The Injective’s price could benefit from the changing market trends, especially if INJ holders act in accordance with the bullish cues.

Buy signals are flashing across the market. However, the question remains whether now is the right time to invest.

Injective Exhibit Positive Cues

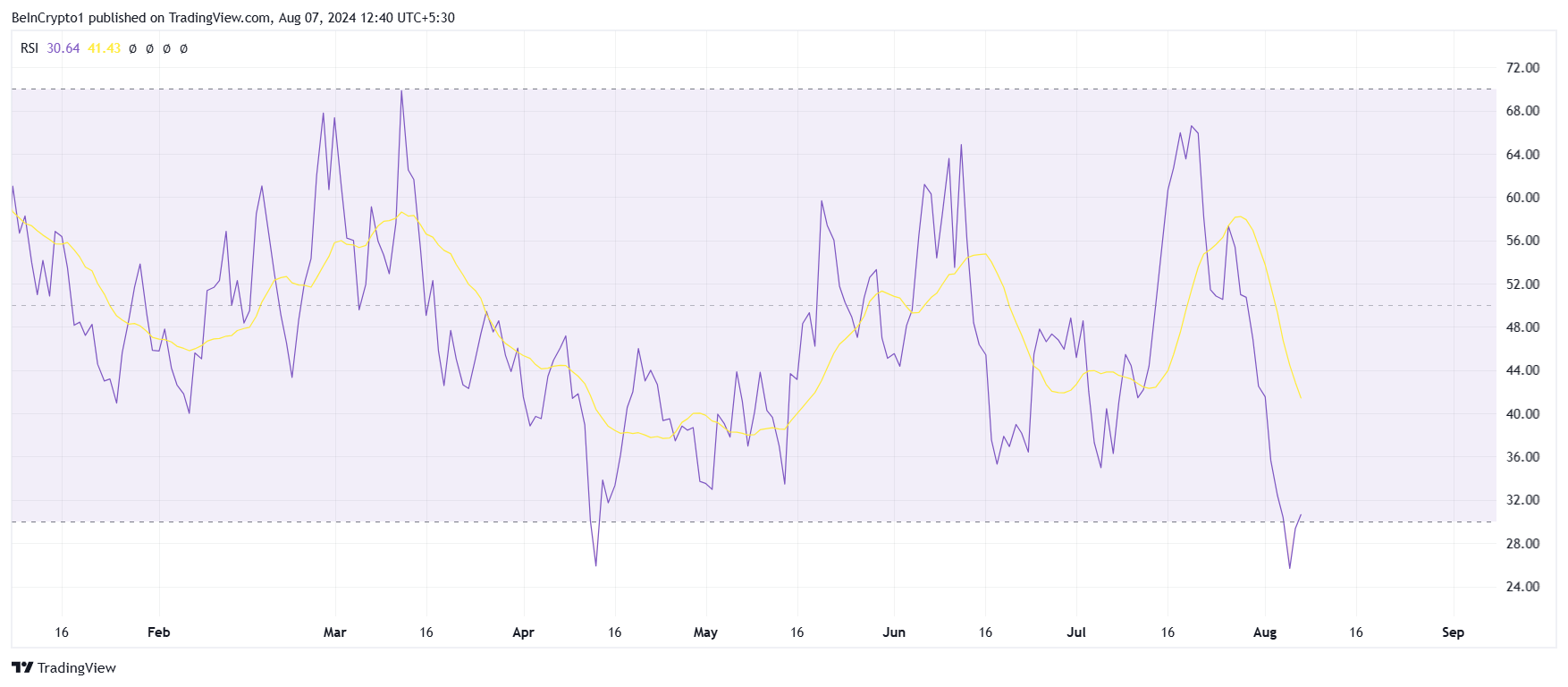

Injective’s price is slowly attempting to reclaim the profits it lost in the last couple of days. Signs of this happening are also coming from the Relative Strength Index (RSI). RSI recently entered the oversold zone for the first time in four months, indicating a potential for price recovery.

