Digital asset investments hit $176 million last week, effectively registering a resumption of inflows after a streak of negative flows.

It comes after the recent market correction, with ETF (exchange-traded funds) investors seizing the opportunity to buy the dip.

Ethereum Leads As ETF Investors Buy The Dip

ETF analyst Eric Balchunas from Bloomberg Intelligence highlights an all-time high for year-to-date (YTD) net crypto inflows. He records this as the most important metric for measuring the success of ETFs.

“And after the dust settled on the downturn in BTC last 2 weeks (although it came back a bit) the YTD net total flows are at an ATH of +$19b which is surprisingly strong all things considered (again this number is the most imp metric to measure success IMO bc net price moves and GBTC unlock),” Balchunas remarked.

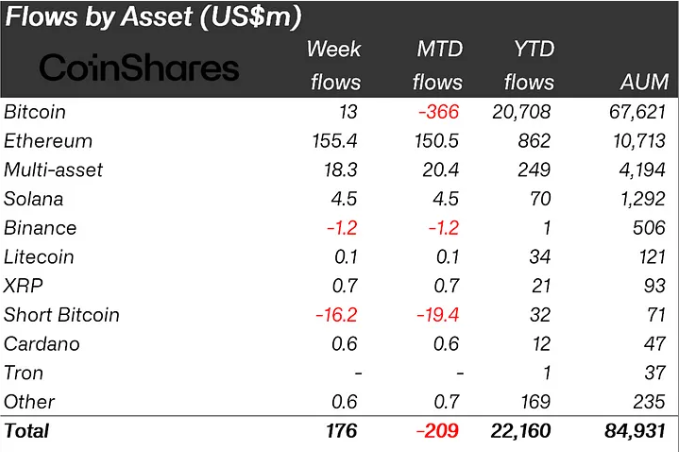

These remarks come alongside CoinShares’ report that Ethereum (ETH) led the positive flows, accounting for $155.4 million of the total inflows. Meanwhile, Bitcoin (BTC) recorded only $13 million and $4.5 million for Solana (SOL). BlackRock’s iShares ETFs led the pack among financial instrument issuers.

“Ethereum has benefited the most from the recent market correction, attracting $155 million in inflows last week. This brings its year-to-date inflows to $862 million, the highest since 2021, largely driven by the recent launch of US spot-based ETFs,” an excerpt in the report read.

Read more: How to Invest in Ethereum ETFs?

The crash, which saw Bitcoin price slump as low as $49,000, also wiped out almost $20 billion worth of assets under management (AUM). Nevertheless, ETF investors unanimously capitalized on the dip to acquire investment products at a discount.

Evidence of this, according to CoinShares, includes every region recording inflows last week alongside elevated trading activity in ETPs (exchange-traded products).

Meanwhile, Bitcoin is back below $60,000, setting the week off to a bad start after nicking $61,000 over the weekend. It would be nice to see some solid buying pressure this week among ETF investors, even as QCP indicates cautious short-term sentiment with a BTC put skew out until September.

Bitcoin Put Skew Dynamics

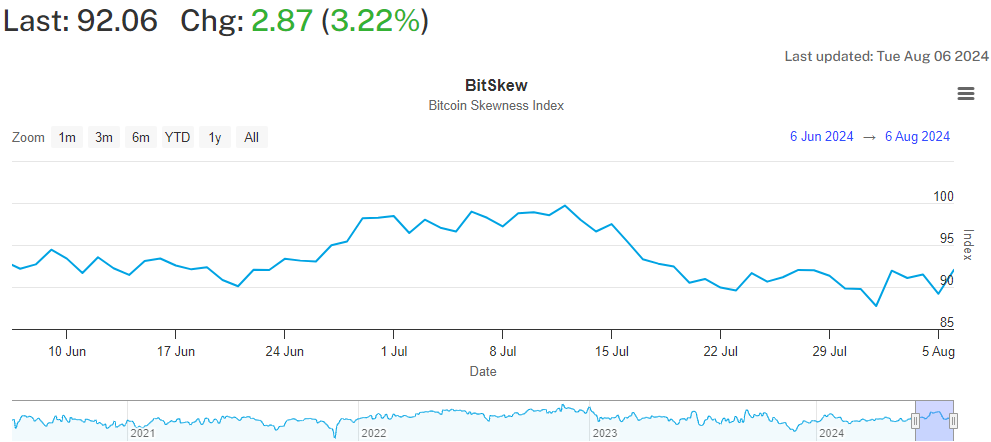

After the recent market panic drove Bitcoin put skew to extreme levels of -25%, there has been a significant normalization back to more stable levels. This adjustment suggests that the heightened fear and uncertainty that triggered the panic selling have subsided. Market participants are regaining some confidence in Bitcoin price stability in the near term.

“While the BTC put skew has normalized significantly from -25% during the panic to pre-washout levels at -5%, the market remains cautious in the near term with a BTC put skew out till September. Some potential volatility events to look out for are Elon Musk’s interview with Trump at 8 pm ET and US CPI on Wednesday,” WuBlockchain reported, citing QCP.

The Bitcoin put skew refers to the pricing imbalance between BTC put options (which bet on a price decline) and call options (which bet on a price increase). A negative (or bearish) put skew indicates that market participants are pricing in a higher probability of a price drop compared to a price increase, reflecting a cautious or pessimistic sentiment towards Bitcoin.

Although the Bitcoin (BTC) put skew has normalized, market caution persists, especially with the skew extending into September. This extended bearish put skew suggests that traders remain cautious about potential downside risks for Bitcoin in the medium to long term. Concerns over macroeconomic factors or geopolitical tensions might be fueling this cautious sentiment.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Investors should, therefore, remain vigilant and proactive in response to potential volatility events that could impact the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.