21Shares has introduced its Wrapped Bitcoin on the Ethereum blockchain, marking its second launch of this product after its debut on Solana.

WBTC continues to draw attention, especially after BitGo announced plans to shift its custody to a new multi-jurisdictional model.

21Shares Introduces Second WBTC

The Wrapped Bitcoin, branded as 21BTC, emerges from a partnership between 21.co, the parent company of 21Shares, and global market maker Flow Traders. According to the announcement, 21BTC is designed to provide users with “peace of mind” as they engage with decentralized applications.

Unlike vulnerable “lock-and-mint” methods, 21BTC prioritizes cold storage, eliminating the need for users to rely on a bridge. Asset storage is handled by institutional-grade, third-party custodians, ensuring added security.

“21BTC offers an institutional-grade wrapped Bitcoin token on Ethereum. With five years of asset management expertise and experience, 21BTC provides access to Bitcoin through wallets similar to the way ETFs are accessed through banks and brokerages. In addition, 21BTC is supported by market makers and custodians, who support 21Shares’s ETPs,” Tom Wan, Associate, Strategy and Business Development at 21.co, told BeInCrypto.

Read more: Wrapped Bitcoin (WBTC): A Beginner’s Guide

However, 21Shares faces the challenge of reassuring customers who are wary of Wrapped Bitcoin (WBTC) following BitGo’s recent decision to shift its custody of WBTC to a new multi-jurisdictional model. Investors have expressed concerns due to Justin Sun’s involvement, particularly in light of his association with other projects that have encountered operational issues.

“BitGo partnering with Justin Sun for WBTC custody is up there with the most insane business decision I’ve ever seen,” Bitcoin Magazine’s Alex Bergeron stated.

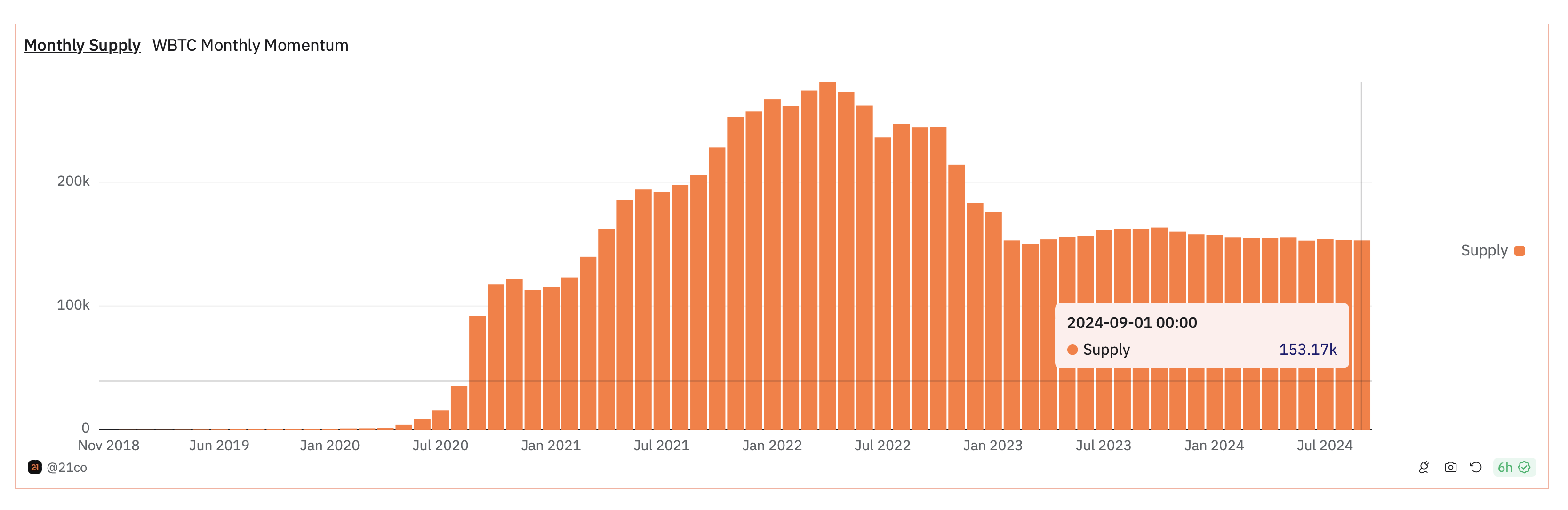

DeFi platform MakerDAO has also raised concerns and started evaluating the risks linked to BitGo’s new WBTC custody model. In response, the lending protocol voted to halt new users from borrowing against WBTC, which led to a decline in demand. Data from Dune supports this, showing a supply decrease of over 1,000 tokens in August.

Despite these hurdles, BitGo CEO Mike Belshe aims to address the fear, uncertainty, and doubt (FUD) surrounding WBTC. He argues that critics are not being “intellectually honest” about their concerns.

Belshe made these remarks in a recent interview where he also criticized Coinbase’s potential competitor to WBTC, known as cbBTC. According to Belshe, cbBTC would go against the core principles of decentralized finance (DeFi).

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

“DeFi community picking central bank Coinbase as the ultimate steward, then I think all DeFi hope should be lost,” the report read.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.