So far, the Solana (SOL) ecosystem has been recognized as one of the breakout sectors of the crypto economy in 2024. This breakout was one reason the SOL price registered notable gains in excess of 65% in March.

The cryptocurrency has struggled to replicate a similar form after reaching a yearly high in the same month. But here is why Solana could be gearing up for another impressive upswing phase.

Bullish Signals Appear for Solana in the Futures Market

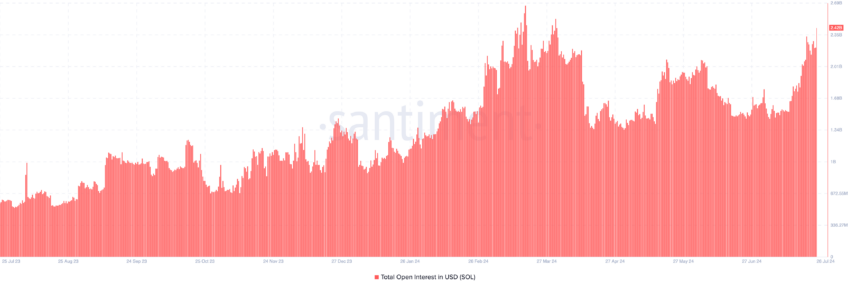

Data from Santiment traced back to the first quarter of the year, showing that Solana Open Interest peaked at $2.66 billion in March. OI, as it is often called, refers to the value of open contracts in the market.

Typically, rising Open Interest indicates increasing trading activity around a cryptocurrency. It also signals an increase in new money allocated to contracts related to the crypto. However, when OI decreases, traders withdraw money.

An increase in OI alongside a bump in price strengthens the uptrend, and this was what SOL experienced at that time. At press time, Solana Open Interest has gained almost $1 billion since July 13.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

With a value of $2.42 billion, SOL’s price is only inches away from reaching or surpassing the yearly high. Furthermore, SOL’s price has been increasing. This week alone, the price has climbed by more than 10%.

This pattern is similar to the one played in March, which led to the token’s rise above $200 this year. If the pattern rhymes, SOL’s price may retest the yearly high and probably surpass it.

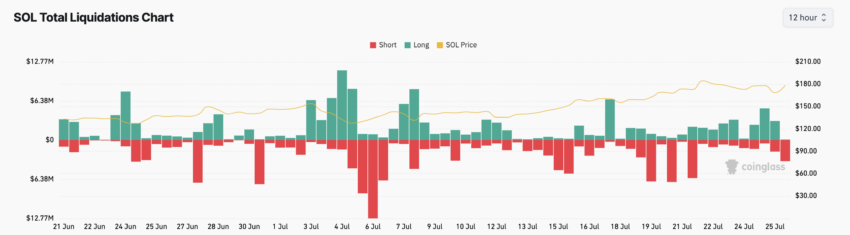

Further, the total SOL liquidations in the last 24 hours amount to $8.52 million, with shorts accounting for over 60% of the wipeout.

Liquidation occurs when a trader cannot keep a position open or fulfill margin requirements, prompting a trading platform to close the contract. Therefore, the data below shows that most positions closed are traders who bet on a decrease.

However, liquidations can also form price trends. If OI increases and long liquidation is dominant, the price dumps into underlying support. Since the OI increase comes with a surge in short liquidations, the price of SOL can break out.

SOL Price Prediction: Can the Price Reach Four Digits?

According to the daily chart, Solana has broken out of the descending trendline, meaning the token is no longer under the control of bears. This breakout is one reason the token reached $185 on July 22.

Despite a fall from that ceiling, SOL exhibits signs of another rally that could see it surpass $190. Currently, the cryptocurrency trades at $178.58.

For crypto analyst Ali Martinez, the market structure of SOL is similar to what occurred in July 2021 before the token rallied to its all-time high. According to him, if the pattern repeats itself, SOL’s price might reach $1,000 before the end of this cycle.

“Solana is looking a lot like July 2021… $1,000 $SOL coming soon!” He wrote on X while sharing a chart backing his thesis.

The SOL/USD 4-hour chart gives additional context to this prediction. From the chart below, one can see that the Relative Strength Index (RSI)r rating has increased, indicating bullish momentum for Solana.

However, another notable change is the formation of a golden cross displayed by the Exponential Moving Average (EMA). The EMA is a technical tool that measures price changes and identifies trends.

When the longer EMA crosses the shorter one, it is a death cross, and the trend is bearish. However, as shown below, the 50 EMA (yellow) has crossed above the 200 EMA (blue), suggesting that SOL’s potential in the mid to long-term is bullish.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

In addition, the fact that the price trades above the indicators suggests that the price action in the short term is also bullish. Considering the current condition, SOL looks set to retest $185.10 in the short term.

Once this happens, it could begin a March-like rally. However, if the price falls below the short-term EMA, the forecast may not come to pass. If this is the case, SOL may drop to $170.61.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.