During Thursday’s trading session, Injective’s (INJ) Age Consumed metric hit a 30-day high, indicating that previously inactive tokens have started to move again.

This surge has since been followed by a rise in INJ’s value, indicating that a local bottom has been reached.

Injective Long-Held Tokens Begin to Change Hands

A local bottom refers to the lowest price point reached by an asset within a specific timeframe before it starts to rise again. The spike in an asset’s age-consumed metric, followed by a price rally, is a good indicator of this.

The age consumed metric tracks the movement of an asset’s dormant coins. It measures the time coins have been held before being transferred to a new address, multiplied by the number of coins moved.

This metric provides insight into the behavior of long-term holders, who typically keep their coins inactive. When these holders start moving their coins, it often signals an upcoming shift in market trends.

On Thursday, INJ’s age consumed surged to 133,000, a level not seen since June 12. This spike in the metric was followed by a price rally, indicating that the lowest price before the rally, $16.13, marked a local bottom. Currently trading at $17.60, INJ’s price has increased by 9%.

When an asset’s age consumed metric spikes followed by a price rally, it is often viewed as a bullish signal. This implies that a considerable number of older coins have been moved, suggesting that large investors are accumulating the asset.

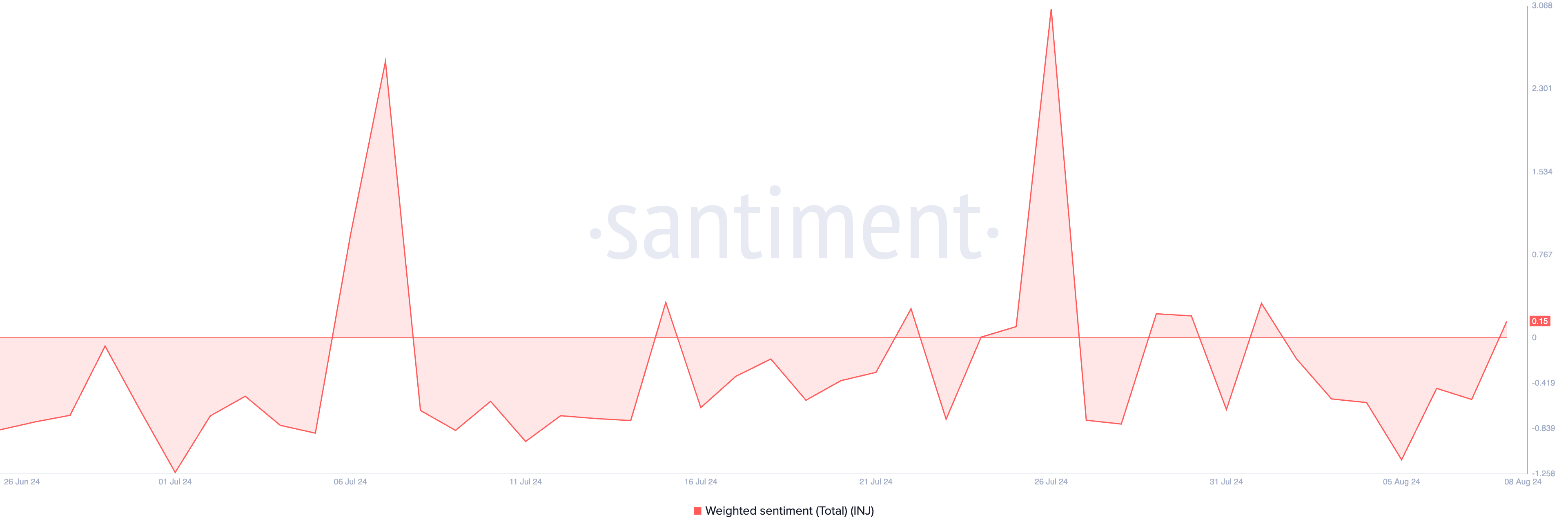

The positive shift in market trends can also be gleaned from INJ’s weighted sentiment. The on-chain metric has returned a positive value for the first time since the beginning of August. At press time, INJ’s weighted sentiment is 0.15.

Read More: What is a Layer-1 Blockchain?

An asset’s weighted sentiment metric tracks the market’s mood regarding it. When its value is above 0, most social media discussions are fueled by positive emotions.

INJ Price Prediction: The Demand Is Rising

BeInCrypto previously reported that INJ’s Relative Strength Index (RSI) suggested the altcoin was oversold and poised for a rebound. This rebound appears to be underway, as the rising RSI indicates growing demand for the altcoin. At press time, INJ’s RSI is trending upward at 40.10.

If sentiment remains positive and the altcoin continues to see growth in demand, its price will climb to $22.81.

However, any shift in market trend or change in sentiment will cause its price to plummet to $13.51, a 30% drop from its current value.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.