The price of AAVE, the governance token of leading lending protocol Aave, has surged by 15% in the past 24 hours.

The price rally is attributed to the recent temperature check conducted for a governance proposal that could introduce a fee switch and a token buy-back program to the platform.

Aave Climbs as Demand Spikes

As of this writing, AAVE is trading at $102.22. It is the second-highest gainer among the top 100 cryptocurrencies by market capitalization in the past 24 hours. Its trading volume totals $244 million during that period, rising by over 150%.

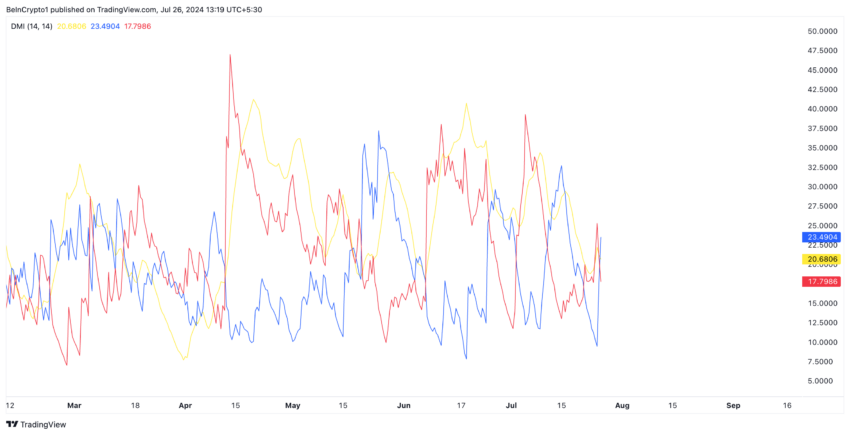

Its price movements assessed on a 12-hour chart confirm the uptick in the demand for the altcoin. Firstly, readings from its Directional Movement Index (DMI) show that its positive directional index (+DI) (blue line) just crossed above its negative directional index (-DI) (red line).

Read more: What Is Aave?

An asset’s DMI measures the strength and direction of its price trends. When the +DI crosses above the -DI, it signals a shift in trend direction from bearish (downward) to bullish (upward).

Traders often interpret this crossover as an indication to enter long positions in anticipation of further price growth.

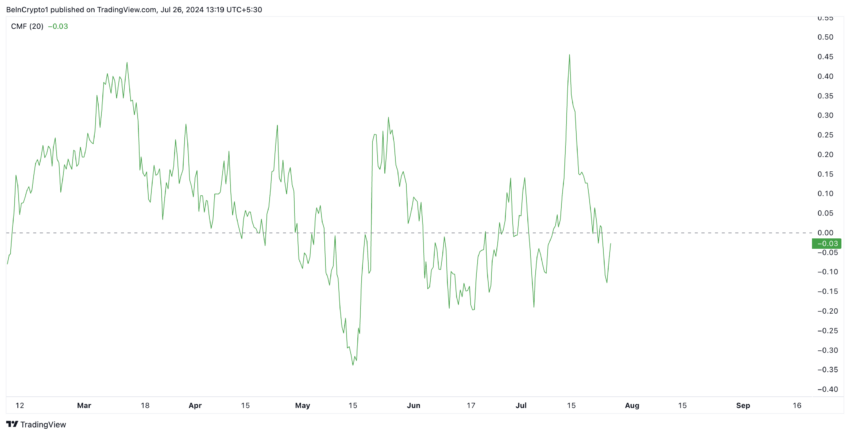

Also, AAVE’s Chaikin Money Flow (CMF) has initiated an uptrend, confirming the growth in the bullish bias toward the altcoin since the temperature check went live. The indicator is poised to cross above the zero line at press time.

An asset’s CMF measures money flow into and out of an asset. When the CMF attempts to cross above the zero line, it indicates increasing buying pressure, which can strengthen the current uptrend. Traders often consider the CMF crossing above the zero line a potential entry point for long positions. It indicates a favorable condition for further price increases.

The positive bias has also spread to AAVE’s derivatives market. In the past 24 hours, trading volume across the market has exceeded $450 million, spiking by 369%, according to Coinglass.

During that period, its open interest has also increased by almost 50%. This indicates that there has been a significant uptick in the number of new traders that have entered AAVE’s futures and options markets to open new positions in the past 24 hours.

AAVE Price Prediction: The Uptrend Is a Strong One

AAVE’s Aroon Up Line is 100% at press time. When the Up Line is at or close to 100%, it suggests a strong uptrend and that the most recent high was reached relatively recently. Therefore, if the uptrend persists, AAVE’s price might rally to $111.

Read more: Aave (AAVE) Price Prediction 2024/2025/2030

However, if the market trend shifts to bearish, the altcoin risks plummeting to a multi-month low of $70.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.