Leading oracle network Chainlink has been making significant strides in expanding its ecosystem in recent days. These developments have reignited interest among long-term holders, who have begun to move their tokens around in anticipation of a price rally.

However, LINK’s muted price reaction over the past few days suggests that the altcoin may have other plans.

Long-Term LINK Holders Move

The week so far has seen a flurry of positive developments within the Chainlink ecosystem. As reported by BeinCrypto, one of the most notable announcements came on Tuesday when Chainlink Labs partnered with Fireblocks. On Monday, Chainlink announced at SmartCON 2024 that its Cross-Chain Interoperability Protocol (CCIP) has officially gone live on ZKsync’s Era Mainnet.

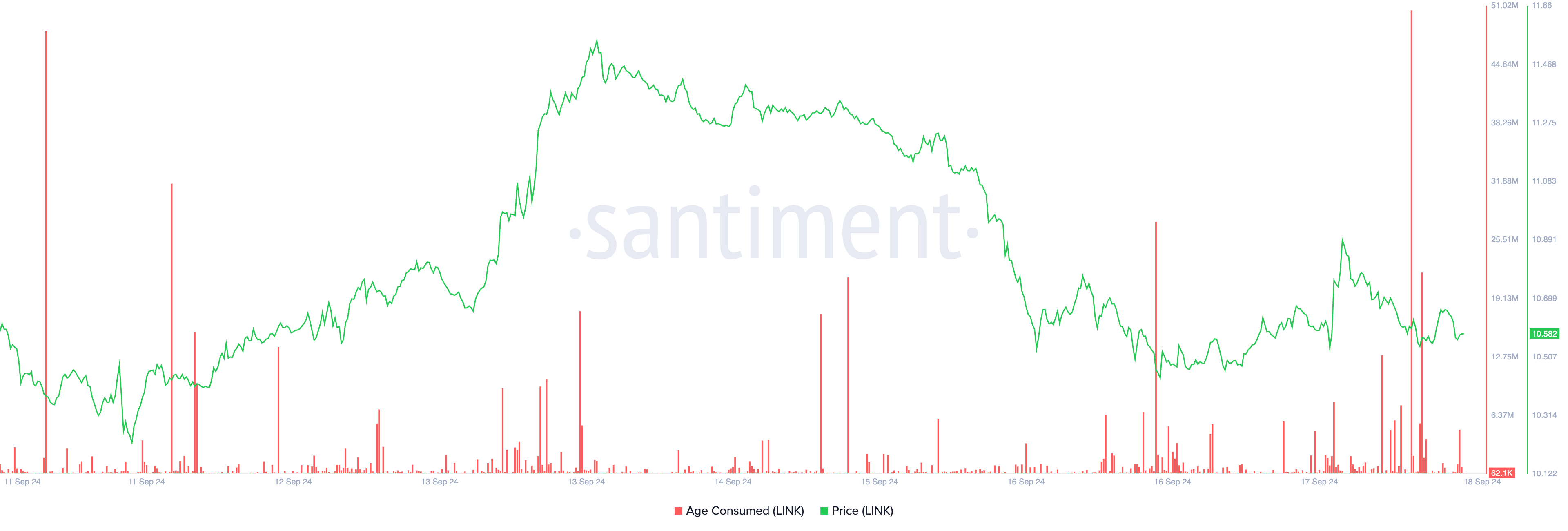

These developments have prompted long-term LINK holders to move around their previously dormant tokens in anticipation of a price rally. This is reflected in the spike in the altcoin’s age-consumed metric.

On-chain data shows that LINK’s age consumed, which tracks the movement of its long-held tokens, rose to a seven-day high of 50.51 million on Wednesday morning. This surge is notable because long-term holders rarely move their coins around. When they do, it often precedes a shift in market trends.

Moreover, the metric is a good marker of a local bottom, especially when the spike in its value is followed by a rally in Chainlink’s price. This has played out in LINK’s case. After its age consumed skyrocketed, the token’s price briefly surged to $10.63 before retracing to trade at $10.58.

