The declining interest in Solana (SOL) meme coins has caused a sharp decrease in user activity on the Layer-1 blockchain.

Over recent weeks, daily active addresses and transaction counts have notably dropped, leading to a reduction in network fees and the revenue generated from them.

Solana Revenue Falters Amid Low Usage

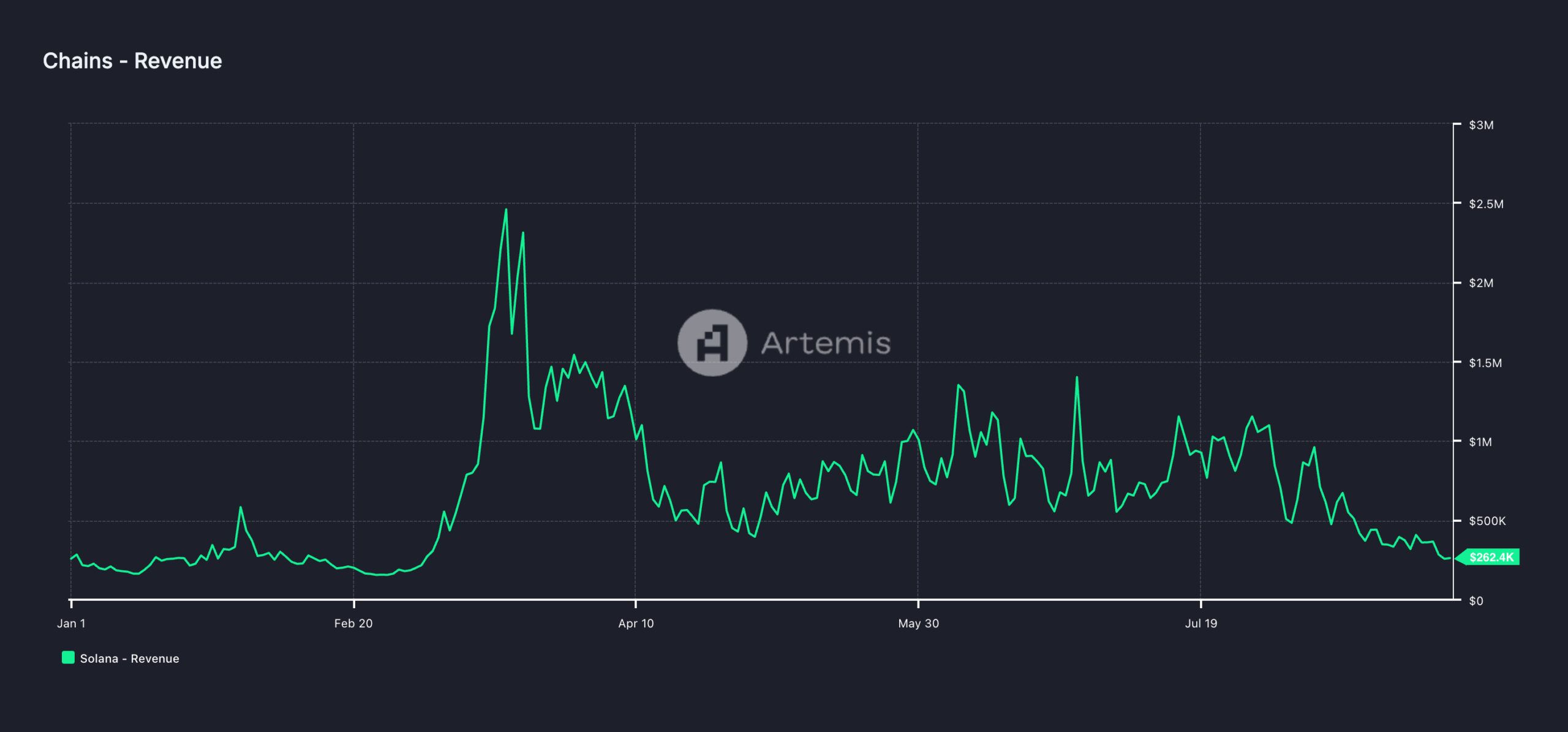

Solana’s daily revenue has been on a downward trend since August 1, dropping by 46% over the past 30 days, marking its lowest point since March 5. This decline is largely due to reduced demand for Solana, evident in its decreasing on-chain activity.

