Shiba Inu’s (SHIB) price could grow in the coming days as the meme coin is seeing support from multiple directions.

One of the biggest recovery driving factors will be SHIB’s improving ability to follow Bitcoin’s (BTC) footsteps.

Shiba Inu Investors Remain Hopeful

Shiba Inu’s price is looking to reclaim May highs as the meme coin bounced back from the lows of $0.00001473. The meme coin is not alien to the volatility of the crypto market, but the recovery this time around is not as rapid.

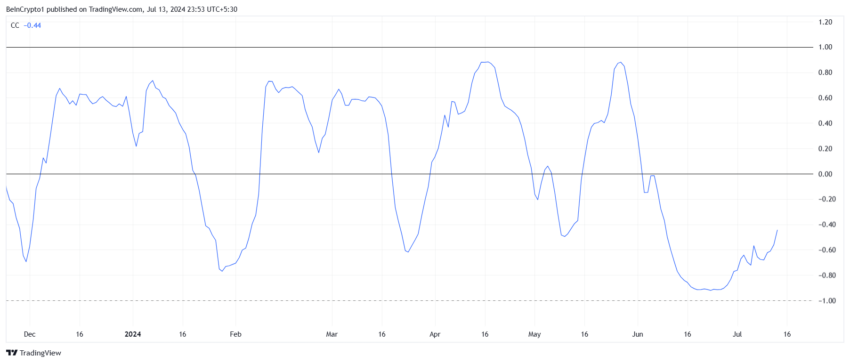

A key factor behind this is the low correlation that Shiba Inu shares with Bitcoin. At the time of writing, Bitcoin is exhibiting strong signs of recovery, but SHIB may not see the same since its correlation with BTC stands at -0.44, which is an improvement from -0.96 a month ago.

A positive correlation means the asset will follow BTC’s steps, while a negative suggests the opposite. This is hampering Shiba Inu’s ability to note a recovery, as when the broader market improves, SHIB may struggle.

Thus, when the correlation turns positive, growth can be expected for the meme coin.

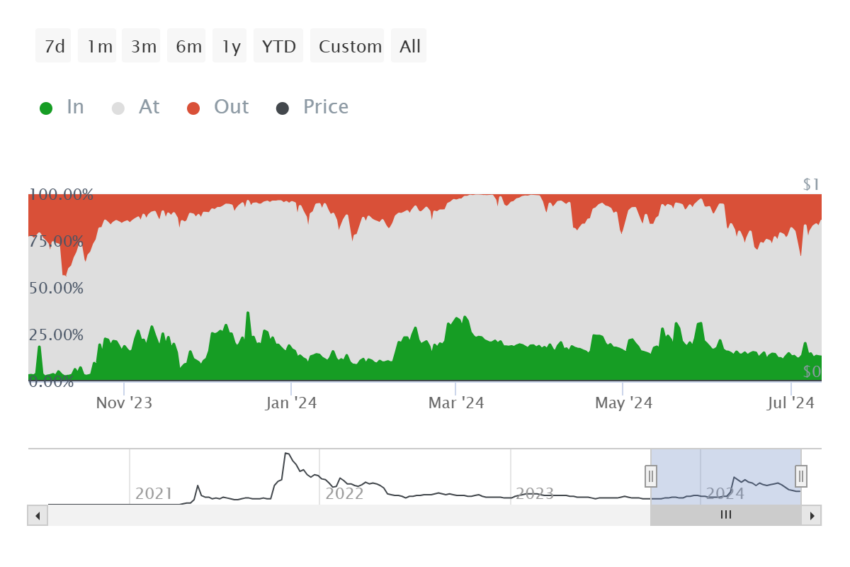

This notion is already supported by investors who have been scaling back on selling for a long time now. Observing the active addresses by profitability reveals that the altcoin is not witnessing much selling at the moment.

Generally, when the investors in profit exceed 25% participation on the network, the probability of selling rises. This is because these investors tend to attempt to book profits on their holdings. However, since, in the case of SHIB, this dominance is less than 13.5%, investors are not too keen on selling.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

This is a good thing for Shiba Inu’s price as it hints at recovery.

SHIB Price Prediction: Recovery After Consolidation

Shiba Inu’s price trading at $0.00001719 is observing minimal bounce back from the lows of $0.00001473. The next resistance for the crypto asset stands at $0.00001800, breaching, which would enable a rise to $0.00002903.

SHIB will likely form consolidation under this level until stronger bullish cues arise. The same could the meme coin rallying beyond $0.00002093 towards $0.00002267.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

However, should this fail, the consolidation could continue between $0.00002093 and $0.00001800. This will likely invalidate the moderate bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.