Chainlink’s (LINK) price has shown signs of recovery, aiming to return to the $12 level after a 4.20% rise in the last 24 hours. This rebound comes after the token, ranked as the 14th most valuable cryptocurrency, dropped below $10 a few days ago.

If LINK maintains its upward trajectory and key indicators continue to improve, it could avoid another dip and sustain its climb.

Chainlink Open Interest, Large Transactions Jump

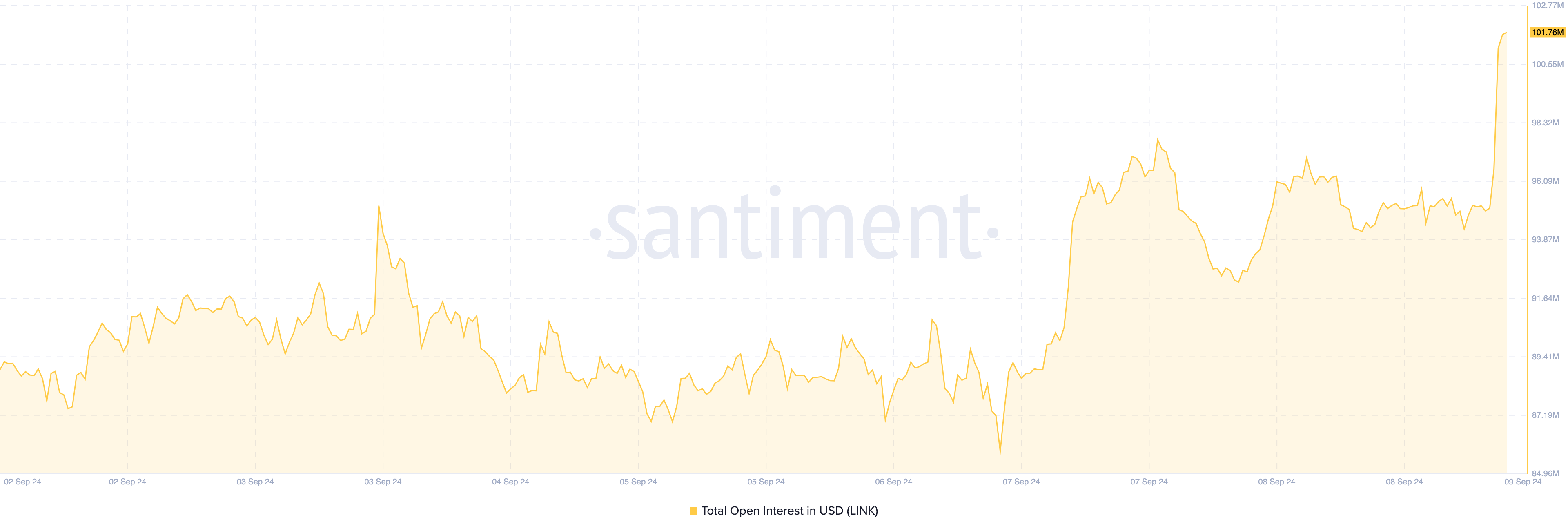

One key indicator supporting Chainlink’s recent upswing is its rising Open Interest (OI). OI tracks the number of active contracts tied to the cryptocurrency, reflecting the market’s engagement. An increase in OI suggests growing liquidity and interest in those contracts, while a decline points to reduced exposure.

From a price perspective, rising OI alongside a price dip often confirms a downtrend. Conversely, if OI decreases during a price rise, it could signal a bearish reversal. In Chainlink’s case, however, both OI and price are increasing, suggesting the uptrend may continue.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

Furthermore, Chainlink has seen a rise in large transactions since September 5, indicating increased liquidity around the cryptocurrency. However, a spike in large transactions doesn’t always signal upward pressure. If these transactions surge during a price drop, it points to dominant selling pressure.

In LINK’s case, the recent jump in large transactions suggests growing demand. This demand, paired with the larger transaction sizes, may help sustain the current price increase and support the ongoing uptrend.

LINK Price Prediction: It’s the Season to Get Back $12

Chainlink’s price currently trades at $10.74, reaching this level after bulls successfully defended the $10.05 support. According to the daily chart, the cryptocurrency may be forming a V-shaped recovery — a sharp rebound following a steep decline. LINK’s price fell to $9.57 on September 8 before reversing at that level.

Additionally, the Relative Strength Index (RSI), a momentum indicator, is nearing the neutral line. If the RSI climbs above 50.00, it could confirm the bullish outlook, potentially driving LINK toward $12.34, where the neckline of the V-shaped pattern lies.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in September 2024

In a highly bullish situation, Chainlink’s price might jump toward $14.82. However, market participants need to watch for the crypto’s price at $10.75, as this was the point at which where the uptrend faced rejection on August 8.

Should bulls fail to break this resistance, LINK could experience a retracement, which would cause the price to decline to $10.05.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.