According to Artemis, daily transactions on Solana totaled 29 million over the past 30 days, a 22% decrease. This reduction in transaction count led to a 45% drop in transaction fees, totaling $523,000. Additionally, SOL’s value declined by 11%, currently trading at $133.68.

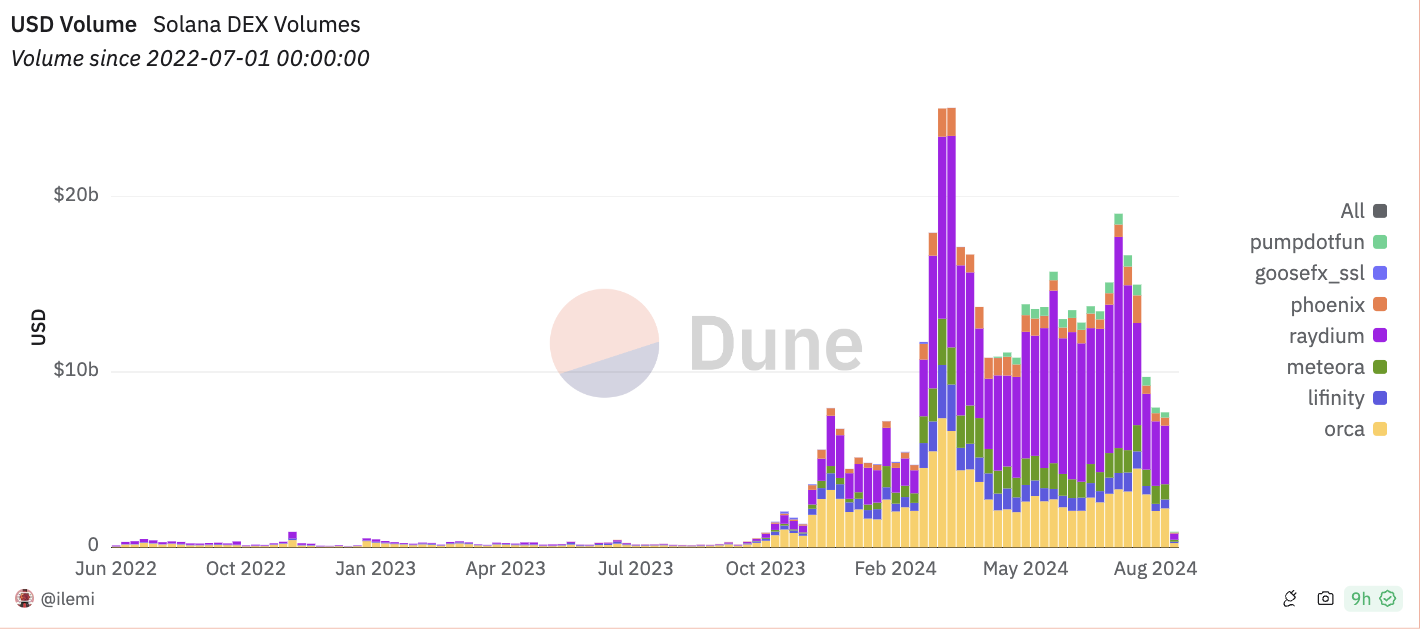

The decrease in user activity is also reflected in Solana’s DEX volume, which hit a six-month low of $7.7 billion last week, according to Dune Analytics. Additionally, the decline in Solana’s activity is reflected in its NFT sales volume. CryptoSlam data shows that Solana’s NFT sales volume in August totaled $79 million, marking a 24% decrease in monthly sales on the network.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

SOL Price Prediction: Solana’s Value is Falling Faster Than Bitcoin’s

The SOL/BTC trading pair has been on a decline since July 31, as shown on the one-day chart. This pair represents the exchange rate between Solana (SOL) and Bitcoin (BTC). As of the latest data, the exchange rate stands at 0.002.

When the SOL/BTC pair drops, it indicates that SOL’s value is declining relative to Bitcoin, meaning SOL holdings are becoming less valuable in terms of BTC. As a result, if a trader exchanges SOL for BTC, they would receive less BTC than before.

If SOL’s value continues to decline, it could potentially revisit its August 5 low of $110, which would represent a 17% drop from its current value.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if the market trend shifts and SOL begins to rally, its price could climb to $148.27.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.