Solana’s (SOL) price prediction is bullish even though it has recently failed to breach the key resistance level at $138. A rise past this level could be the push SOL needs to hit $160, especially with growing institutional interest.

As more investors show confidence in the altcoin, the potential for SOL to rally becomes more likely.

Institutions Take Solana Back

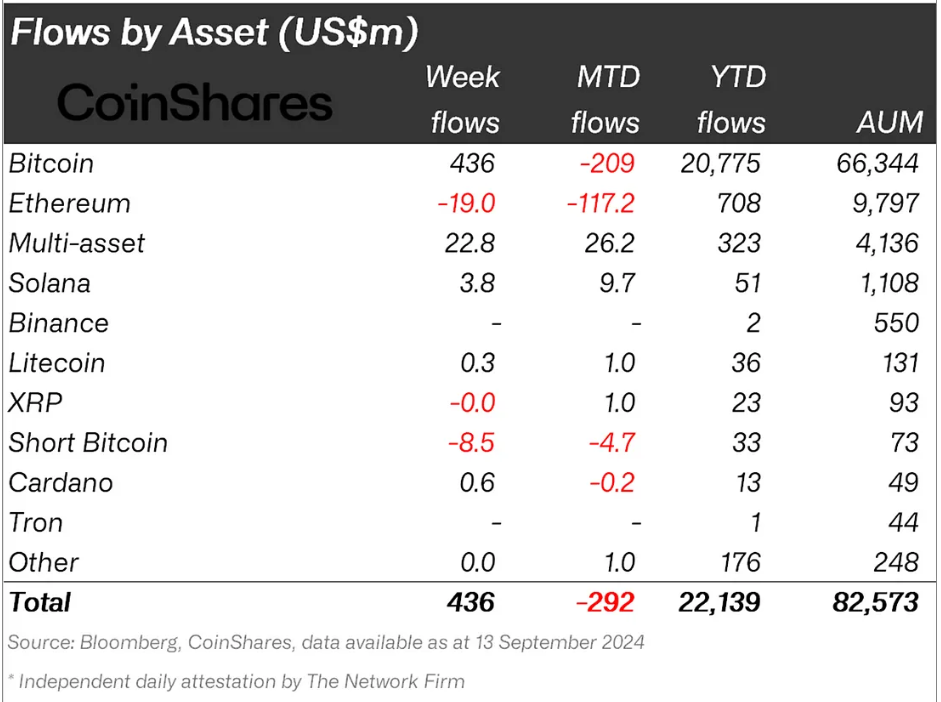

Institutional interest in Solana has been on the rise again, especially after a relatively bearish August. This month, institutions have invested over $9.7 million into SOL, with $3.8 million pouring in during the week ending on September 13. Such strong inflows from institutional investors indicate renewed confidence in Solana’s long-term potential and could act as a driving force behind its price growth.

This surge in institutional capital is helping to sustain Solana’s current momentum. If these trends continue, SOL could see further price gains, particularly as larger investors accumulate the cryptocurrency. Institutional support often provides stability and can serve as a key catalyst for upward price movement.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

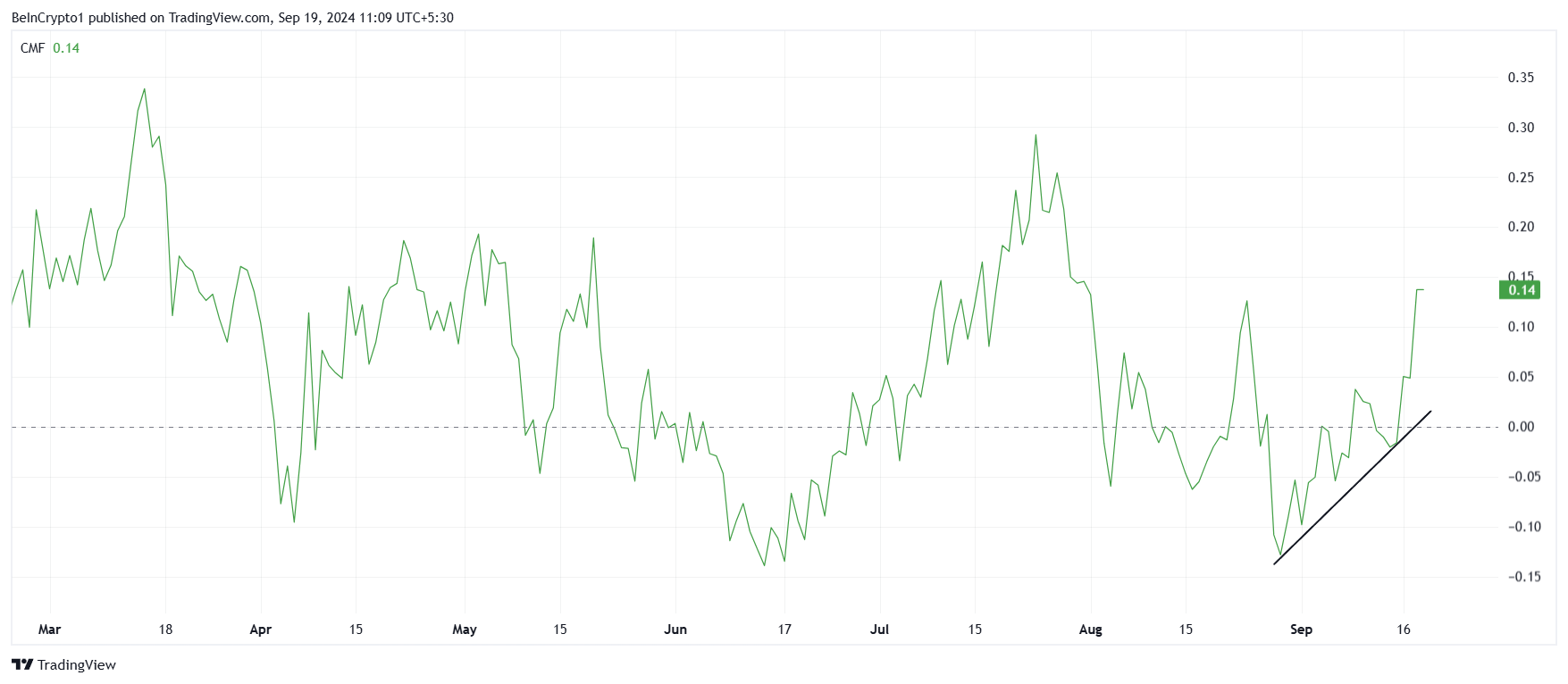

Additionally, Solana’s macro momentum appears to be strengthening, as shown by the Chaikin Money Flow (CMF) indicator, which has reached its highest point in a month and a half. While netflows were primarily negative earlier in September, the last three days have seen a shift to positive, largely driven by increased institutional activity.

This positive change in netflows signals that the tide could be turning for Solana. The combination of bullish technical indicators and rising institutional interest provides a favorable environment for further price increases, but challenges remain in sustaining this momentum as SOL approaches higher resistance levels.

SOL Price Prediction: The Fight to Rise

Solana is currently trading near $138, and flipping this barrier into support could be crucial for pushing the price toward $155 and $160. While a successful breach would position SOL to test these higher levels, continued bullish momentum will be key to sustaining this upward trend.

Furthermore, while the factors mentioned suggest a breach of $138 is likely, the bullish momentum could weaken before Solana hits $160. This may limit the altcoin’s ability to surpass this critical level, keeping it within a lower trading range.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if Solana fails to break through $138, the bullish outlook would be invalidated. In this case, SOL could face a decline to $124 or $120, exposing it to further downward pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.