This week, the broader crypto market experienced a dramatic decline, with Bitcoin falling to $53,500—a four-month low. Simultaneously, altcoins are also down by double digits.

Bearish developments were dominant throughout the week. Yet Hamster Kombat’s popularity and phase 1 of the Artificial Superintelligence (ASI) merger stand out as some of the crypto sector’s positive developments.

Binance Expands Altcoins Monitoring

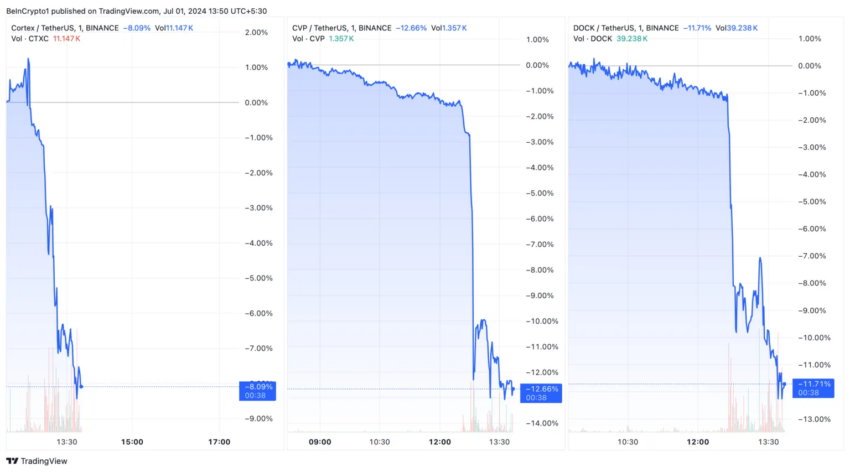

On Monday, Binance added 11 altcoins to its Monitoring Tag list, raising concerns about potential delistings. Tokens such as Balancer (BAL), Cortex (CTXC), PowerPool (CVP), Convex Finance (CVX), Dock (DOCK), Kava Lend (HARD), IRISnet (IRIS), MovieBloc (MBL), Polkastarter (POLS), Status (SNT), and Sun (SUN) are now under scrutiny, which has led to notable price declines.

For instance, immediately after the announcement, Cortex plummeted by 8.09%, while PowerPool and Dock dropped by 12.66% and 11.71%, respectively. Binance’s action aims to manage tokens that show higher than usual volatility or risk, warning investors of possible non-compliance with the exchange’s listing standards in the near future.

“Keep in mind that tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance warned.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Upcoming $3 Billion Token Unlocks

Moreover, July is poised to be a critical month with over $3 billion worth of token unlocks. These events might increase selling pressure in the market.

Significant among these is AltLayer (ALT), which will release tokens valued at about $119 million on July 25. This represents around 22% of its market cap.

Additionally, platforms like Aptos (APT) and Arbitrum (ARB) will continue their monthly token releases, potentially impacting their market values. These two platforms will cumulatively release $150 million worth of tokens into circulation.

Read more: 11 Cryptos to Add to Your Portfolio Before Altcoin Season

Insights into Vitalik Buterin’s Wealth

Vitalik Buterin, co-founder of Ethereum, has seen his public portfolio rise to $707.70 million, largely due to his Ethereum holdings and strategic investments. Despite market volatility, Buterin’s financial status remains solid, reflecting his foundational role within the Ethereum ecosystem.

Public reaction to the disclosure of his wealth has been mixed, with some community members emphasizing his focus on technological advancement rather than personal wealth.

“I believe that Vitalik Buterin does not care about how much money he has. His wealth lies in blockchain and his belief in what he is doing. Therefore, I do not care if he is the richest man in the world or the poorest. Enter his mind, not his wallet,” one X user said.

Read more: Who Is Vitalik Buterin? An In-Depth Look at Ethereum’s Co-Founder

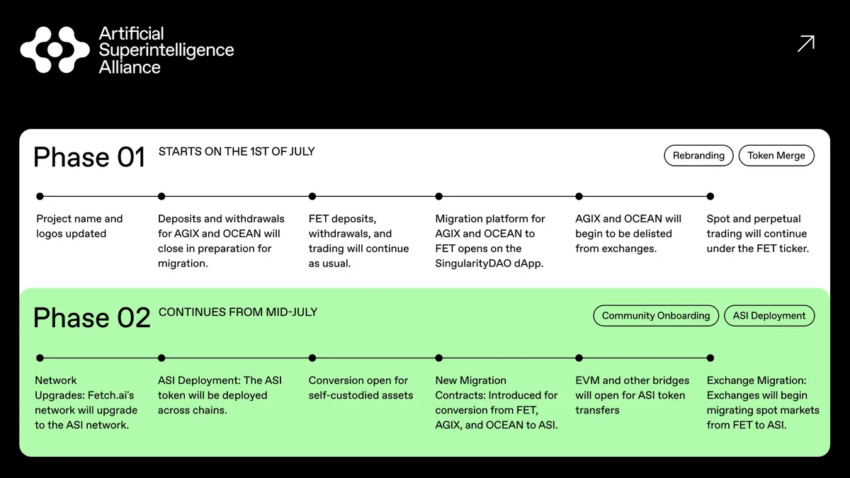

ASI Alliance Initiates Token Merger

Furthermore, the ASI Alliance has started Phase 1 of its token merger involving Fetch.ai (FET), SingularityNET, and Ocean Protocol. The merger aims to unify these tokens under the ASI banner, which is expected to streamline operations and enhance governance.

The merger process has temporarily halted deposits and withdrawals for AGIX and OCEAN, preparing for a smooth transition. Furthermore, crypto exchanges have delisted them.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Hamster Kombat’s Explosive Popularity

On a lighter note, Hamster Kombat, a blockchain-based game, has gained popularity, potentially setting a new Guinness World Record for its swift subscriber growth on YouTube. This game demonstrates how blockchain technology can intersect with entertainment, offering new user engagement mechanisms.

Its YouTube success is particularly notable as it has outpaced famous content creators like Mr. Beast in terms of new subscriber growth. Moreover, the game claims that it has hit 200 million users.

Hamster Kombat’s token generation event (TGE) is expected to happen this month.

Read more: Tap-to-Earn: What to Know About the Crypto GameFi Trend

This Week’s Crypto Top 10

This week marks the fourth consecutive week of the crypto market decline. The total cryptocurrency market cap has shrunk from $2.28 trillion last Friday to $1.99 trillion, indicating a strengthening bearish trend in the market.

Even the flagship crypto assets such as Bitcoin and Ethereum are down by 11.51% and 16.28%, respectively in the past seven days. Dogecoin faced the maximum drawdown among the top crypto assets. It is down by 24.16% in the same timeframe.

This drop was influenced by major global financial maneuvers, including the start of Mt. Gox’s creditor repayments and the German government’s decision to move its Bitcoin to centralized exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.