The price per TRX, the native coin of the decentralized blockchain Tron, has grown by almost 15% in the past 30 days.

As of this writing, the 11th cryptocurrency asset by market capitalization trades at $0.12, its highest price level since March.

Tron Makes a Series of New Highs

Tron’s recent price rally began on May 29, after the altcoin revisited its year-to-date low of $0.11. The token’s value has since climbed by 9%.

As observed on-chain, the uptick in the coin’s Relative Strength Index (RSI) confirms that the price hike is backed by real demand. As of this writing, TRX’s RSI is 74.13. The last time this metric returned such a high value was on March 2.

The metric measures an asset’s overbought and oversold conditions. It ranges between 0 and 100. An RSI above 70 suggests an asset is overbought and at risk of a price correction or reversal. Conversely, an RSI below 30 suggests an asset is oversold and may witness a rebound.

At 75.72, TRX’s RSI suggests that the coin’s traders favor its accumulation over sell-offs. However, the market may be overheating, suggesting potential buyer exhaustion. This situation could lead to a slight price correction.

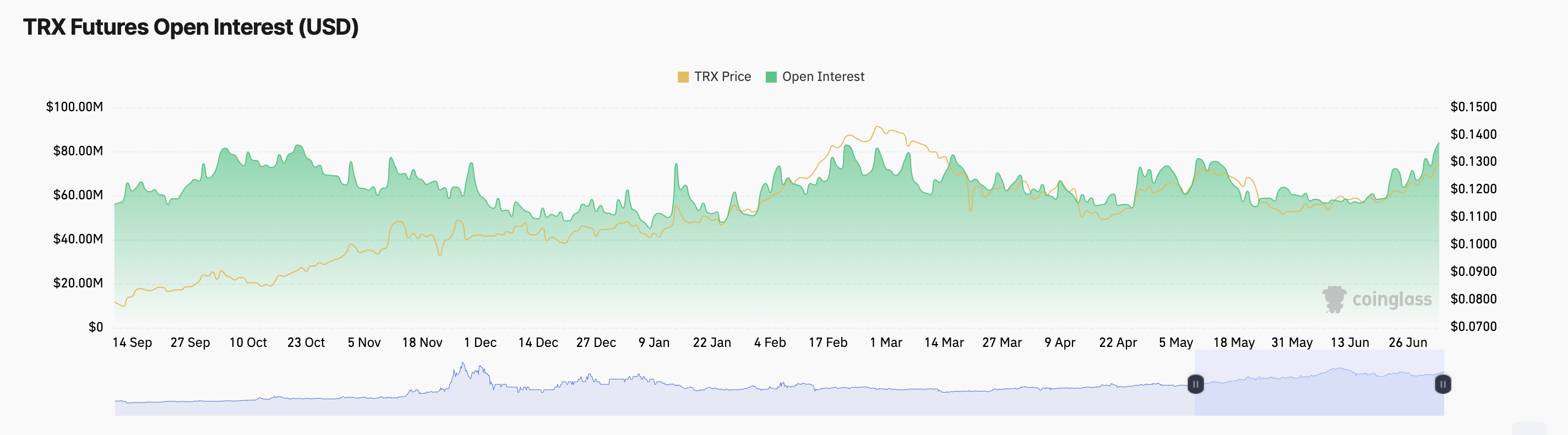

Nonetheless, the spike in TRX’s spot price has led to a surge in activity in its derivatives market. At $84.07 million at press time, TRX’s futures open interest has risen by 39% in the last month and is currently at its highest level since October 2023.

Read more: Tron (TRX) Price Prediction 2024/2025/2030

An asset’s futures open interest measures the total number of outstanding futures contracts that have not been settled. When it spikes, it means that more traders are entering into new positions.

When an asset’s price rises and its futures open interest climbs, this typically indicates an increase in traders’ participation and confidence in the current trend.

