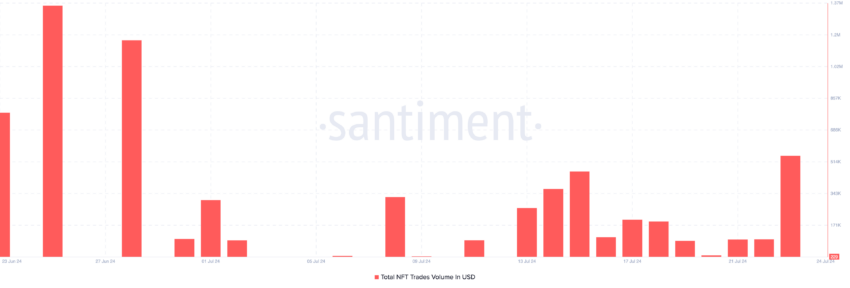

Leading Layer 2 (L2) network Optimism (OP) saw an uptick in trading activity on Tuesday across its non-fungible token (NFT) ecosystem.

That day, NFT sales volume climbed to a monthly high of $547,000.

Optimism NFT Vertical Sees Spike in Activity

According to Santiment’s data, Optimism recorded a single-day NFT sales volume of $547,000 on Tuesday. This represented a 475% spike from the $95,040 recorded in NFT sales volume on the network the previous day.

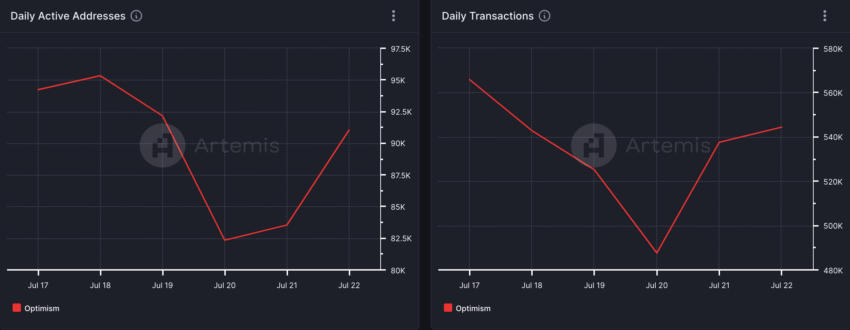

The spike in NFT trading activity on the L2 network comes amid the surge in its user demand in the past few days. Ahead of the eventual approval of spot exchange-traded funds that hold Ethereum’s ether, there has been a gradual uptick in the demand for L2 networks.

On-chain data reveal an increase in the daily count of unique addresses involved in at least one transaction on Optimism. Due to the growth in unique addresses on the chain, the number of transactions completed daily has also risen.

Read More: What Is Optimism?

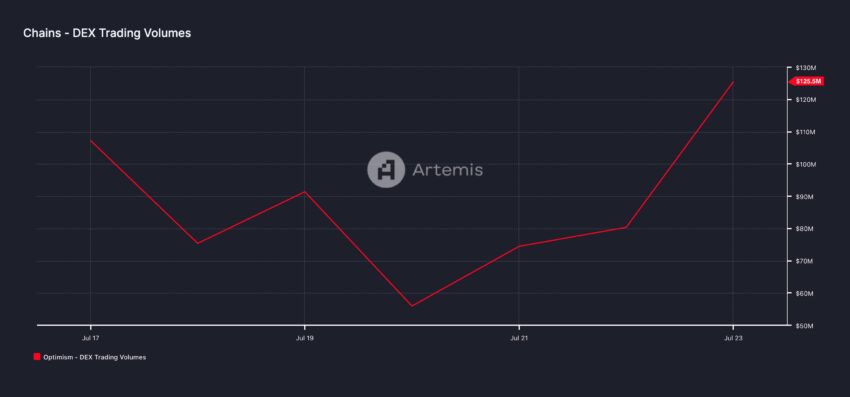

Apart from its NFT vertical, another area of growth within the Optimism ecosystem is its decentralized finance (DeFi) vertical. Aided by the broader market rally in the past few weeks, the value of assets locked (TVL) across the network has risen by 15% in the past 30 days.

Also, the volume of transactions completed daily on the decentralized exchanges (DEXes) housed on the L2 network has increased. Per Artemis’ data, this has increased by 17% in the past seven days.

The combined increase in Optimism’s NFT sales volume, DeFi TVL, and DEX volume points to a significant uptick in overall network activity. This is a positive indicator of the network’s growth and adoption, especially as spot ETH ETFs go live.

OP Price Prediction: Current Uptrend is Strong

At press time, OP trades at $1.86. The surge in user demand for Optimism in the past month has impacted the token’s price, which has risen by 10% in the past 30 days.

Its Aroon Up Line, assessed on a daily chart, confirmed the possibility of extending the uptrend. At press time, the indicator’s value is 85.71%.

An asset’s Aroon Indicator tracks its price trend and identifies potential price reversal points. When the Up Line is close to 100, it indicates that the uptrend is strong and that the most recent high was reached relatively recently.

Should OP’s value continue to rise, it may exchange hands above the $1.90 price level.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

However, if the current uptrend weakens, the bullish thesis above will be invalidated, and the token’s price will plummet to $1.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.