Ripple, the financial technology firm behind the XRP cryptocurrency, has initiated testing of its much-anticipated stablecoin, Ripple USD (RLUSD).

According to its official announcement, the testing is currently being conducted on both the XRP Ledger (XRPL) and the Ethereum mainnet.

Stablecoin Stakes: Ripple Navigates Legal Battles and Market Demand

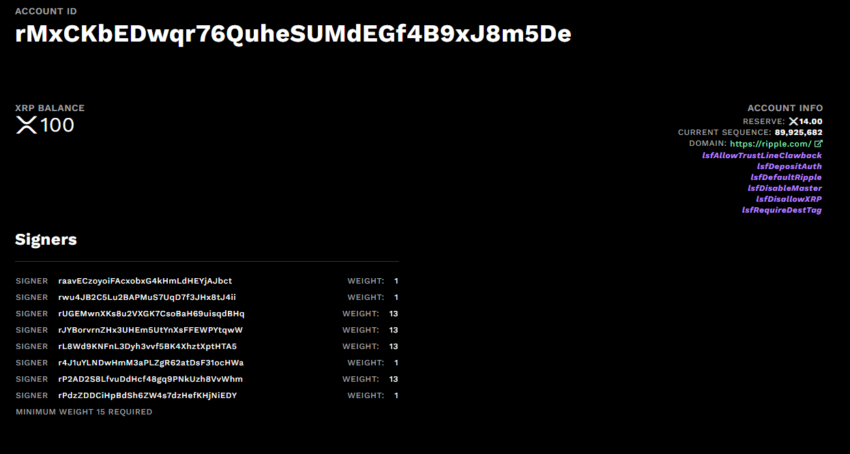

The beta phase of Ripple USD is crucial for ensuring that the stablecoin meets the highest standards before its broader release. Ripple has also emphasized that RLUSD is not yet available for public purchase or trading. It is currently undergoing rigorous testing with select enterprise partners.

“Please be cautious of scammers who claim they have or can distribute Ripple USD,” the firm warned.

Read more: A Guide to the Best Stablecoins in 2024

The firm further revealed that RLUSD’s valuation will be pegged 1:1 to the US dollar. Its backing includes a mix of US dollar deposits, short-term US government treasuries, and other cash equivalents.

Ripple aims to meet the increasing demand for reliable, stable digital currencies by launching RLUSD. By integrating RLUSD with its existing cross-border payment solutions, Ripple seeks to offer a seamless experience for its global customers. Furthermore, the company plans to enhance transparency and trust by providing monthly attestations of its reserves.

Ripple revealed its plan to launch the stablecoin in early April. At that time, Brad Garlinghouse, Ripple’s CEO, highlighted the strategic importance of the new stablecoin.

“We have the years of experience, regulatory footprint, a strong balance sheet, and a network with near-global payout coverage to offer the best of crypto-enabled payments using XRP and our (future) stablecoin together,” Garlinghouse affirmed.

However, Ripple’s ambitions with RLUSD might face challenges, particularly due to its legal disputes with the US Securities and Exchange Commission (SEC). BeInCrypto reported earlier in May that the SEC submitted a redacted remedies reply brief against Ripple Labs and its executives, in which the agency highlighted the firm’s plans to issue a new unregistered crypto asset. According to the exhibit section of the document, the SEC referred to Ripple USD stablecoin as the asset in question.

Read more: Everything You Need To Know About Ripple vs SEC

Ripple’s stablecoin development follows a recent order from a federal judge to pay a $125 million penalty for selling XRP without proper registration. This decision is part of its long-standing legal battle with the SEC.

Despite securing a more favorable outcome than initially expected, Ripple still faces potential legal hurdles. Reports suggest that the SEC might appeal the ruling. The appeal will likely focus on classifying XRP secondary sales as securities, and it might also challenge the court’s decision on programmatic sales and the reduced fine Ripple was ordered to pay.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.