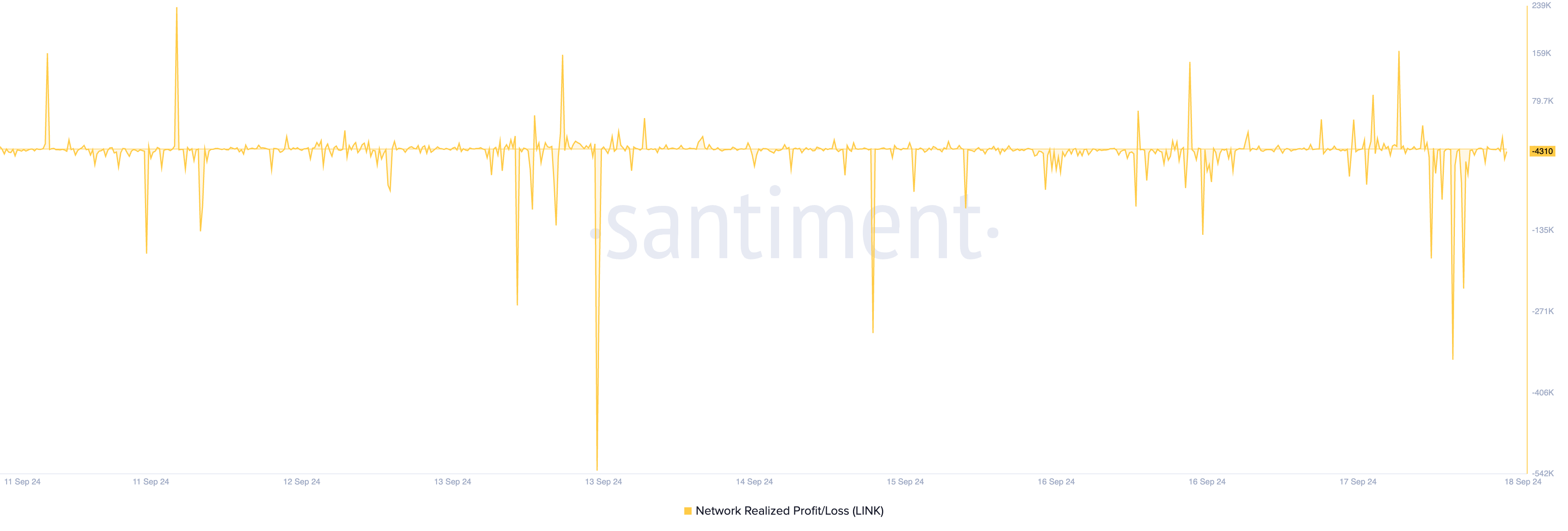

Further, the token’s Network Realized Profit/Loss is another indicator to consider. This metric, which tracks the average profit or loss of all LINK tokens that change addresses daily, saw a dip on Wednesday morning.

These dips usually signal a short-term capitulation of ‘weak hands’ and the re-entry of ‘smart money,’ which is why they mark a local price bottom and the beginning of price recovery.

Chainlink Price Prediction: Dip

However, Chainlink’s price recovery may prove difficult in the short term. As reflected in its technical setup, the market sentiment toward the altcoin remains significantly bearish.

At its current price of $10.58, the altcoin trades below its 20-day exponential moving average (EMA), which tracks its average price over the past 20 trading days. When an asset’s price trades below this key moving average, the market is in a downtrend, and recent selling pressure outweighs buying momentum.

If selling pressure intensifies, Chainlink’s price could drop to $8.08. This level was last seen on August 5, when more than $1 billion in liquidated positions was recorded.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

However, a shift in the market trend could drive Chainlink’s price towards resistance at $11.24. If the price breaks through this level, it could advance further to $13.73 and pave the way towards $17.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.