Now, the RSI has shown an uptick in the oversold territory. This shift suggests that strong buying momentum is driving the price, setting the stage for possible upward movement.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

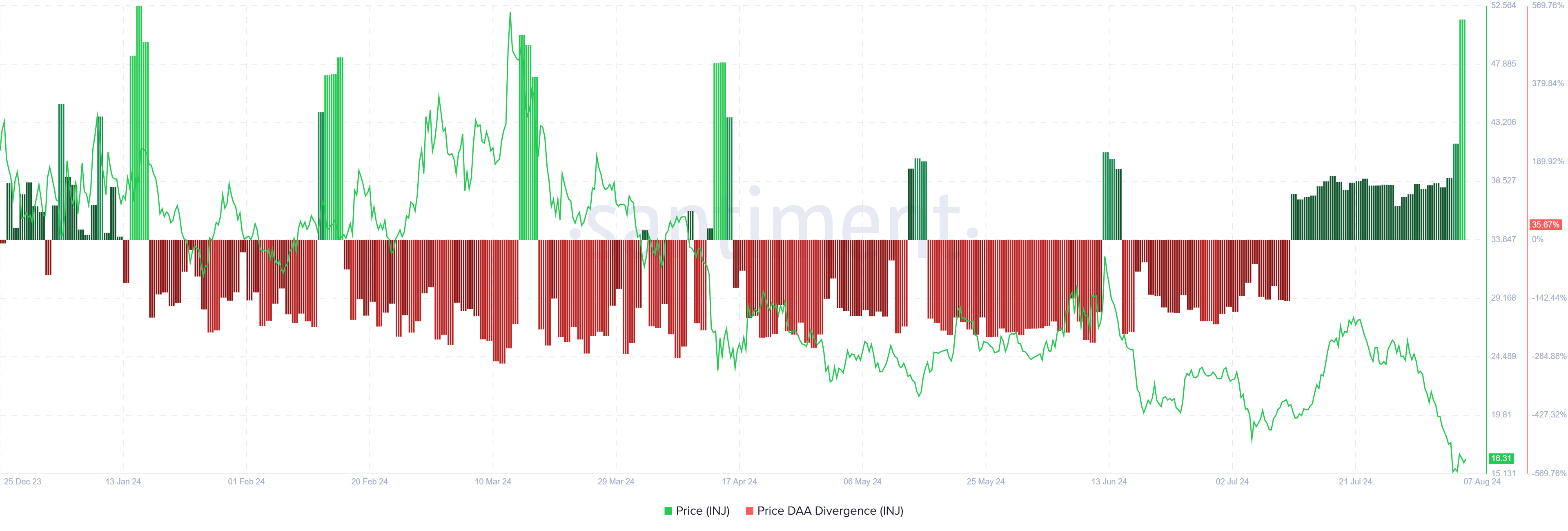

Moreover, the price DAA (Divergence Accumulation Analysis) is flashing a buy signal for INJ. This signal is reinforced by a significant increase in market participation, which often precedes positive price action and reflects growing investor interest.

The surge in participation highlights a growing confidence among investors, which is crucial for sustaining price gains. As more investors engage on the network, the potential for a continued price recovery strengthens.

The current indicators suggest that the price is likely to benefit from continued investor enthusiasm and momentum. However, this would be sustained only when the Injective’s price manages to breach a key resistance.

INJ Price Prediction: Clearing Barriers

The Injective’s price at $16.2 is bouncing back after nearly hitting the eight-month low of $14.1. The last time INJ was around this price was December 2023. Thus, it is important for the altcoin to first breach and flip the resistance at $18.5 into support.

Doing so would provide the necessary boost to initiate a sustainable recovery. A bounce off the $18.5 support coupled with potential accumulation could send INJ rallying towards $28.0.

Read More: Top 9 Web3 Projects That Are Revolutionizing the Industry

Breaching this resistance is important to secure the rise, as in the past, a failed breach has erased gains, sending the altcoin back to $18.5. If the same were to happen again, the bullish thesis would be invalidated, as Injective’s price could drop to $18.5.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.