Following Grayscale’s launch of its Sui Trust, the coin has surged to become the top-performing crypto asset in the past 24 hours.

Currently trading at $1.04, its value has jumped nearly 20% since the digital asset manager announced that the SUI Trust is now accessible to accredited investors seeking exposure to SUI.

Sui Spikes, Trading Volume Climbs to Monthly High

A high trading volume has backed SUI’s price rally. As of press time, the coin’s trading volume has surpassed $516 million, marking a 115% increase in the past 24 hours.

When both price and trading volume rise simultaneously, it signals a bullish trend, suggesting growing interest and confidence in the asset. Buyers are willing to purchase at higher prices, driving up demand. On-chain data shows that SUI’s daily trading volume is currently at its highest level in the past 30 days.

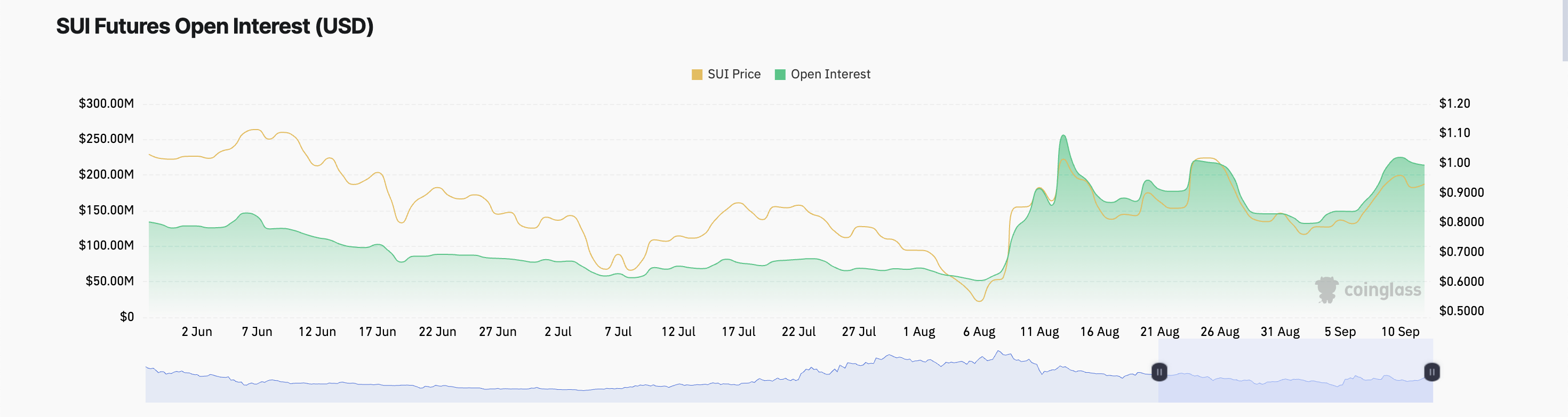

Additionally, activity in SUI’s derivatives market is also on the rise, with its open interest — representing the total number of outstanding futures or options contracts — climbing by 53% in the last 24 hours, according to Coinglass. This surge in open interest indicates increased participation in SUI’s futures market, further fueling the positive market sentiment.

When an asset’s open interest climbs, it signals a growing interest in the asset. It indicates that more investors are willing to take positions in the derivatives market, either to hedge existing positions or to speculate on price movements.

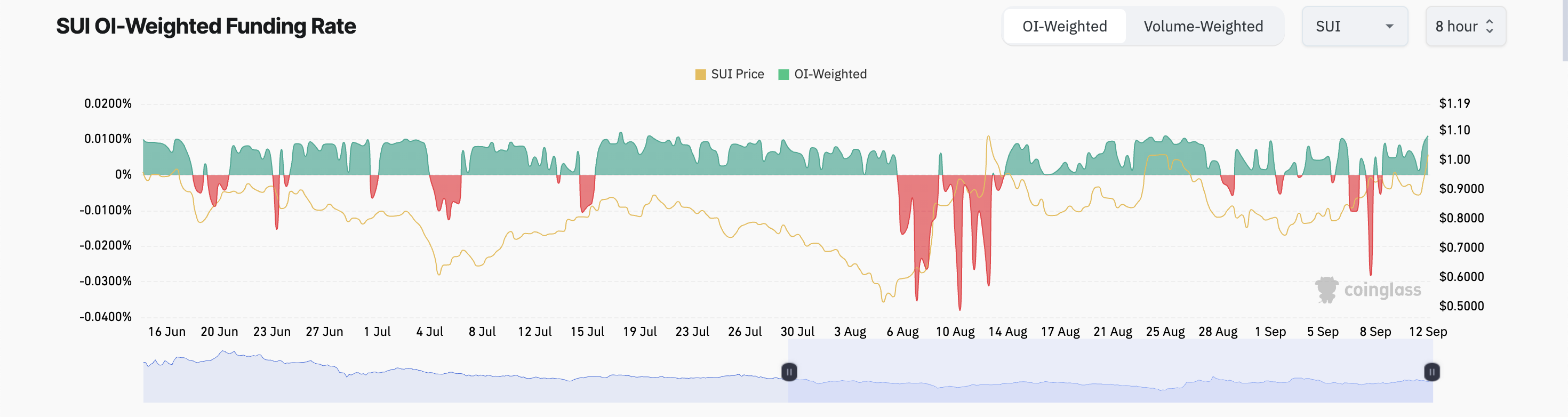

SUI’s positive funding rate suggests that many of these traders are betting on a continued price rally. The coin’s funding rate, which is a period fee paid to ensure the contract price stays close to the spot price, is at 0.0086% at press time. It signals that there is a higher demand for long positions among market participants than short ones.

Read more: Everything You Need to Know About the Sui Blockchain

SUI Price Prediction: A Rally To 60-Day High On the Horizon

SUI’s rising Relative Strength Index (RSI) supports the bullish outlook highlighted above. The indicator, which measures an asset’s overbought and oversold market conditions, is in an uptrend at 64.92 at press time.

This suggests that SUI buying pressure exceeds the selling activity in the market. It means that there is a high demand for the coin among market participants. If this trend continues, SUI’s next target is its 60-day high of $1.11.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

However, if profit-taking activity gains momentum, SUI’s price may fall 55% to $0.46.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.