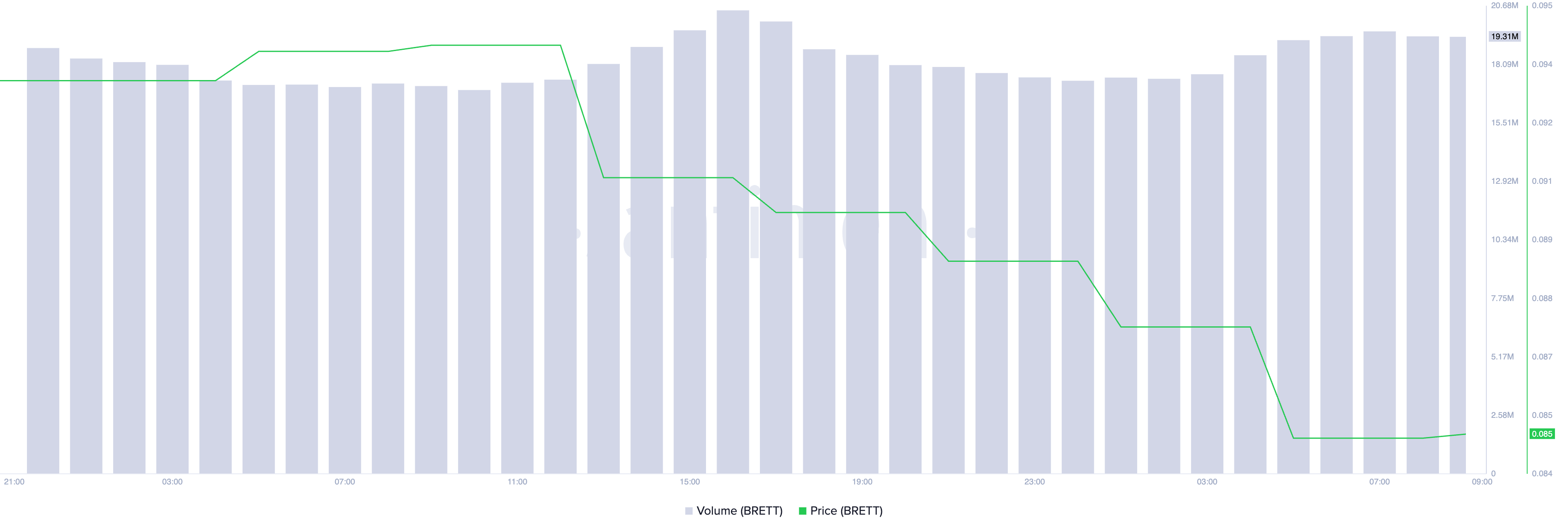

The meme coin Brett (BRETT), built on the Base network, could be gearing up for a rebound as a price/volume divergence emerges.

While BRETT’s price has been declining, its trading volume has surged. This contrast suggests that selling pressure might be nearing its peak, potentially setting the stage for a recovery.

Brett May Be on the Verge of Rebound

As of now, BRETT is trading at $0.085, marking a nearly 10% decline over the past 24 hours. In the same timeframe, its trading volume reached $19 million, a 13% increase. This divergence between price and volume suggests that holders are offloading their positions.

However, it also signals that the market might be approaching a tipping point where selling pressure could ease. At this stage, buyer interest typically resurfaces, which could lead to a price rebound.

An analysis of BRETT’s Relative Strength Index (RSI) supports the likelihood of sellers reaching exhaustion. Currently, the RSI sits at 39.17, approaching the oversold territory.

The RSI measures whether an asset is overbought or oversold on a scale of 0 to 100. A reading above 70 indicates overbought conditions and a potential correction, while a value below 30 signals oversold conditions and a possible rebound.

Although BRETT’s RSI hasn’t entered oversold territory yet, the current reading suggests that the asset might be undervalued and positioned for a price recovery. If the RSI dips below 30, it would confirm oversold conditions, making a rebound highly likely.

Read more: 7 Best Base Chain Meme Coins to Watch in June 2024

Additionally, BRETT’s Chaikin Money Flow (CMF) is trending upward despite its declining price, creating a bullish divergence. The CMF currently stands at 0.07, reinforcing the possibility of a price reversal.

This divergence occurs when an asset’s price falls while its CMF rises and turns positive. Such a pattern suggests that the selling pressure driving the price down is losing momentum, signaling that a rebound could be imminent.

BRETT Price Prediction: Meme Coin May Touch $0.11 if Sellers Tap Out

Once sellers’ exhaustion sets in, BRETT’s price rebound will occur. Its price will climb as buying activity intensifies. The shift in market trends may push the meme coin’s value to $0.11.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, if the current trend persists and selling activity remains significant, BRETT’s value may fall to $0.05.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.