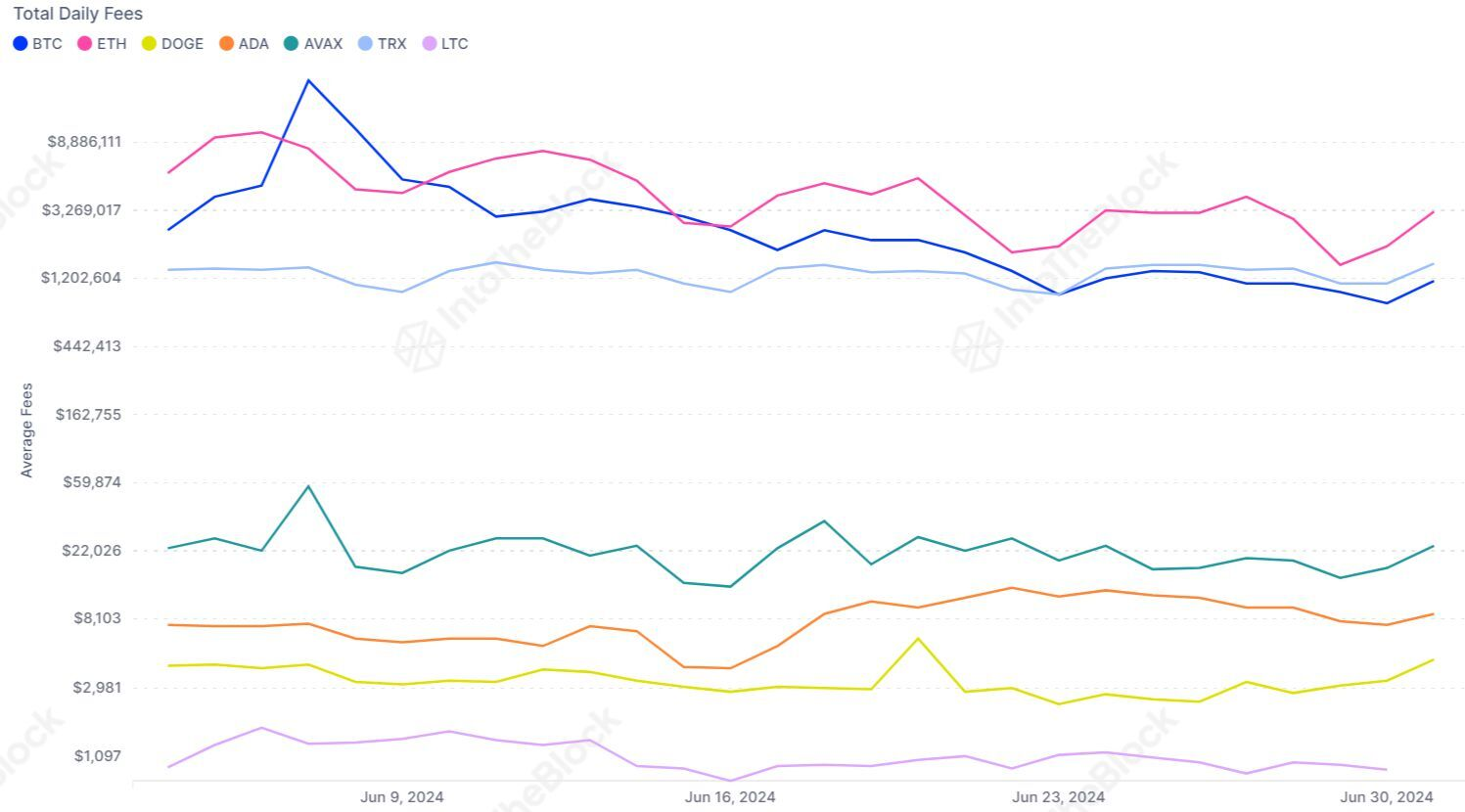

Another metric worth attention is daily fees. This week Tron generated more fees than Bitcoin, suggesting heavy network usage and demand.

“TRON generated more fees than Bitcoin this week. While Ethereum (ETH) tops this category with $3 million in daily fees, TRON (TRX) recently surpassed Bitcoin with $1.4 million in fees recorded on Monday versus Bitcoin’s 1.1 million. Nonetheless, in some cases high fees can be an indication of congestion issues, as has been the case for Bitcoin and Ethereum during previous bull markets”, Juan Pellicer, Senior Researcher at IntoTheBlock, told BeInCrypto.

TRX Price Prediction: Price Trends Within a Channel

The surge in TRX’s price has led to the formation of an ascending channel. This channel is a bullish signal formed when an asset’s price consistently moves between two upward-sloping parallel lines.

The upper line of the channel forms resistance, while the lower line represents support level. In TRX’s case, it has faced resistance at the $0.13 price level and has found support at the $0.11 price point.

As of this writing, TRX’s price is poised to cross above the upper line of the channel.

However, based on readings from the coin’s RSI, TRX may witness a slight pullback and fall back within the channel if profit-taking commences.

If demand is sustained, it may breach resistance to trade above $0.13.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.