Tron (TRX) may have displayed incredible strength during past drawdowns. However, the altcoin was not exempted during the recent one that saw Bitcoin (BTC) drop below $50,000.

At press time, TRX price has decreased by 10.51% in the last seven days. While a slight recovery has happened in the last 24 hours, this on-chain analysis explains why the rebound could expedite further.

Tron Holders Show Confidence Despite Market Sentiment

On Monday, August 5, BeInCrypto reported that the crypto market collapse was primarily caused by macroeconomic events. This led investors to panic and increased selling pressure among some BTC holders and altcoin investors.

However, according to Coin Holding Time, TRX did not experience the same. This on-chain metric measures the amount of time a cryptocurrency has been held without being transacted or potentially sold.

Based on IntoTheBlock’s data, Tron’s Coin Holding Time increased by a jaw-dropping 324.40% within the same period that the crypto price dropped by 10%. This data suggests that TRX holders were unperturbed by the decline and are confident in the cryptocurrency’s short to long-term potential.

Read More: 7 Best Tron Wallets for Storing TRX

When things like this occur, a crypto price may not experience quick respite. However, TRX holders’ decisions could offer potential price stability. If sustained, they could help the price accelerate toward the local top of $0.14, which it hit around July 13.

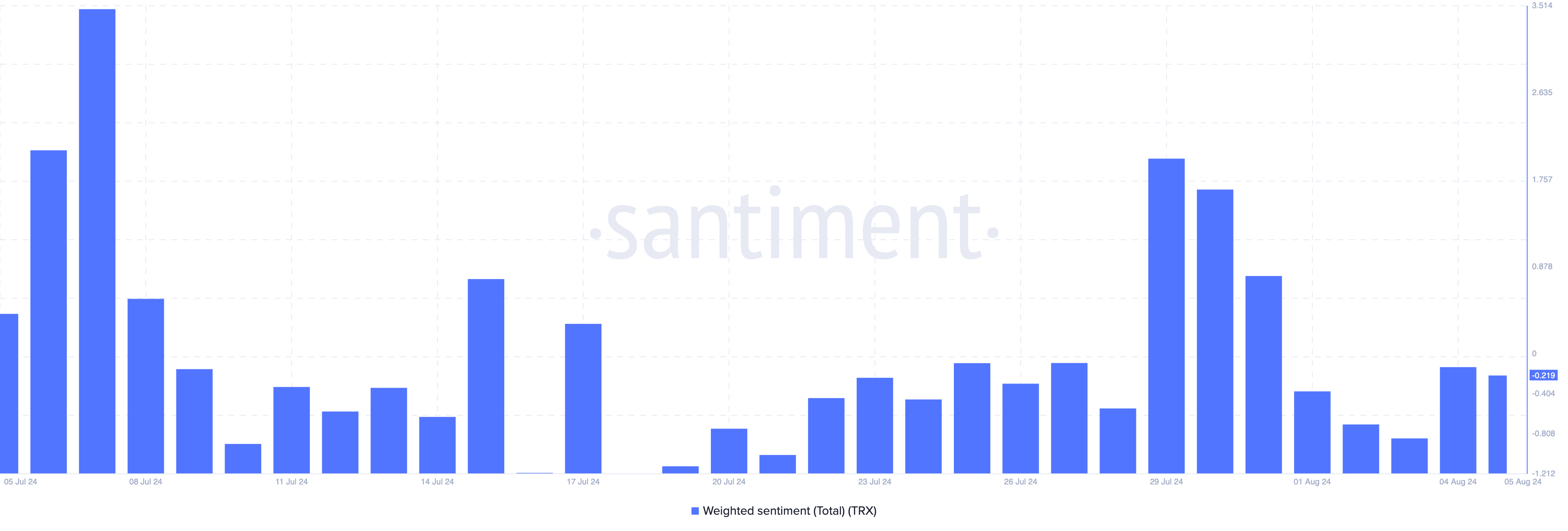

Meanwhile, Tron’s Weighted Sentiment shows that the broader market may be cautious about displaying high conviction about the token. This is because the sentiment reading remains in the negative region.

Typically, a positive sentiment rating implies that there are more bullish comments online than bearish ones. Therefore, for TRX, the bulls have not been able to completely wipe out the bearish social volume dominance, especially as the wider market decline is just exiting.

However, should positive sentiment improve, it could lead to higher demand for TRX, possibly resulting in a higher price.

TRX Price Prediction: The Race to $0.14 Is On

According to the daily chart, TRX’s price ascended from $0.10 to $0.14 within the first two weeks of July. However, recent price movements show that the beard has exerted pressure on the token, with the value at $0.12.

As of this writing, the altcoin has produced a 2.50% daily increase. If sustained, TRX may form another ascending channel pattern that leads its price toward the previous month’s peak.

Meanwhile, the Fibonacci retracement indicator gives an idea of the potential resistance and support zones TRX may face. From the chart below, the token may attempt to retest the 61.8% golden ratio, which is close to $0.13.

Read More: TRON (TRX) Price Prediction 2024/2025/2030

However, this will only be the case if bulls keep applying pressure. If successful, the altcoin may inch closer to $0.14. Should the broader market experience another wave of selling pressure, this prediction will be invalidated. If this happens, TRX’s price may drop to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.