Leading Layer 2 (L2) network Optimism (OP) has witnessed a decline in user activity in the past few weeks. Its daily active address count continues to decrease, impacting its network fees and revenue.

However, the current broader market rally has led to an uptick in the total value of assets locked (TVL) across its decentralized finance (DeFi) vertical.

User Activity Slows on Optimism, But There Is a Catch

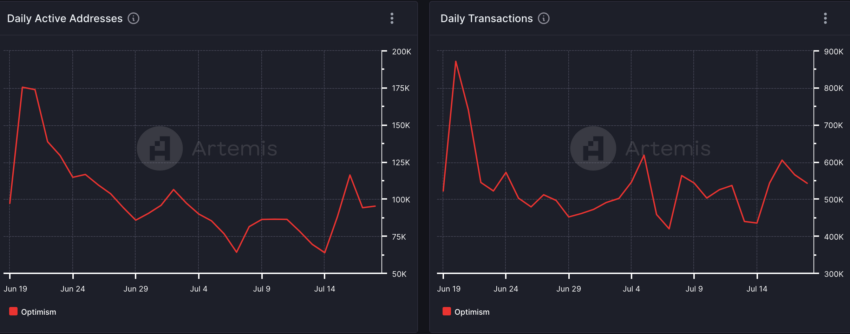

Artemis’ data has revealed a steady decline in user demand for Optimism in the past 30 days. During that period, the number of unique addresses involved in at least one transaction on the network daily dropped by 45%.

Due to the low user count on the network, daily transactions have also dropped. According to Artemis’ data, this decreased by 31% during the period in review.

The reduced user activity on Optimism and the 6% decline in OP’s value in the last month have culminated in a drop in network fees and revenue. For context. On July 17, Optimism’s network fees totaled $61,600. This marked a 71% drop from the $208,000 in total network fees a month ago.

On-chain data revealed that the network’s revenue derived from fees dropped by 65% during the period under review.

However, the recent uptick in the general crypto market has prevented the decline in user activity on Optimism from impacting its DeFi ecosystem.

At $766.55 million at press time, the network’s DeFi TVL has surged by 15% in the last week and is currently at its highest level in over a month.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

OP Price Prediction: Token Trades Within a Range

OP’s price has trended within a range in the past few days. This comes after it traded within an ascending channel between July 5 and 15.

When an asset trades in a range after trading within an ascending channel, the price is no longer in a clear uptrend. Instead, it is moving sideways within a defined range. This signals a period of consolidation where buying and selling pressures are balanced, and the asset’s price oscillates between support and resistance levels.

In OP’s case, it seems to be facing resistance at $1.88 and is forming support at $1.84. If it breaks above resistance, the token will trade above $1.91.

Read More: What Is Optimism?

However, if it falls below support, its value may plunge toward $1.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.