction, BeInCrypto examines the weekly chart. According to the analysis, the meme coin has formed a falling wedge, which dates back to the yearly high in March when the price hit $0.000032.

A falling wedge is a bullish technical pattern formed by the downward slope of lower peaks and troughs. Based on the image below, buyers are beginning to come in and capitalize on sellers’ exhaustion.

Should this remain the same, SHIB’s price might fail to drop to $0.000010. Instead, the token could break above the resistance around $0.000015 and climb by 40% toward $0.0000019, possibly around the first weeks of 2024’s last quarter.

Read more: 12 Best Shiba Inu (SHIB) Wallets in 2024

However, if sellers neutralize the buyer’s recently found control, the prediction might be invalidated. If that happens, SHIB might decline to $0.000010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.