Blockchain payment project Ripple, as well as its native token XRP, were in the news for seemingly right reasons during the week. This is due to the surge in the cryptocurrency’s price and the partial win in the long-standing legal battle between Ripple and the US SEC.

These two events increased comments online, suggesting an unprecedented XRP rally. However, noteworthy observations on-chain reveal that this sentiment may be inaccurate.

Recent Data Suggest Caution for Ripple Investors

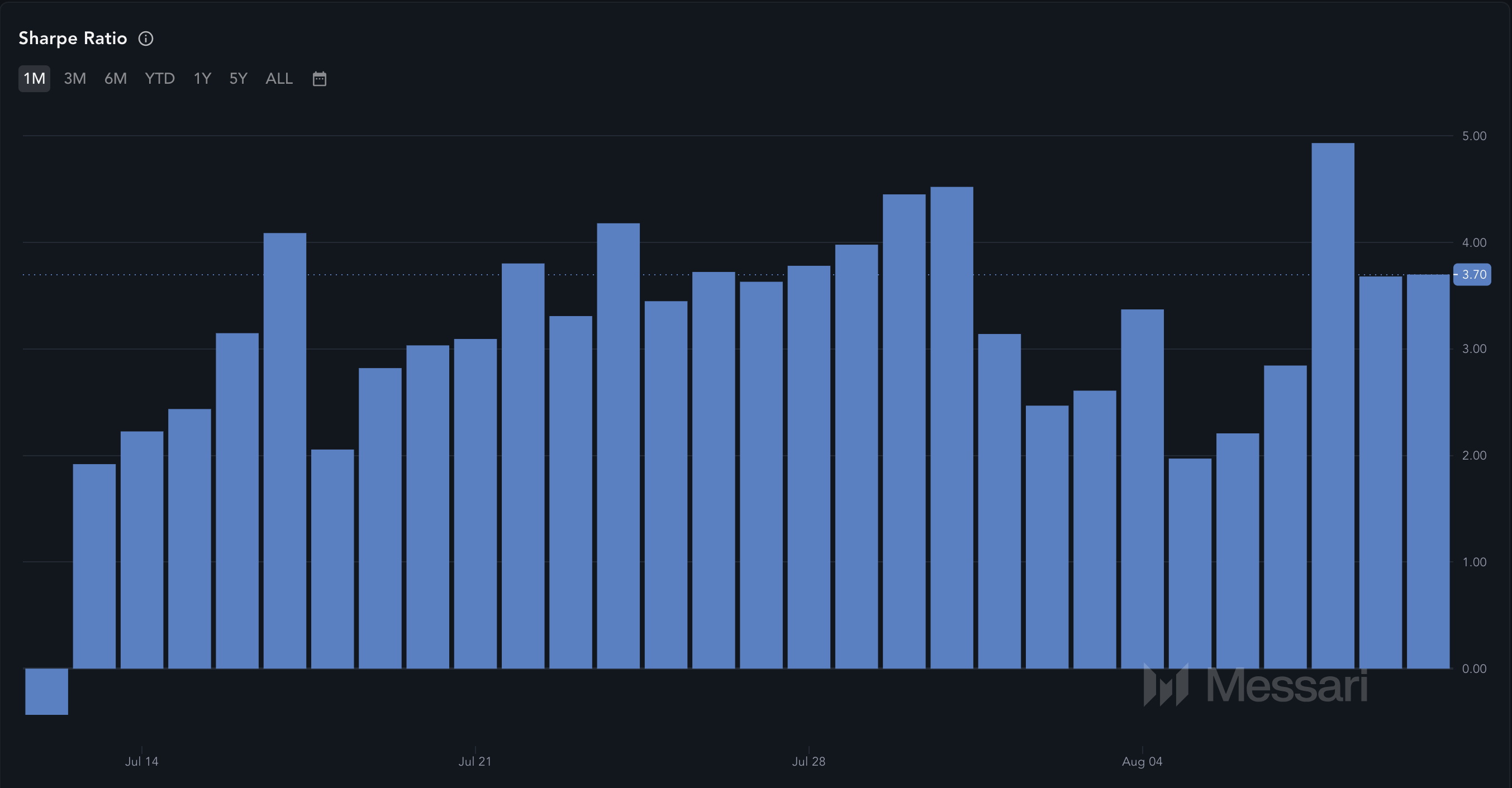

One way BeInCrypto analyzes XRP’s potential performance is by evaluating the Sharpe Ratio. This ratio measures the risk attributed to a token compared to the return it can offer. A highly positive Sharpe Ratio means that one can expect a good return on investment.

However, a negative ratio suggests that the crypto in question is risk-free of returns or could remit losses. According to Messari, XRP’s Sharpe Ratio is 3.70.

During the aforementioned rally to $0.65, the ratio was 4.93, suggesting that the token was worth buying. As of this writing, the negative reading suggests that this is no longer the case. Therefore, the calls for an extended rally could be rendered null and void.

Read more: Everything You Need To Know About Ripple vs SEC

The ratio’s decline could be linked to the fall in price. On August 8, the value notched a 20% increase and traded at $0.65. At press time, it is $0.58.

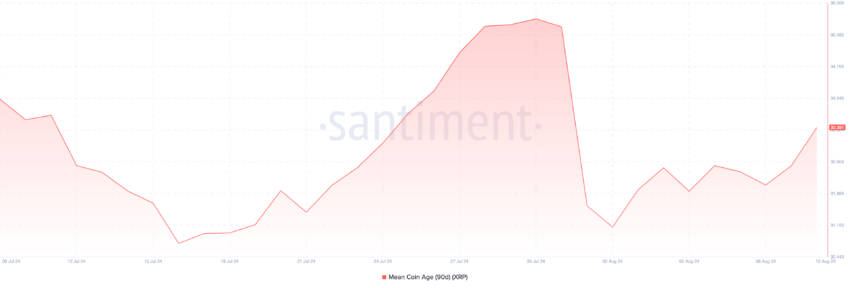

Beyond that, on-chain data from Santiment shows that the Mean Coin Age (MCA) has increased. Put simply, the MCA is the average of all tokens on a blockchain. When the reading increases, it means that tokens that have remained dormant for a while have been moved.

Furthermore, spikes in the coin age suggest that those moving tokens will likely exchange them. However, low coin age signifies increasing accumulation and suggests that holders are retiring the tokens to a cold wallet.

If the metric continues to jump, then XRP may face another round of selling pressure. As such, it may not be the best time to buy the cryptocurrency for short-term gains.

XRP Price Prediction: No Buyers, No Recovery

According to the daily chart, the token could not build up on its earlier increase after hitting a supply zone around $0.62 and $0.63. This lack of demand forced a rejection that saw the price drop to $0.56 before a slight uptick.

Furthermore, the Moving Average Convergence Divergence (MACD) is negative. The MACD uses the difference between the 12-day and 26-day exponential moving averages to spot trend-following momentum.

A positive reading of the MACD suggests that buyers are in control, and momentum is bullish. However, for XRP, the momentum is bearish, hinting at a possible price decrease. If this remains the same, the token’s value may drop to the $0.55 underlying resistance.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, in a highly bearish scenario, XRP may drop another 10% to support at $0.52. This could also get worse if the SEC appeals and wins over Ripple. But if buying pressure increases, the price of XRP may experience another jump. Should that be the case, the cryptocurrency may attempt to retest $0.63.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.