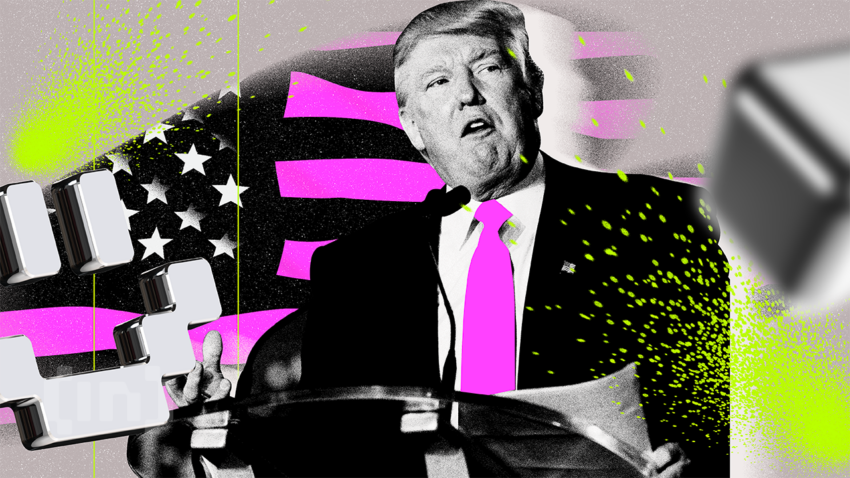

Donald Trump and his sons announced the launch of their DeFi venture, World Liberty Financial (WLFI), during an X Spaces session on Monday. The 143-minute event, however, missed the mark according to some crypto investors.

World Liberty Financial is positioned as a decentralized lending platform, with Donald Jr. and Eric Trump playing key roles.

World Liberty Financial Not As Impressive, Crypto Investors Say

Donald Trump’s family launched World Liberty Financial (WLFI) on Monday, with a commitment to democratize and depoliticize finance. The venture aims to provide individuals, often excluded by traditional banks, with easier access to borrowing and lending crypto assets.

Despite this ambitious mission, crypto investors remained unimpressed. Many expressed doubts about the project’s viability, with skepticism surrounding its business model and whether it could truly deliver on its promises.

“We’re over two hours into this Trump crypto call and they haven’t yet spoken about what the platform does. The listener count has dropped from 150,000 to 47,000. What a wasted opportunity!” CEO of blockchain firm Tierion, Wayne Vaughan, shared mid-way into the Monday X Spaces.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

“I will never get back those two hours and 23 minutes,” Vaughan added, criticizing the overly lengthy session that failed to provide substantial details about World Liberty Financial (WLFI). Attendees left the session without key information, such as how WLFI would operate, who its target customer base would be, or how its decentralized lending protocol would generate revenue.

Further disappointment came from the announcement that the WLFI token would only be available to accredited investors who meet a certain wealth threshold, excluding a broader audience that may have been interested in participating.

“It’s not for retail so defeats the message he wants to push Retail is not poor and stupid,” crypto YouTuber Wendy O. said.

Despite failing to impress crypto investors, World Liberty Financial has plans for more initiatives. Fox Business reported the introduction of a non-transferable “governance” token, available to select investors through Telegram. This token would grant holders voting rights on future developments.

Read more: How To Fund Innovation: A Guide to Web3 Grants

The less-than-desirable debut notwithstanding, a select few applaud the Trump family for its bold foray into digital finance. This sentiment stems from World Liberty Financial’s integration with Aave, a market leader in decentralized lending.

“We’re not just another hostile fork of Aave. History shows those don’t work. We’re working with Aave, collaborating to create a platform that sets new standards and pushes all of DeFi forward,” World Liberty Financial revealed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.