Litecoin’s (LTC) price has been in a downtrend in the past few weeks, reaching its lowest point since February.

This price decline has occurred despite a recent uptick in whale accumulation.

Litecoin Whales “Fill Their Bags”

Litecoin’s poor price performance since the middle of May has not deterred its whales from buying the token. An on-chain assessment of the activity of the token’s large holders reveals a surge in LTC accumulation by that group of investors.

Since the beginning of June, the number of LTC whales holding between 10,000 and 1,000,000 tokens has increased by 2%. For context, this cohort of investors currently comprises 613 addresses, a high last observed in March.

As of this writing, this group of LTC investors holds 56% of its total circulating supply of 74,675,850 LTC.

When the large holders of an asset increase their holdings despite a price decline, it may be because they see the value dip as a buying opportunity, believing the asset is undervalued and poised for a future rise.

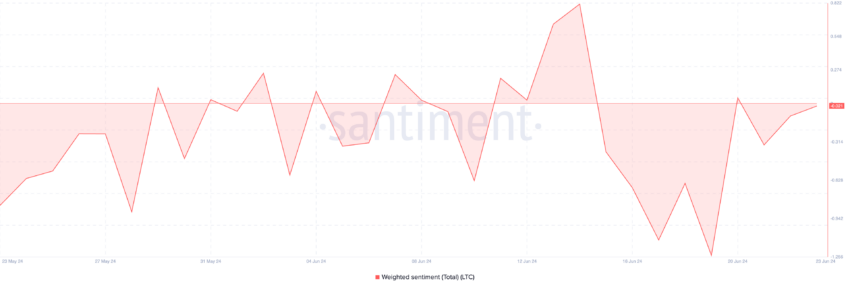

However, for any significant price increase, there has to be a shift in LTC’s weighted sentiment. As of this writing, this metric returns a value of -0.021.

Read More: Litecoin: A Complete Guide to What it is And How it Works

This metric measures the market’s mood regarding an asset. When its value is below one, it signals that the asset is trailed by negative sentiment. It is often a precursor to a sustained price decline.

LTC Price Prediction: Brace For Further Decline

At press time, LTC trades at $71.58. The token’s value has plummeted 17% in the last month.

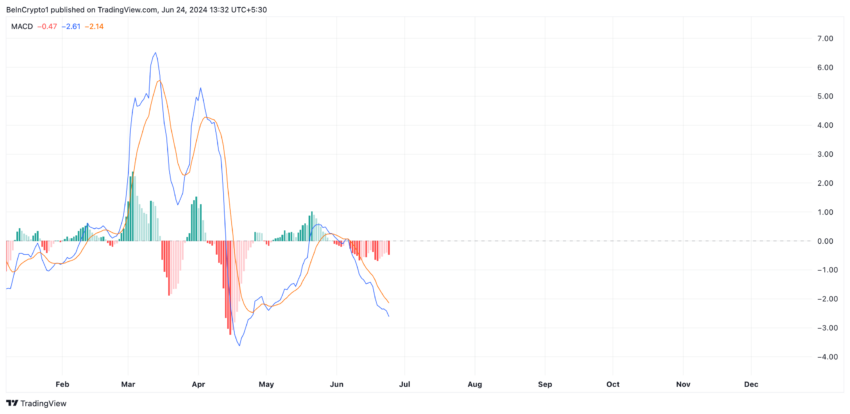

Readings from its Moving average convergence/divergence (MACD) indicator hint at the possibility of a continued decline in the token’s value. This indicator helps traders to identify potential buy and sell signals.

At press time, LTC’s MACD line (blue) rests below its signal (orange) and zero lines. When this indicator is set up this way, it is viewed as a bearish signal because the asset’s short-term moving average is below the long-term moving average.

Traders interpret it as a sign to sell or exit long and open short positions.

If selling pressure spikes, LTC’s price may fall to $70.50.

Read More: How To Buy Litecoin (LTC) and Everything You Need To Know

If sentiment shifts from bearish to bullish and buying momentum gains, the token’s price may climb to $74.61.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.